According to analysts, Bitcoin has moved into the late – and most vulnerable – phase of the current market cycle. Large holders of the first cryptocurrency have noticeably slowed their accumulation, while retail investors, on the contrary, have stepped up buying on the dip. BRN describes what is happening as a “classic late-cycle picture”, when the market becomes especially fragile. The Block reports.

On the night of December 1, Bitcoin’s price fell below $85,500 after a recent recovery toward $91,000. The asset is now trading around $86,400.

The total crypto market capitalization has shrunk by roughly $114 billion in a short period, down to around $3 trillion. Futures liquidations reached $638 million, of which $569 million came from long positions.

Late-Stage Cycle and “Emotional Flush-Out”

Head of Research at BRN, Timothy Mssir, described the sharp move as a typical market “flush-out”, driven by liquidity imbalances and skewed positioning among traders.

According to him, realized losses among short-term holders surged during the sell-off. This points to an emotional capitulation of a portion of retail investors who couldn’t withstand the volatility and closed positions at a loss.

At the same time, on-chain data, Mssir notes, remains mixed:

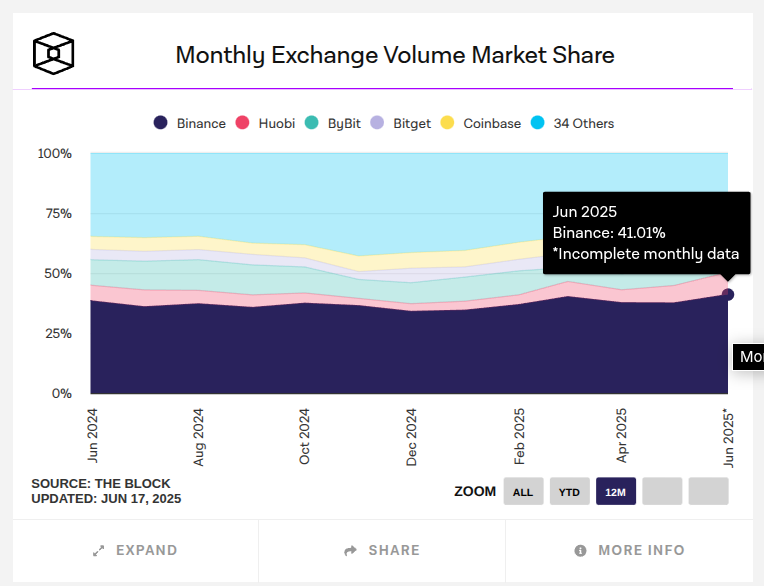

- balances on centralized exchanges still do not indicate a massive capital exodus;

- the ongoing inflow of stablecoins signals available dry powder and potential buying power from market participants.

In other words, the market is not showing a full-blown trend reversal, but rather elevated stress and fragility in the current phase.

The Asian Factor: What Triggered the Drop

The correction started with a negative impulse from the Asian region, where several adverse events coincided.

Analysts at QCP Capital primarily link the crash to the hawkish rhetoric of Bank of Japan Governor Kazuo Ueda. His comments pushed the yield on two-year Japanese government bonds toward 1%, reinforcing expectations of a key rate hike as early as December. Higher yields on traditional assets automatically dampen the appeal of risk assets, including cryptocurrencies.

Additional pressure came from weak macro data out of China:

the non-manufacturing PMI dropped below the key threshold, effectively “contracting” for the first time in almost three years. This intensified concerns about regional demand and the availability of global liquidity.

Sentiment worsened further after a statement by Strategy CEO Phong Le that the company may start selling Bitcoin if its mNAV metric falls below 1. The firm currently holds 649,870 BTC with an estimated value of $55.9 billion.

