Blockchain analytics firm Arkham Intelligence has revealed that it has identified previously unknown Bitcoin addresses associated with Strategy, one of the largest institutional investors in cryptocurrency. According to Arkham’s report, the identified addresses hold 70,816 BTC — worth approximately $7.6 billion at current market prices. This sum represents 87.5% of Strategy’s total Bitcoin holdings, marking a significant discovery in the crypto sector.

“[Michael] Saylor said he would never disclose his addresses. So we did it,” Arkham stated, emphasizing the importance of transparency in the crypto space.

Arkham’s findings have sparked intense debate within the community, as Strategy’s founder Michael Saylor has previously expressed strong opposition to publishing corporate wallet addresses. At the Bitcoin 2025 conference in Las Vegas, Saylor warned of the dangers of such disclosures:

“No institutional or corporate security analyst would consider it a good idea to publish all wallet addresses in a way that makes you trackable,” Saylor remarked.

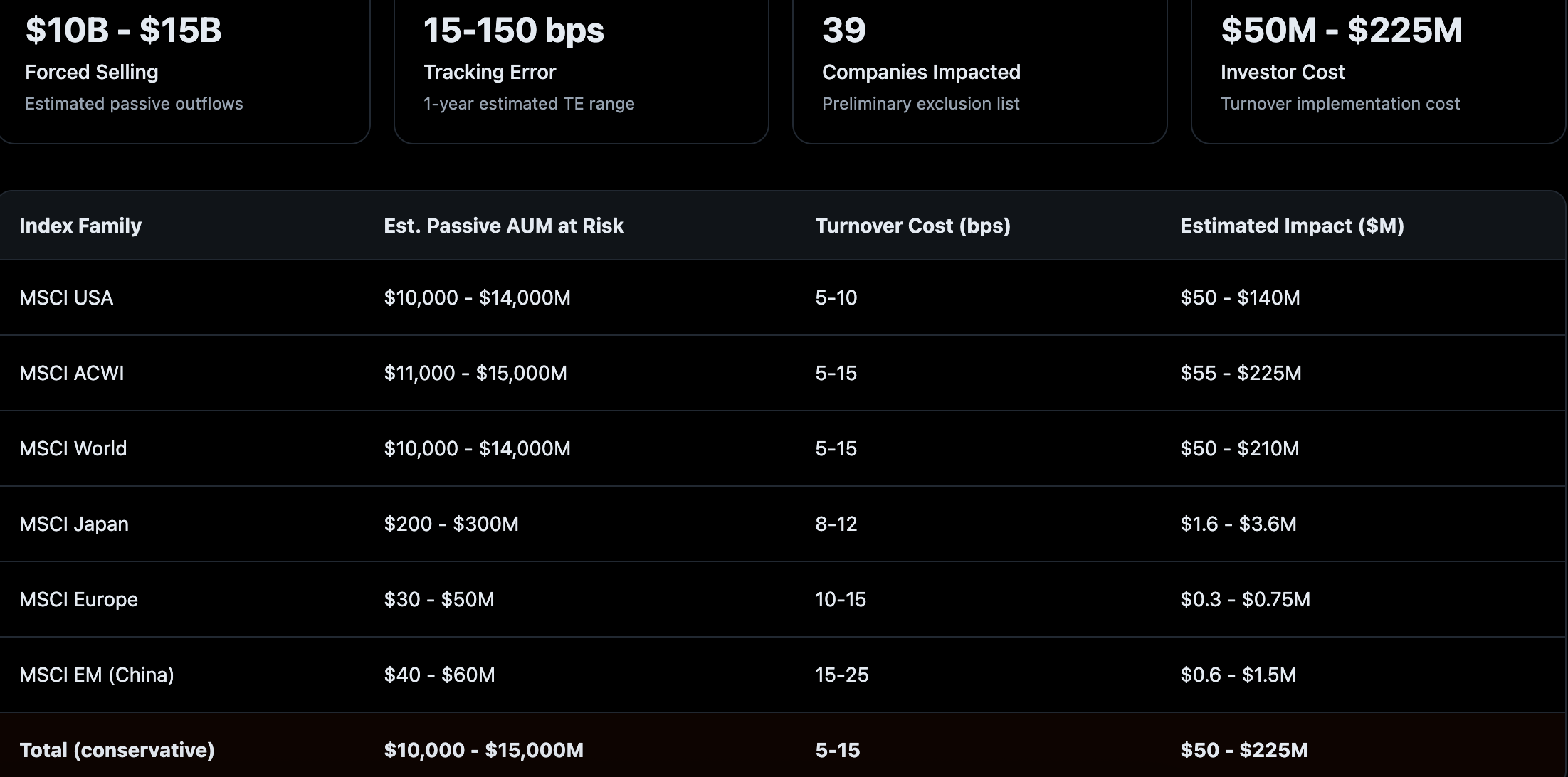

He stressed that revealing such information exposes companies to a wide range of risks — including hacking, phishing attempts, regulatory scrutiny, competitive threats, and potential market manipulation. Saylor also highlighted the challenge of having every future transaction under the spotlight, as this could compromise the company’s strategic decisions and create unforeseen risks:

“Disclosing addresses means every move you make will be under a microscope. This creates not-so-obvious but significant threats,” he added.

