At 08:00 UTC on Friday, Bitcoin (BTC) options worth $6.68 billion and Ether (ETH) options worth $3.5 billion will expire on the leading crypto derivatives exchange, Deribit.

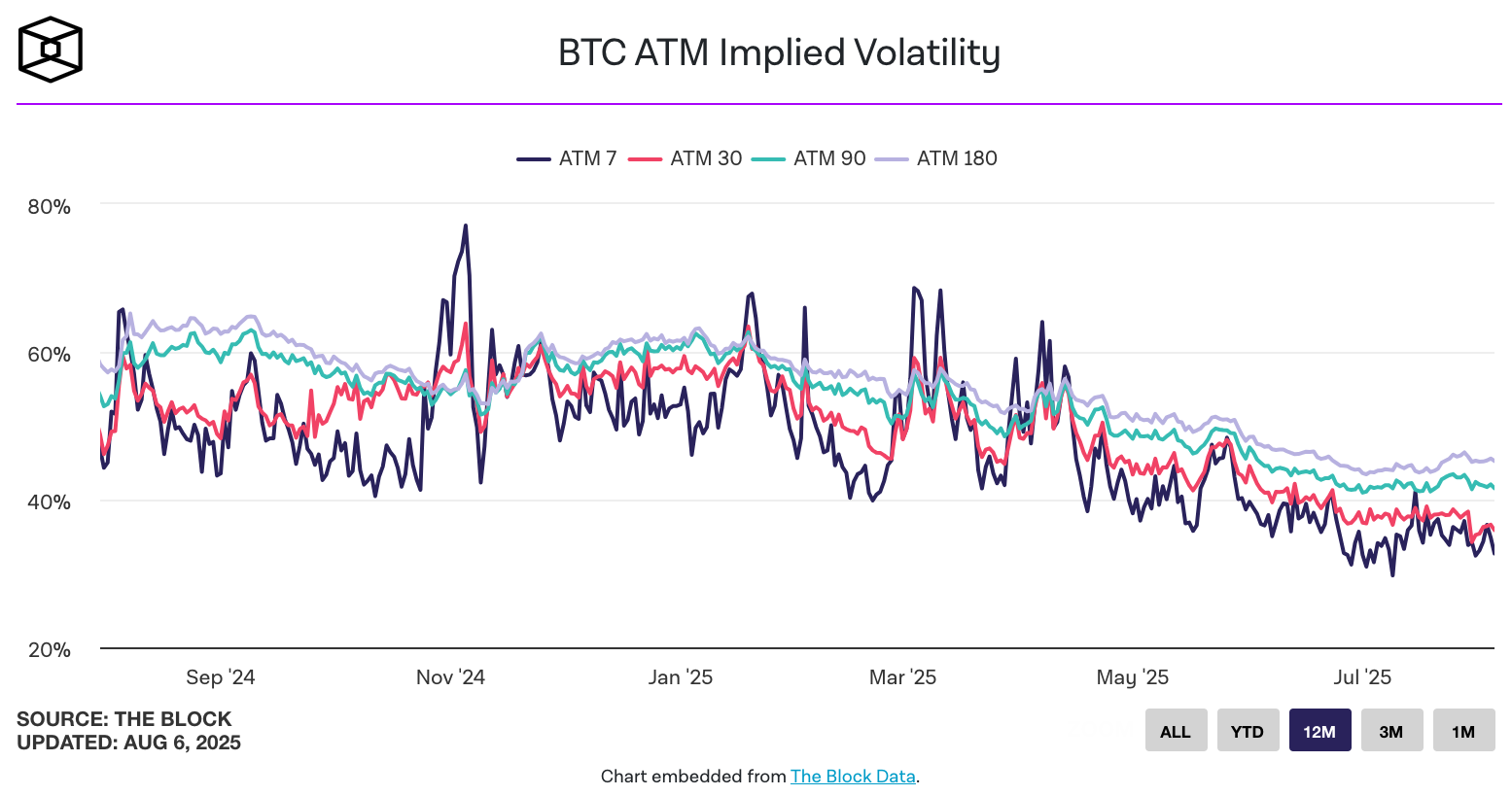

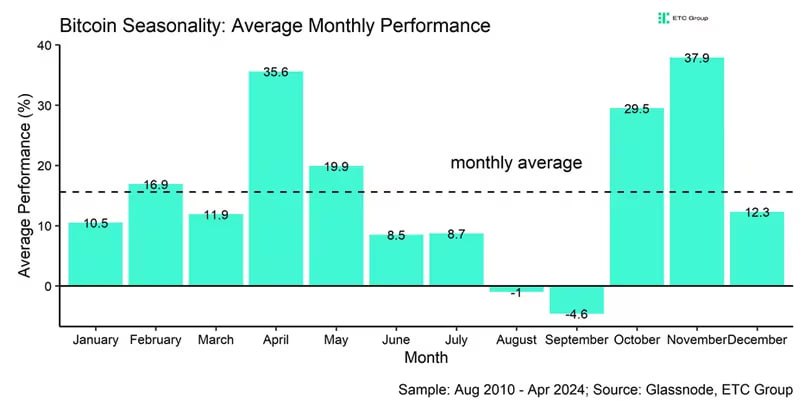

The upcoming expiration, representing over 40% of the current total open interest exceeding $23 billion, could trigger a surge in market volatility. Large quarterly expirations often lead to increased volatility, making prices more unpredictable due to high trading volumes and the closing/rolling over of positions.

“As we approach the large quarterly expiration on Friday, potentially influenced by quadruple witching and related volatility in U.S. stock markets, more than 25% of Deribit’s open interest expires in the money, which equals over $2.7 billion. The total notional size of the expiration exceeds $10 billion,” said Luuk Strijers, Chief Commercial Officer of Deribit.

Options are derivative contracts that grant the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on a specific date. Bitcoin, the leading cryptocurrency by market value, has fallen nearly 9% this month, testing bargain hunters below $60,000 at one point.