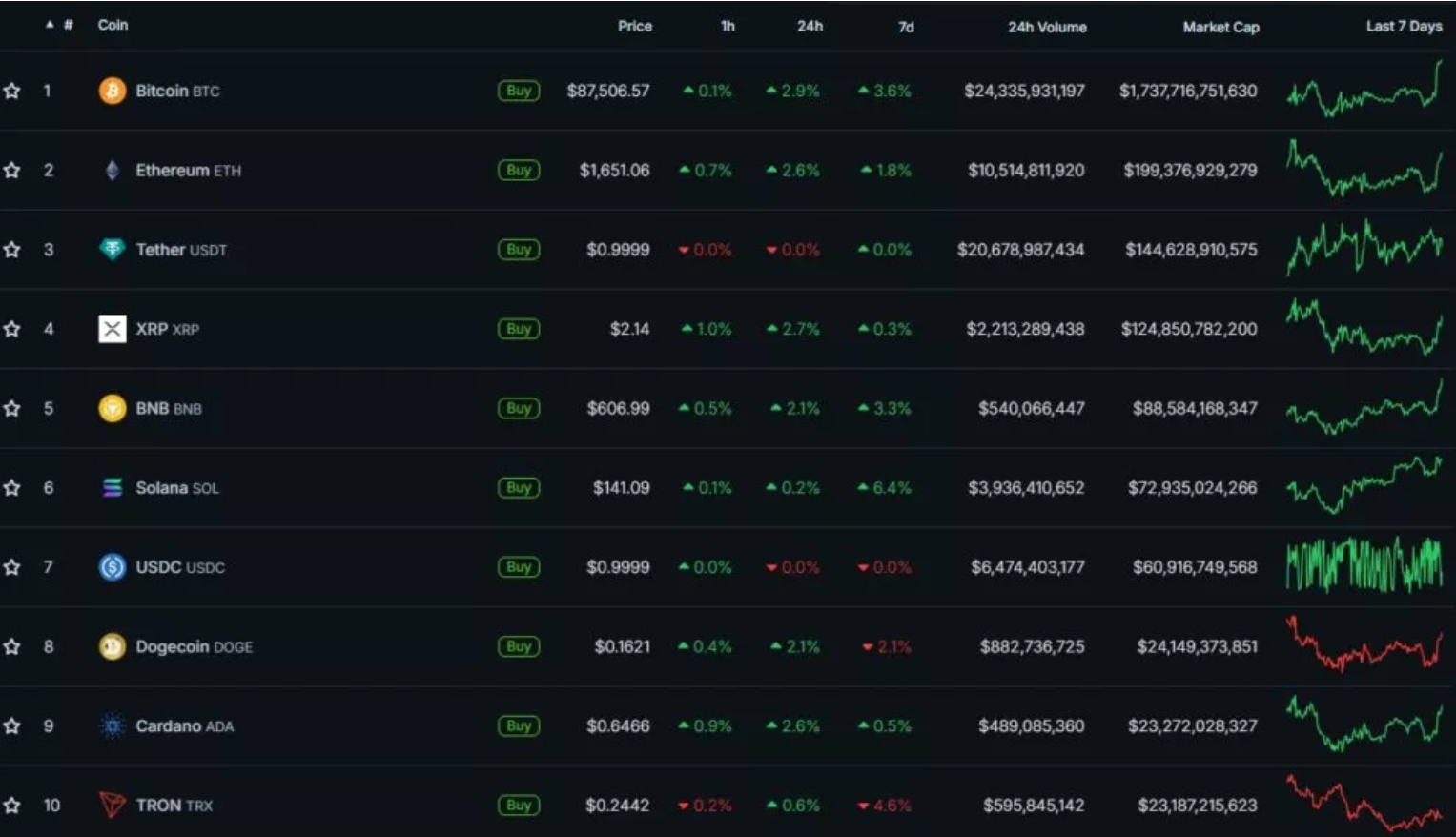

On April 21, the price of the leading cryptocurrency surged back above $87,000, revisiting levels seen earlier this month. Over the past 24 hours, Bitcoin gained nearly 3%, reaching around $87,500. Most top-10 altcoins by market capitalization followed suit with upward movement, with the exception of Solana (+0.2%) and TRON (+0.6%), which showed more modest gains.

The total crypto market capitalization grew by 0.5%, reaching $2.85 trillion. Bitcoin’s dominance now stands at 61%, reflecting its continued market leadership.

Bitcoin’s rise coincided with gold hitting a new all-time high of $3,389 per troy ounce. Meanwhile, futures for major U.S. stock indices continued to decline, signaling growing investor concerns over global economic instability.

Tensions between the U.S. and China have further intensified the market atmosphere. China’s Ministry of Commerce issued a stern warning, promising countermeasures against nations cooperating with the U.S. at the expense of Beijing’s interests. According to analysts at The Kobeissi Letter, this has boosted demand for “safe-haven” assets like gold and Bitcoin.

“The breakout above $87,000 was driven by rising global liquidity, expanding money supply, and renewed institutional interest. We’re also seeing a tightening in available supply as major players continue to accumulate,” said Dominic John, an analyst at Kronos Research, in a comment to The Block.

Data from MacroMicro shows that the combined M2 aggregate of the four largest central banks (the Federal Reserve, ECB, Bank of Japan, and People’s Bank of China) has been steadily increasing since December 2024, reaching $90.2 trillion as of February 2025.

One of the most prominent institutional investors, Michael Saylor’s Strategy firm, announced the purchase of 3,459 BTC on April 13 at an average price of $82,618. The company’s total Bitcoin holdings now amount to 531,644 BTC.

Nevertheless, despite its growing reserves, Strategy reported an unrealized loss of $5.91 billion for Q1, driven by price volatility in the digital asset market.