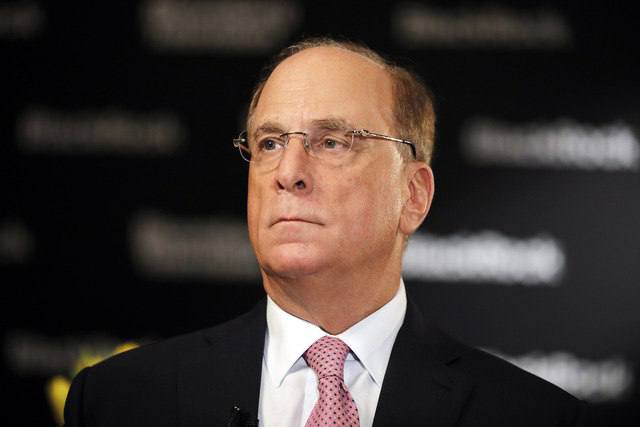

In an interview with CNBC, BlackRock’s founder Larry Fink noted that institutional investors’ interest in Bitcoin continues to grow, highlighting its strategic importance for future financial systems.

According to Fink, Bitcoin is a legitimate financial asset, as it generates returns for investors even during periods when other assets stagnate. Investors view it as a reliable means of preserving and growing capital, which enhances its appeal amid global economic challenges.

The digital currency also serves as a hedge against risks in times of macroeconomic instability. The volatility of traditional markets and global economic shifts drive investors to seek assets that can protect their portfolios, and Bitcoin is increasingly seen as such an alternative.

Fink emphasized that there is currently a capital shift toward Bitcoin, which is becoming a significant part of both retail and corporate investors’ portfolios. The rise in institutional investments in Bitcoin reflects growing confidence in digital assets as long-term financial instruments capable of providing stable returns even in an unstable global economy.

Each year, Bitcoin’s role in the financial world grows, and its recognition among major market players signals its potential as a key element of the future financial landscape.