At a glance

On October 1, after the scheduled recalculation, Bitcoin’s mining difficulty rose by 5.9% to a record 150.8 T—a new all-time high for the network.

What happened

- The October 1 adjustment pushed difficulty to 150.8 T, reflecting the overall competition and compute power connected to the network.

- Next-adjustment outlook: a modest 1.7% decrease to 148.1 T.

Network dynamics

- Difficulty has been rising steadily since mid-July.

- The average block interval had long stayed below 10 minutes, but most recently exceeded 11 minutes, prompting a corrective adjustment.

- According to Glassnode, the smoothed hashrate (7-day MA) remains above 1 ZH/s (zettahash per second).

Pool breakdown

- Foundry USA — 29.7% of hashrate

- AntPool — 15.5%

- F2Pool — 14.8%

Together, three pools control around 60% of the network’s computing power.

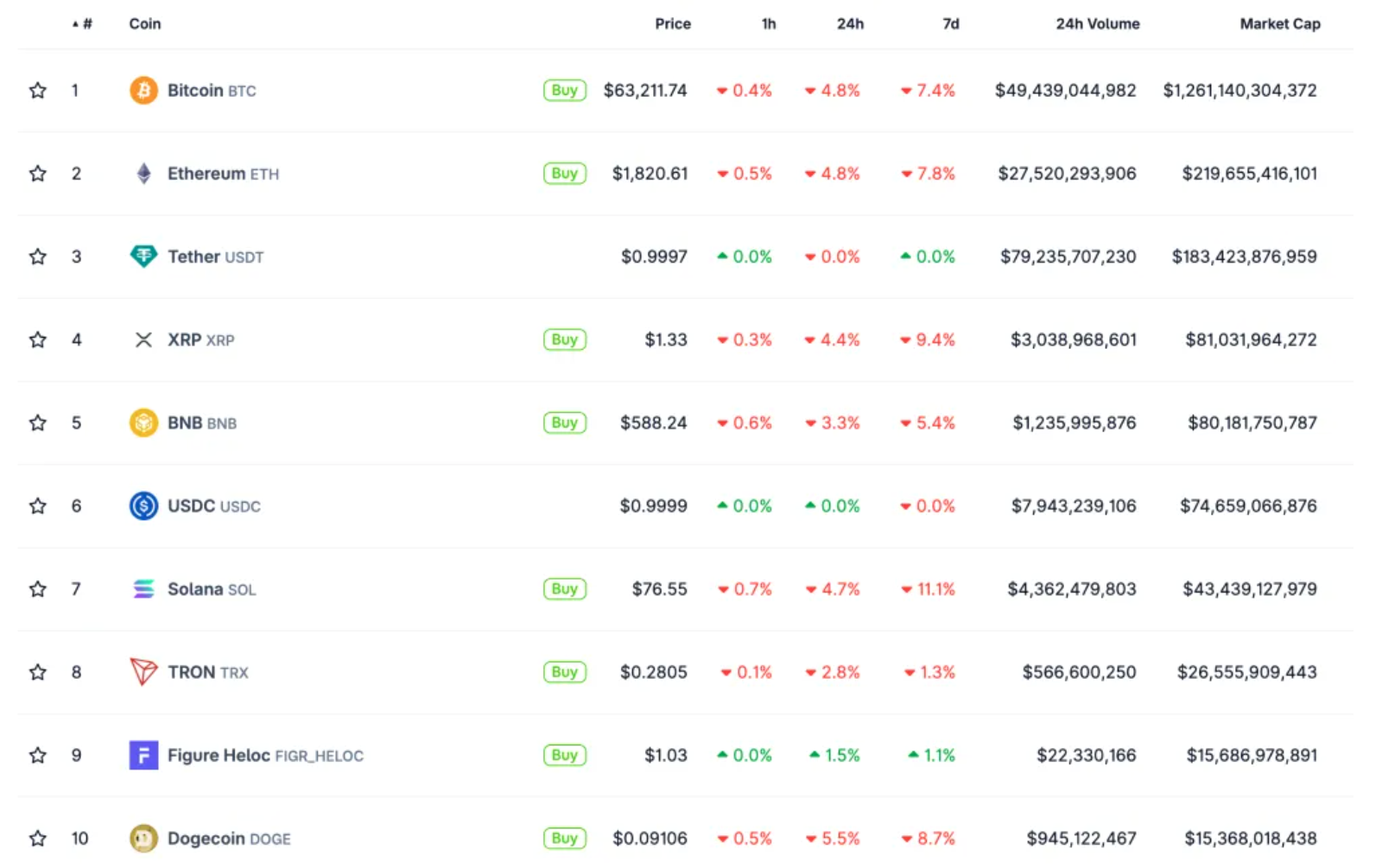

Market and miner profitability

- Hashrate Index reports hashprice over the last 24 hours increased from $49.8 to $50.3 per PH/s per day.

- Miner revenues are also supported by Bitcoin’s recovery above $120,000.

Public miners gain share

BitcoinMiningStock estimates public mining companies have increased their share of total compute power to 39.8%, signaling accelerating industry consolidation.

Deals & infrastructure

In late September, mining firm TeraWulf announced plans to raise $3 billion—with Morgan Stanley’s support—to build data centers, a notable signal for capital-intensive infrastructure.

Betting on efficiency: how miners are adapting

Rising difficulty amid a moderately volatile hashprice raises the bar for operational efficiency. Key adaptation vectors:

- ASIC efficiency: migration to more energy-efficient models, fine-tuning firmware and frequency/voltage profiles.

- Energy management: long-term power contracts, siting in regions with surplus generation, flexible demand-response programs.

- Power dispatching: dynamically throttling farms based on BTC price and electricity tariffs.

- Financial hedging: managing risk via BTC/hashrate derivatives and revenue diversification.

- Infrastructure & scale: consolidation and M&A to lower unit costs, better access to capital, and capex optimization.

Bottom line

The new 150.8 T difficulty high underscores intense competition in the Bitcoin network. With a slight pullback forecast and hashprice improving, miners’ focus is shifting to operational efficiency and energy costs. The growing share of public players and multi-billion-dollar infrastructure plans suggest the hashrate race is very much on—and the winners will be those who manage costs and scale best.