October 29, 2025 — The U.S. Federal Reserve (Fed) has reduced its key interest rate for the second consecutive time, cutting it by 25 basis points to a range of 3.75–4%. The decision aligned with market expectations and caused only a mild reaction across financial markets, including the cryptocurrency sector.

Economic Outlook and Fed Statement

In its official press release, the Fed noted that U.S. economic activity continues to expand at a moderate pace. However, job growth has slowed, and unemployment has edged slightly higher while remaining low by historical standards.

“Inflation has increased since the beginning of the year and remains somewhat elevated,” the statement said.

The regulator emphasized that it considers a wide range of factors in its policy decisions, including labor market data, inflationary pressures, expectations, and global economic conditions.

Cryptocurrency Market Reaction

Despite some initial volatility following the announcement, Bitcoin remained relatively stable. At the time of writing, the leading cryptocurrency was trading near $111,500, down 3% over the past 24 hours.

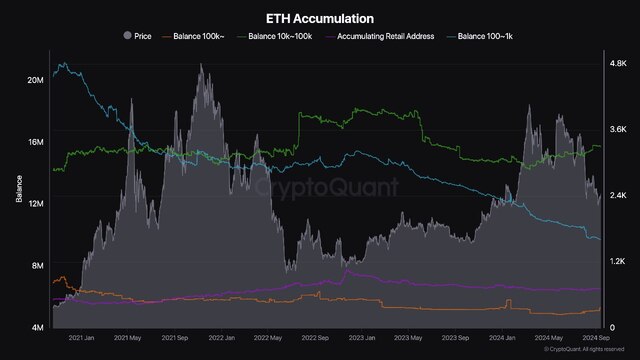

Ethereum fell below the $4,000 mark, while other major digital assets also moved into the red. TRX dropped 11%, and Dogecoin lost 3.7% over the same period.

The Crypto Fear & Greed Index remains neutral at 51 points.

Fed’s Next Steps

The Federal Reserve reaffirmed its long-term goal of maintaining annual inflation at 2%. Starting December 1, the central bank plans to end its quantitative tightening (QT) program, which involves reducing the overall volume of securities held on its balance sheet.

“The Fed stands ready to adjust monetary policy as needed should risks emerge that could impede the achievement of its objectives,” the committee stated.

Powell’s Comments

During the press conference, Fed Chair Jerome Powell highlighted the negative impact of the ongoing U.S. government shutdown on the economy. He noted that the situation has delayed the publication of several key economic indicators.

Powell also pointed out that President Donald Trump’s trade tariffs are contributing to rising prices in certain product categories, further fueling inflationary pressures.

In addition, Powell warned that labor market risks are increasing, posing potential challenges for the broader U.S. economy.