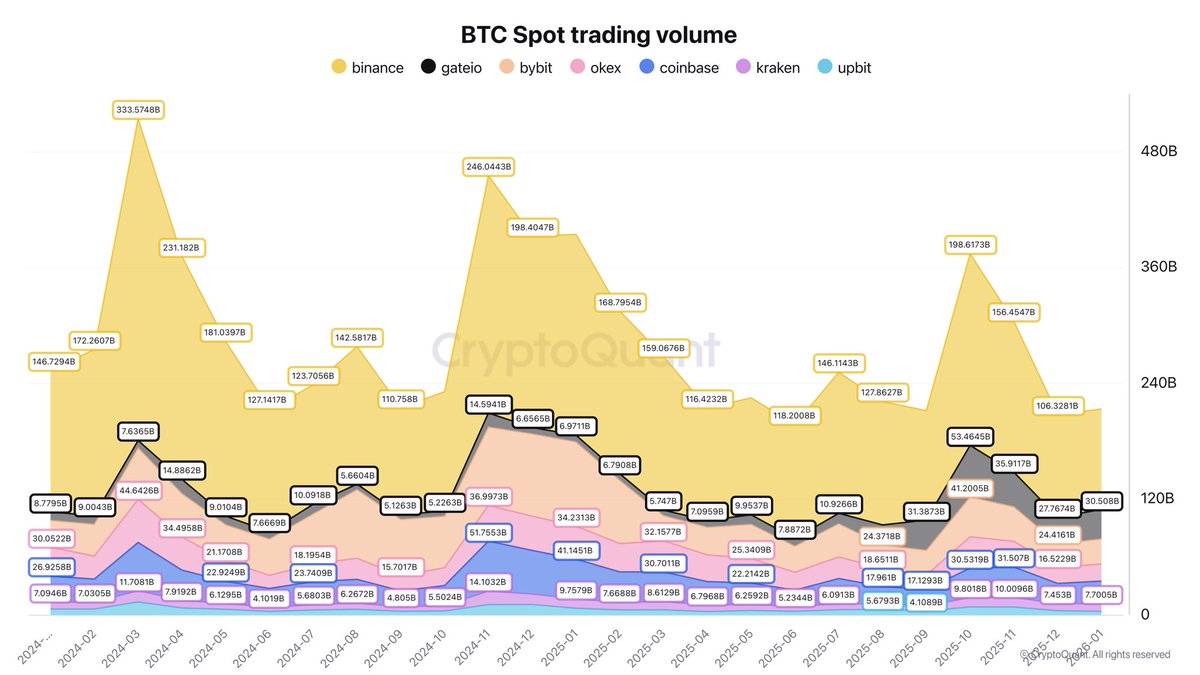

Significantly affecting their earnings and activity levels. Total revenue for the month amounted to $851.36 million, which is significantly lower compared to previous months. Of this amount, only $20.76 million came from transaction processing fees, highlighting a sharp decline in overall mining profitability.

According to The Block Research, miners’ revenues in July were $99.75 million higher, making August a record-low month in 2024. For mining pools, the situation was the toughest since September 2023, with a $4.14 million drop in transaction fee income compared to the previous month.

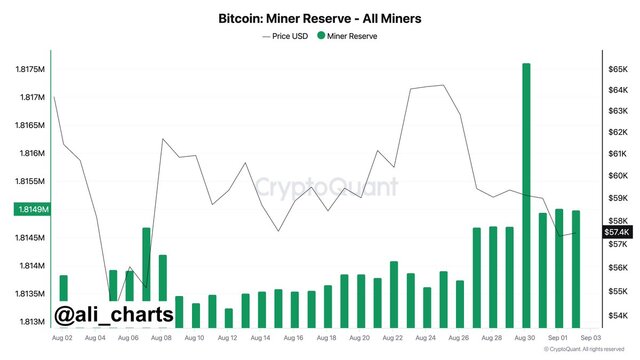

Expert Ali Martinez suggests that the decline in revenue forced miners to actively sell off their accumulated Bitcoin. As a result, 2,655 BTC, worth approximately $154 million, were sold over the weekend. This sell-off has increased pressure on the market, becoming one of the reasons hindering Bitcoin’s recovery to the $60,000 level.

Additionally, other factors continue to influence the market, including overall cryptocurrency market volatility, changes in mining difficulty, and macroeconomic conditions, all of which are putting further pressure on the price of the leading cryptocurrency.