The recent dip in Bitcoin’s price following its fourth halving, which saw a peak of $64,000 on the halving date and a rise to over $67,000 shortly thereafter, is not entirely unexpected. Since the halving on April 20, at 12:09 am UTC, Bitcoin has fallen sharply, now trading at $57,362, marking a 7% decrease in the last 24 hours and over 17% in the last month, as per CoinGecko.

This decline may have come as a surprise to those anticipating a post-halving surge, similar to previous cycles. Historically, Bitcoin has experienced significant rallies post-halving, like the 2016 halving which preceded a 3,000% increase over 17 months. However, this cycle deviates notably, partly because Bitcoin had already achieved a significant bull run and a new all-time high just before this latest halving.

Mati Greenspan of Quantum Economics pointed out that this downturn was anticipated given broader market trends and economic conditions. “Considering the expected adjustments by the Fed and current stock market dynamics, the recent Bitcoin price movement is hardly a surprise,” he commented to Cointelegraph.

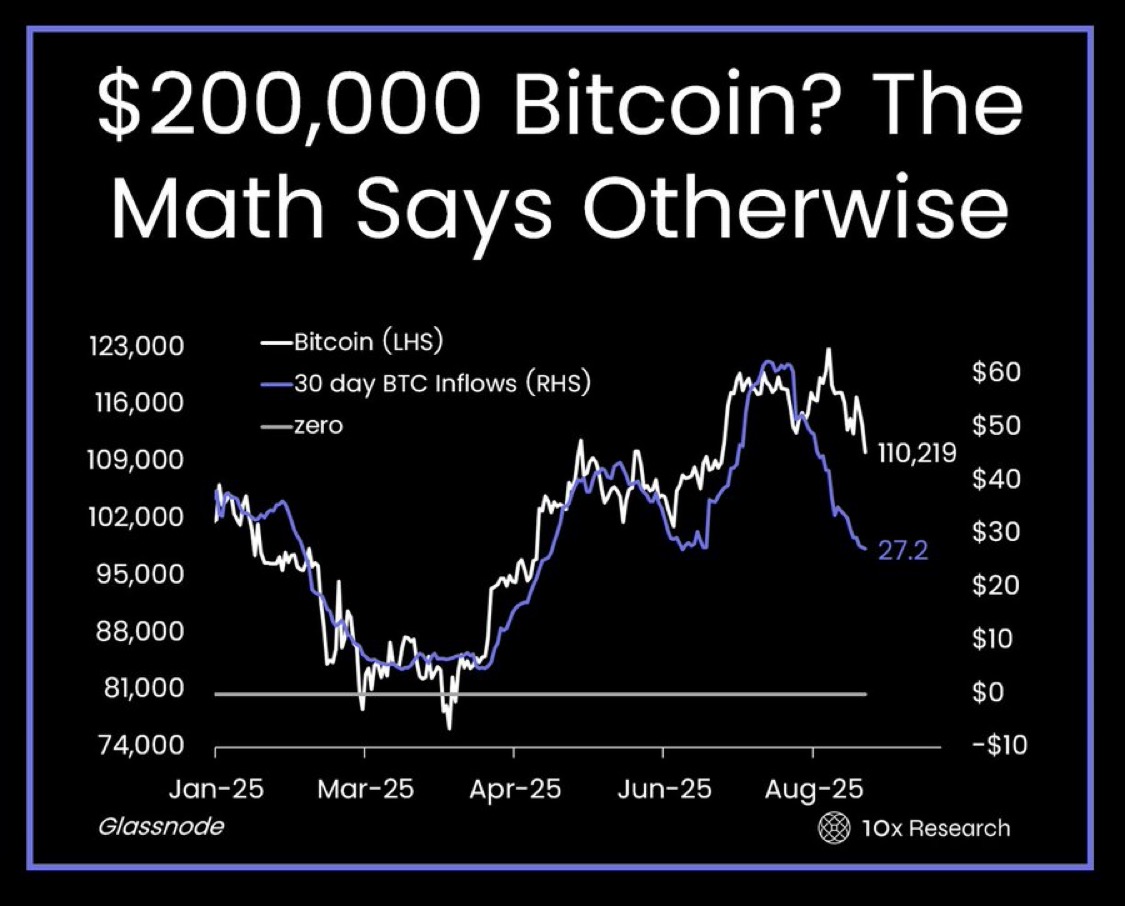

Furthermore, some analysts, including those from JPMorgan in March 2024, had already forecasted a drop in Bitcoin’s price to around $42,000 post-halving. Markus Thielen, CEO and head analyst at 10x Research, also suggested a potential decline to $52,000, attributing the recent rally primarily to inflows into Bitcoin ETFs, which have slowed considerably over the past month.

Despite the downturn, other market observers like investment researcher Lyn Alden believe that factors beyond just the halving and U.S. Bitcoin ETFs could drive Bitcoin to new heights in 2024.