Saylor suggested leveraging artificial intelligence to better understand these threats, claiming that an AI system could generate “50 pages” of potential security issues associated with publicizing wallet addresses.

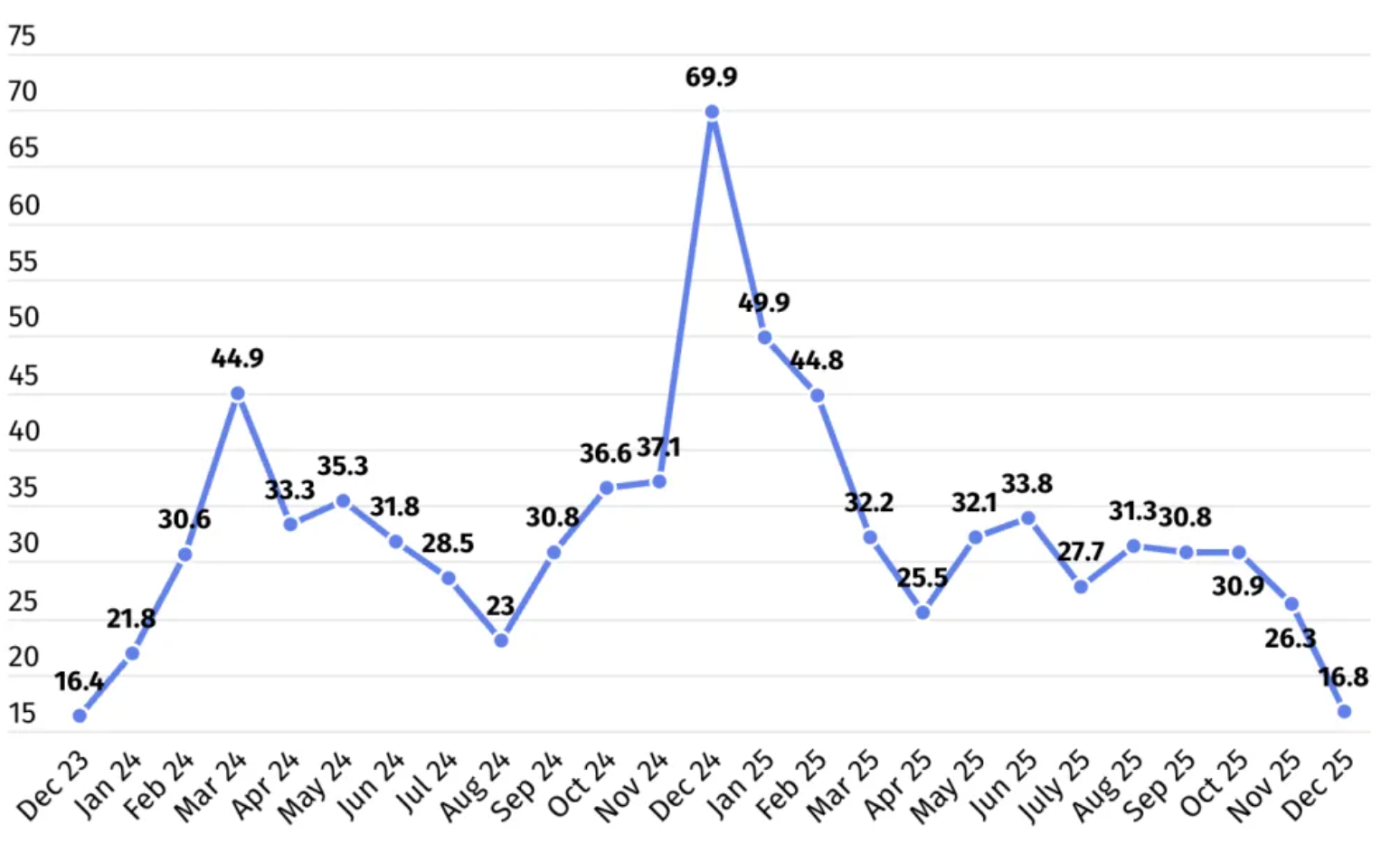

Meanwhile, Strategy remains highly active in the crypto market. In Q1 2025, the company generated $5.8 billion in Bitcoin profits, yet reported overall losses exceeding $4 billion, underscoring the extreme volatility of the crypto landscape.

