At the end of August, miners once again started selling off their reserves amid the stagnation of BTC, aiming to secure profits in uncertain market conditions.

Their income exceeded $3.4 million, marking a significant event for the industry.

On August 28, the difficulty of Bitcoin mining increased from 86.87 T to 89.47 T (up by 2.99%), presenting another challenge for miners operating on the edge of profitability.

The increase in Bitcoin mining difficulty is linked to a rise in hashrate following the connection of new miners to the network. This indicates ongoing competition among market participants, who strive to maximize profits under current conditions.

Another difficulty adjustment is expected on September 10, which could once again alter the market dynamics.

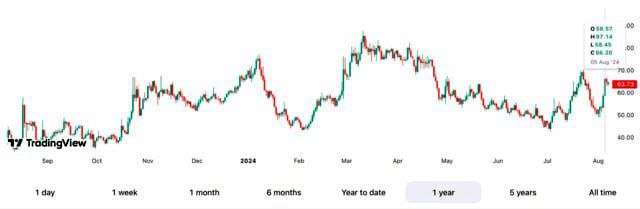

The hash price is still below $50 and recently dropped to $42, which prompted miners to sell in order to maintain profitability.

The largest pools — Foundry and AntPool — currently generate approximately 28.6% and 25.8% of the BTC hashrate, respectively, highlighting their significant influence on the mining process and confirming their dominant positions in the industry.

As Bitcoin continues to grapple with market uncertainty, miners are searching for a balance between maintaining productivity and maximizing revenue, which impacts the entire cryptocurrency ecosystem.