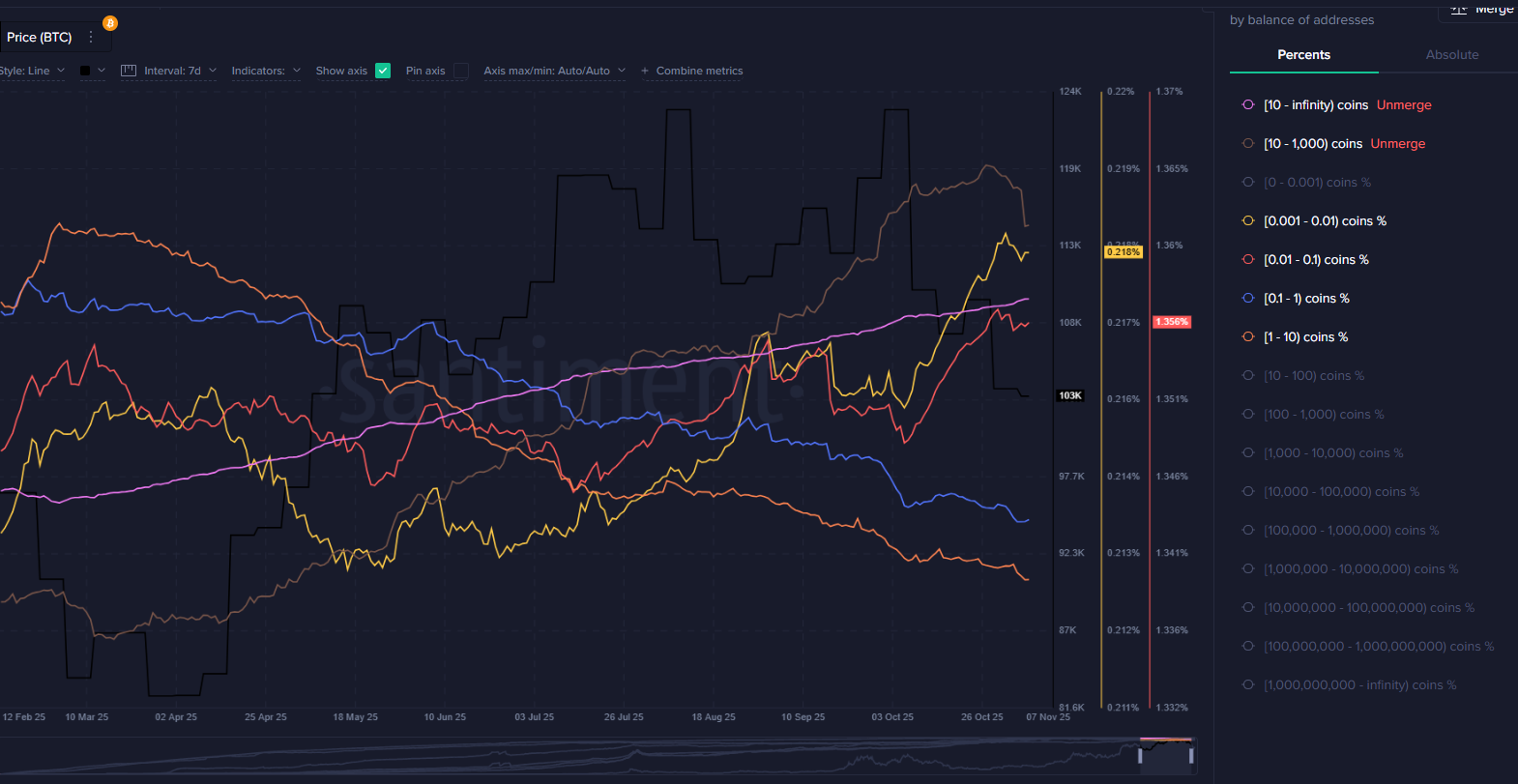

On November 7, Bitcoin fell below the key psychological threshold of $100,000 — down to around ~$99,900. As of publishing time, BTC is trading near $100,110. Over the past 24 hours the asset lost 2.9%, while the weekly drawdown is almost 9%.

According to trader Ardi, the next notable support zone is $98,000. Analysts from CryptoQuant’s XWIN Research also see a local bottom around $100,000 — based on the MVRV indicator. Their key range estimate is $99,000–101,000.

Altcoins are also in the red

Almost the entire market is declining. Ethereum dropped 4.6% in 24 hours and more than 15% this week — current price is about ~$3200.

Within the top-10 by market cap, the only asset in the green is Dogecoin — +0.3%.

Total liquidations exceeded $76.8 million in the last hour alone, and $674.3 million during the last 24 hours.

The Crypto Fear & Greed Index has fallen to 24 — the “extreme fear” zone.

ETF flows turn positive again

Ironically, the price drop is happening while spot crypto ETFs are again attracting fresh capital.

During the latest trading session, spot BTC ETFs recorded net inflows of $240 million — after six straight days of outflows. The segment leader remains BlackRock’s IBIT with $112 million. FBTC from Fidelity ($61 million) and ARKB from Ark & 21 Shares ($60 million) also closed the day in the green.

Ethereum-oriented funds attracted $12 million — with BlackRock’s ETHA leading ($8 million). Fidelity’s FETH got $4 million, Bitwise’s ETHW — $3 million.

Interest in Solana remains strong eight trading days in a row: another $29 million came into spot Solana ETFs during the last trading day. Since launch, cumulative inflows into Solana ETF products reached $323 million. The segment is still represented by only two issuers — Bitwise’s BSOL and Grayscale’s GSOL.

Bottom line: the crypto market is now in a phase of intense volatility and fear, psychological levels on BTC once again trigger sell-offs — but institutional demand, judging by ETF flows, isn’t gone. This is one of the few currently positive metrics.