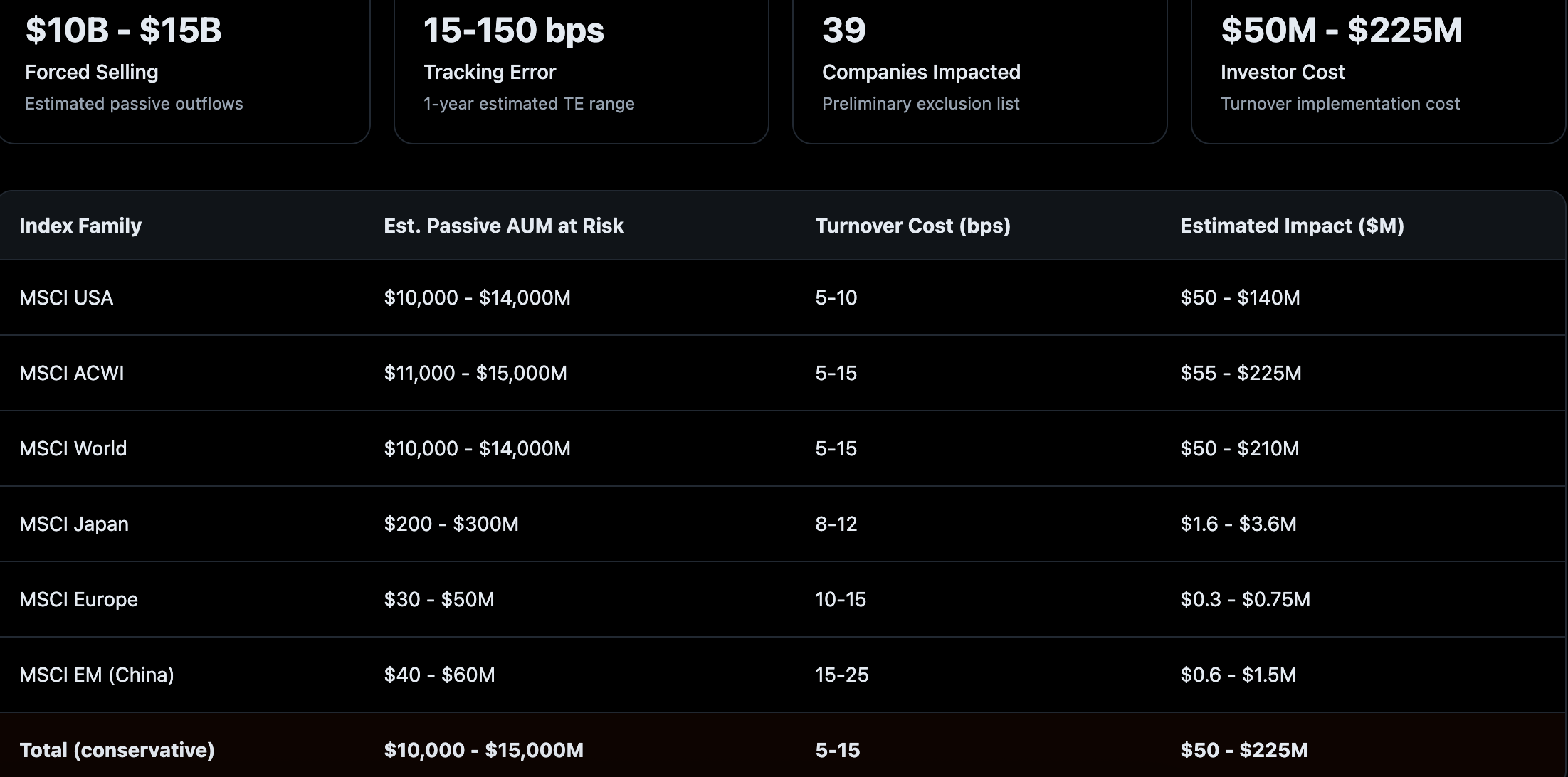

According to QCP, such comments triggered panic and forced liquidations of leveraged positions, especially against the backdrop of the upcoming December rebalancing of equity indices — a critical period for the company.

Mixed Signals: Why the Correction Looks Strange

The current pullback raises questions among analysts because it is happening against a backdrop of factors that, on paper, should be supportive for the market.

On the one hand:

- the probability of a U.S. Federal Reserve rate cut is rising;

- inflows into spot Bitcoin ETFs have resumed after a record November outflow of $3.5 billion, the worst figure since February.

On the other hand, the market has largely ignored the positive backdrop, and the rebound from local lows quickly gave way to another leg down. QCP sees this behavior as typical for a late-stage cycle:

the key question now is whether Bitcoin can hold previous lows amid rising investor caution.

What to Watch Next: Macro Data and ETFs

Bitcoin’s further trajectory will largely depend on incoming U.S. economic data. Market participants are closely watching:

- the PMI index,

- the ADP employment report,

- JOLTS job openings data,

- as well as the key inflation gauge PCE.

According to Timothy Mssir, these releases will help clarify whether the December 1 sell-off marked a local capitulation or the beginning of a more prolonged downtrend.

The analyst warns that in the near term, traders should expect elevated volatility with sharp moves in both directions. For a sustainable uptrend to resume, he believes Bitcoin needs to:

- firmly hold above $90,000;

- confirm this move with steady capital inflows into ETFs and improvement in key on-chain metrics.

Possible Scenarios: Wide Ranges and the Risk of a Deeper Correction

Experts at London Crypto Club, David Brickell and Chris Mills, caution that December may play out within uneven and poorly defined trading ranges. Liquidity stress, they say, “is still lurking in the background” and could flare up at any moment.

Bloomberg Intelligence strategist Mike McGlone maintains his Bitcoin price target around $50,000, allowing for the possibility of a deeper correction.

