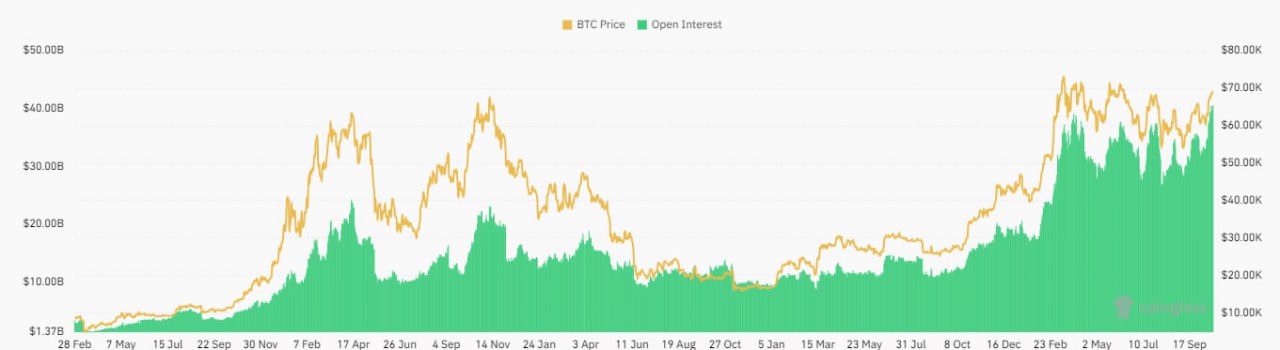

After the July dip, BTC is trying to regain lost ground, but onchain data analysis suggests potential resistance at the $65,000 level. The leading cryptocurrency is currently trading almost 1% higher at $63,200, attempting to recover after a 7% loss in June.

The price decline, which erased the May gains, is attributed to miner sales and concerns that inflows into ETFs represent arbitrage bets rather than purely bullish sentiment. Short-term holders, whose average acquisition cost is now $65,000, are facing losses and may increase selling pressure around this level.

Analysts warn of potential difficulties around $65K, as market participants might aim to break even.