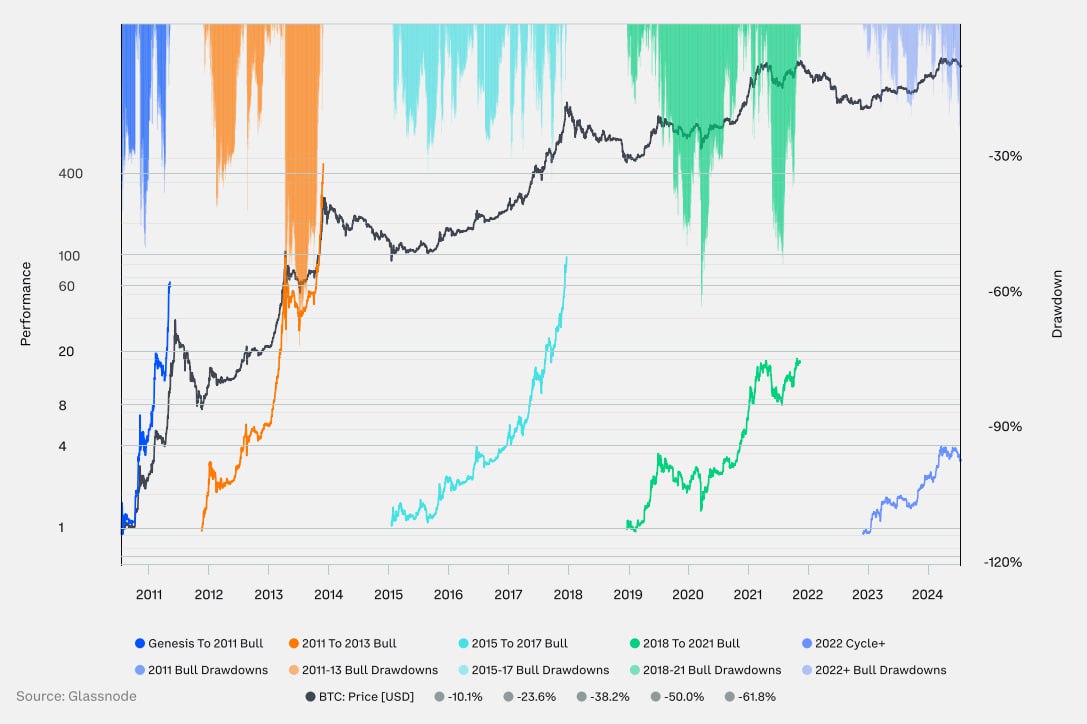

According to a new report by Glassnode analysts, Bitcoin has historically shown exponential growth during bull cycles, accompanied by significant corrections.

In the current bull cycle, which began in November 2022, the Bitcoin price has increased nearly fourfold from its lows. In past cycles (2015-2017 and 2018-2021), prices rose by 100 times and 20 times, respectively.

For previous cycles, the following correction distribution was typical:

- 9 pullbacks in the range of 5%-20%;

- 3 pullbacks in the range of 20%-40%;

- 1 pullback in the range of 40%-70%.

In the current cycle, the following has been observed:

- 8 pullbacks in the range of 5%-20%;

- 2 pullbacks in the range of 20%-30%;

- No pullbacks greater than 30%.