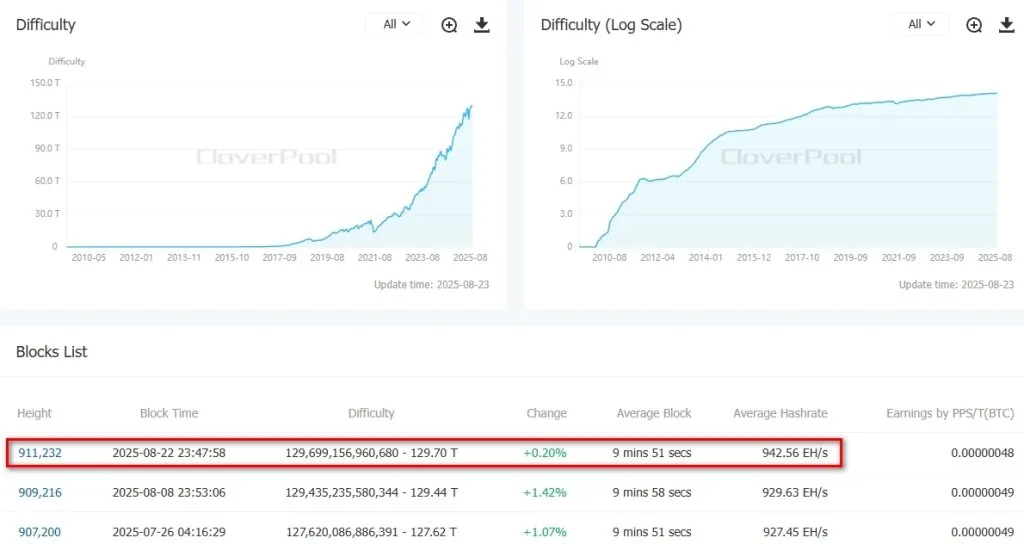

On August 22, 2025, the Bitcoin network recorded a new all-time high in mining difficulty, reaching 129.7 T. Although the increase was only 0.2%, this milestone confirms the steady upward trend in computing power within the ecosystem of the first cryptocurrency.

Difficulty and Hashrate Dynamics

For the past four consecutive adjustments (roughly every 14 days), difficulty has been consistently rising. The average block interval remains below 10 minutes, while forecasts suggest a further growth of about 1.15%.

According to Glassnode, the 7-day moving average (7DMA) hashrate is currently at 945 EH/s, with the absolute peak of 966 EH/s recorded on August 7.

Distribution of Computing Power

Data from BitcoinMiningStock shows that publicly traded mining companies continue to strengthen their positions, now accounting for 39.7% of Bitcoin’s total hashrate.

Mining pool Foundry USA remains the leader with a 32.8% share, followed by AntPool (16.2%) and ViaBTC (11%). Combined, these three pools control nearly 60% of the network’s hashrate, highlighting the sector’s increasing centralization.

Miner Revenue and Bitcoin Price Impact

According to Hashrate Index, over the past 24 hours the hashprice has increased from $55.3 to $56.5 per PH/s per day. The rise in mining profitability is largely attributed to Bitcoin’s recovery above $115,000, while the network difficulty itself has seen only minimal change.

Institutional Mining Outlook

Analysts at GoMining Institutional forecast a new wave of institutional investments in Bitcoin mining. The driving factor is the intensifying competition for energy resources between the cryptocurrency industry and the artificial intelligence sector, which also requires massive computational capacity.