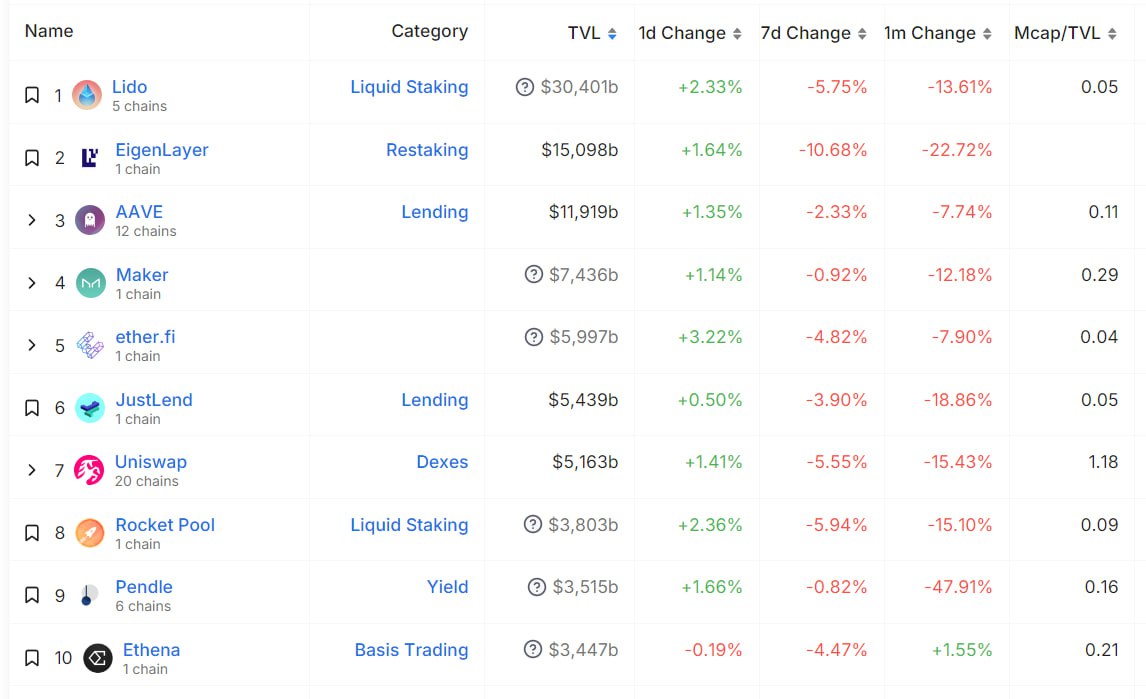

TVL (Total Value Locked) indicates how much money users have locked in a particular protocol. Based on TVL, you can understand which DeFi application people trust the most and are willing to leave their liquidity with.

- Lido — a protocol for liquid staking of ETH. It acts as a middleman to lower the entry threshold for staking, as native staking requires more than 32 ETH and special equipment.

- EigenLayer — the first protocol to implement the concept of ETH restaking. For regular users, EigenLayer allows for increased staking profits, while for developers, it provides a convenient tool for creating and enhancing the security of L2 networks.

- AAVE — the largest crypto bank where you can deposit your coins for interest or take out a loan against your cryptocurrencies. They also issue the stablecoin GHO.

- Maker — the first and oldest DeFi protocol. They created the “decentralized” stablecoin DAI, which ranks among the top three stablecoins by market capitalization.

- ether fi — the largest counterpart to the liquid staking protocol Lido.

- JustLend — a counterpart to AAVE and the largest lending protocol on the TRON blockchain.

- Uniswap — the first and most popular decentralized exchange, operating on an AMM (Automated Market Maker) basis.

- Rocket Pool — a safer and more decentralized alternative to Lido, allowing earnings from staking ETH.

- Pendle — a protocol for complex financial derivatives, allowing trading of “yields” from various protocols.

- Ethena — one of the fastest-growing DeFi protocols, issuing the synthetic stablecoin USDe, which can be staked at 13.6% APY.