On the night of Saturday, August 3rd, the price of Bitcoin dropped below $62,000, losing 4.2% over the past 24 hours. At the time of writing, Bitcoin is trading at $61,750.

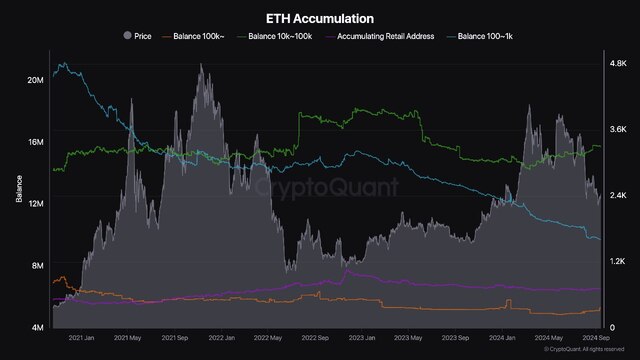

Ethereum, the second-largest cryptocurrency by market capitalization, broke the psychological threshold of $3,000 for the first time since July 8th, decreasing by 5% over the past day.

Most top cryptocurrencies also showed declines. The biggest losers over the past 24 hours were Toncoin (-6.5%) and Solana (-5.5%).

The total market capitalization of cryptocurrencies stands at $2.3 trillion.

According to Coinglass, the total volume of liquidated positions over the past day reached $289 million, with $247 million being long positions.

The Fear and Greed Index dropped to 37, indicating growing panic among investors.

It is worth noting that on July 31st, the Federal Reserve left the key interest rate unchanged, leading to a modest correction in Bitcoin to $66,400. However, on August 1st, its price fell below $63,000.

Reasons for the Decline

The main factors influencing the decline in prices include:

- Overall state of global financial markets: Increasing inflation expectations and concerns about potential interest rate hikes have led to a reduction in risky assets, including cryptocurrencies.

- Regulatory news: Intensified regulatory pressure on cryptocurrency exchanges and miners, particularly in China, continues to negatively impact the market.

- Technical factors: The breach of key support levels triggered a wave of automatic sales, exacerbating the decline.

Analyst Predictions

Cryptocurrency market experts predict further volatility in the near term. Some believe that the current correction may be temporary and followed by a recovery. Others warn of a potential deepening of the decline if negative factors persist.

Recommendations for Investors

In light of increased volatility, analysts recommend that investors:

- Exercise caution and avoid making hasty decisions.

- Consider hedging risks.

- Focus on long-term strategies and avoid short-term speculation.

The situation in the cryptocurrency market remains tense, and future developments will depend on various factors, including economic policy, regulatory changes, and overall investor sentiment.