Adding to the controversy, on May 19, Strategy faced accusations of making “false or misleading statements” regarding the profitability of its Bitcoin strategy. The allegations claim that the company overstated the benefits of its BTC investments while downplaying associated risks, including volatility and potential for severe losses.

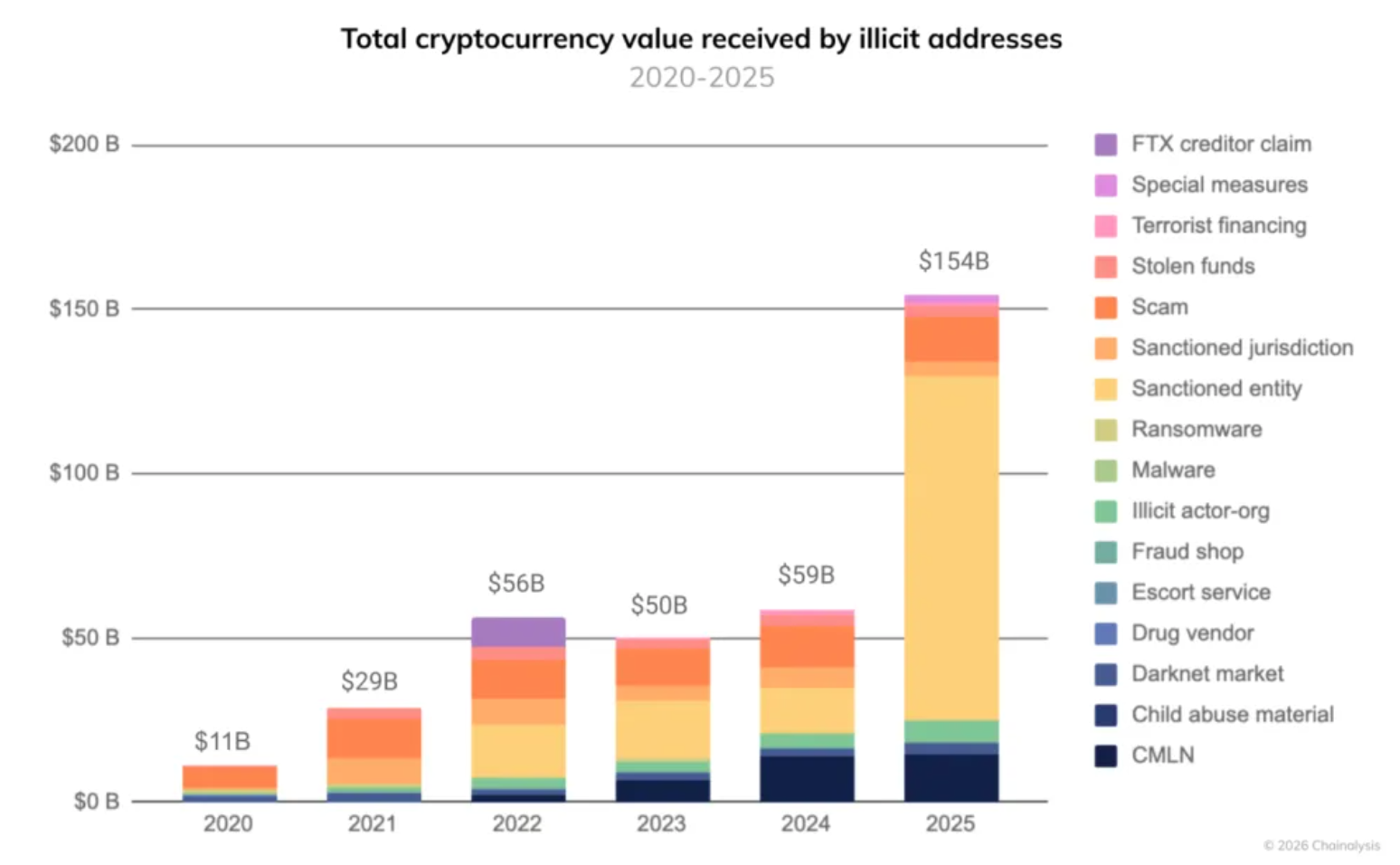

These developments raise critical questions about the future of transparency and security in corporate crypto investments. The Strategy case illustrates the delicate balance between openness and protection in a world where blockchain’s inherent transparency allows anyone to trace funds in real-time.

Key issues remain unresolved: How can companies protect their crypto assets in an ecosystem designed for public visibility? And where is the line between responsible disclosure and unnecessary exposure to risks?

The debate continues, with Strategy and Arkham at the heart of the discussion.

4o