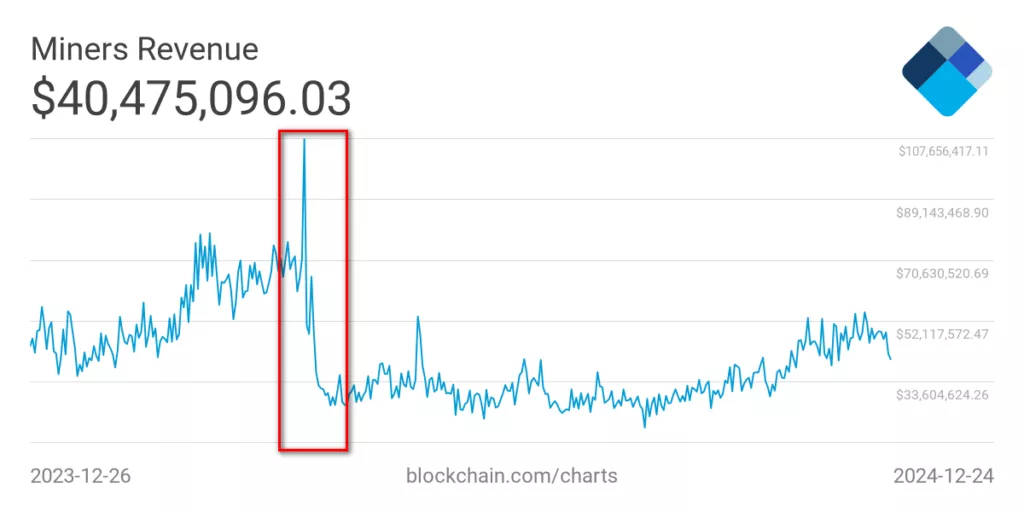

Bitcoin (BTC) sharply declines on Monday after the announcement of the start of the return of more than 140,000 BTC to clients of the bankrupt crypto exchange Mt. Gox, who lost their funds as a result of a hack in 2014.

At the time of publication, Bitcoin’s value stands at $60,700, down more than 5% in the last 24 hours, marking the weakest performance since the beginning of May. Ether (ETH) has also declined by a similar percentage, as has the broader CoinDesk 20 index.

Sellers are analyzing the potential impact of more than 140,000 BTC hitting the market in less than a month. For comparison, this is almost like the immediate liquidation of Fidelity’s spot ETF, which holds 167,375 BTC.

“We believe fewer coins will be distributed than many anticipate, exerting less pressure on the BTC market than expected,” says Alex Thorn, head of research at Galaxy. Thorn notes that, according to his research, 75% of creditors will accept an “early” payout in July, meaning around 95,000 coins will be distributed. Of these, he believes 65,000 coins will go to individual creditors, who may prove to be “stronger” holders than expected.