He highlights several factors that could increase downside pressure:

- “natural” mean reversion after a strong rally;

- record-breaking gold rally as an alternative safe-haven asset;

- artificially suppressed volatility in the stock market;

- virtually unlimited supply from altcoins, diluting demand for Bitcoin.

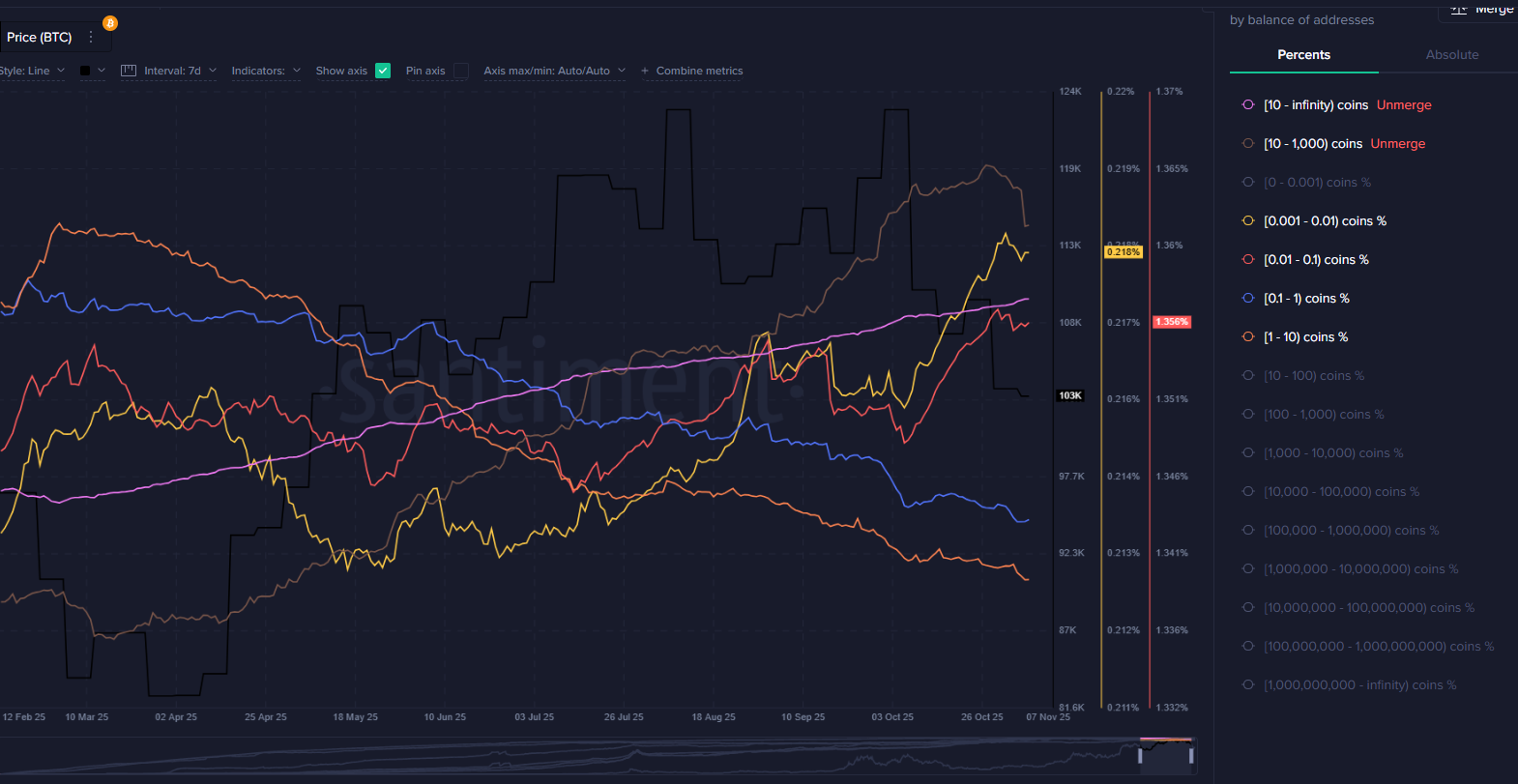

Support Zone and Behavior of New Investors

According to Glassnode estimates, the $80,000–85,000 range looks like a potentially robust support zone. The average entry price of investors in this corridor makes it an important psychological and technical level.

Analysts note that market participants who have opened positions recently are highly likely to defend this range from further downside by aggressively buying dips.

Bottom Line

Bitcoin has entered a late, nervous phase of the cycle, where each new macro release or central bank comment can trigger sharp swings. While core fundamentals do not yet point to a full trend reversal, the combination of liquidity stress, tougher rhetoric from central banks, and growing investor caution makes the market highly sensitive to any negative signals.