On July 1, U.S. spot exchange-traded funds (ETFs) for Bitcoin saw a significant outflow of $342.2 million, ending a 15-day streak of positive inflows, which totaled $4.7 billion. This marked a temporary pause in the institutional accumulation of Bitcoin, but experts suggest it does not necessarily indicate a reversal in the overall trend.

The most popular Bitcoin ETF, IBIT from BlackRock, reported no flow after a 15-day positive streak totaling $3.8 billion. The largest outflow came from Fidelity’s FBTC, with $172.7 million, followed by Grayscale’s GBTC with $119.5 million, ARK Invest’s ARKB with $27 million, and Bitwise’s BITB with $23 million.

“This is a pause in institutional accumulation, but not necessarily a trend reversal,” commented Valentin Fournier, Senior Analyst at BRN.

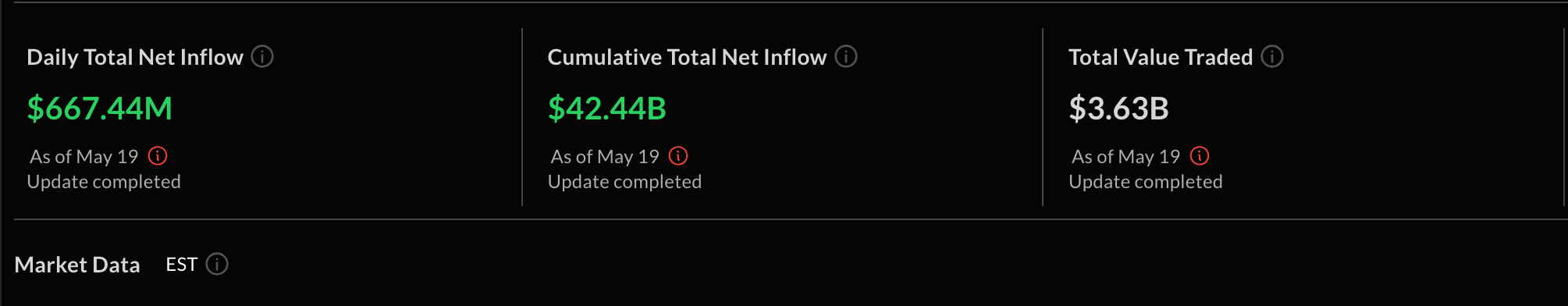

Since its launch in January 2024, U.S. Bitcoin ETFs have attracted a total of $48.9 billion, with $13.5 billion coming in 2025 alone. As of now, assets under management have reached $128 billion.

At the time of writing, Bitcoin is trading at $107,481, marking a 0.8% daily increase according to CoinGecko.

Vincent Liu, Chief Investment Officer at Kronos Research, added, “Markets are in a consolidation phase. Investors are awaiting clarity from the unemployment data set to release on July 3.”

Fournier views the consolidation between $105,000 and $110,000 as a bullish setup, especially if regulatory clarity or new institutional players emerge.

Ethereum ETFs’ Positive Flow Continues

Meanwhile, Ethereum-based funds have been enjoying positive momentum. On July 1, Ethereum ETFs saw an inflow of $40.7 million, with BlackRock’s ETHA leading the pack with $54.8 million. This marks the third consecutive “green” day, bringing the total for the period to $150 million. Since launching in July 2024, Ethereum ETFs have raised $4.3 billion.

Ethereum’s price is currently $2,443, having decreased by 0.1% in the last 24 hours.

Federal Reserve Chairman’s Statement Affects Market Sentiment

The outflows from Bitcoin ETFs coincide with comments from Federal Reserve Chairman Jerome Powell, who reaffirmed the Fed’s intention to maintain a strict monetary policy. He linked this stance to the trade tariffs imposed by former U.S. President Donald Trump, which have increased inflation forecasts.

Powell stated that the Fed would have already started lowering interest rates if it weren’t for the tariffs, which have kept inflation projections high.

Despite the single-day outflow, experts urge investors not to overreact. MEXC exchange analyst Sean Yang referred to the situation as “just a pause.” He explained that after nearly $5 billion in inflows, investors are taking a breather, and the Federal Reserve’s hawkish stance has only amplified this trend.

Yang further commented on the influx into spot Ethereum ETFs, suggesting that the data shows investors are not leaving the market but are becoming more selective in their choices.

“One day of unusual trading activity in the ETF market does not negate the billions that have already flowed in,” concluded Yang.

The outlook remains optimistic for both Bitcoin and Ethereum ETFs, with analysts watching for any potential regulatory developments or shifts in institutional activity.