The prospects of Bitcoin reaching new all-time highs remain a hot topic among analysts, traders, and investors. However, the likelihood that the world’s first cryptocurrency will climb to $200,000 this year is considered extremely low.

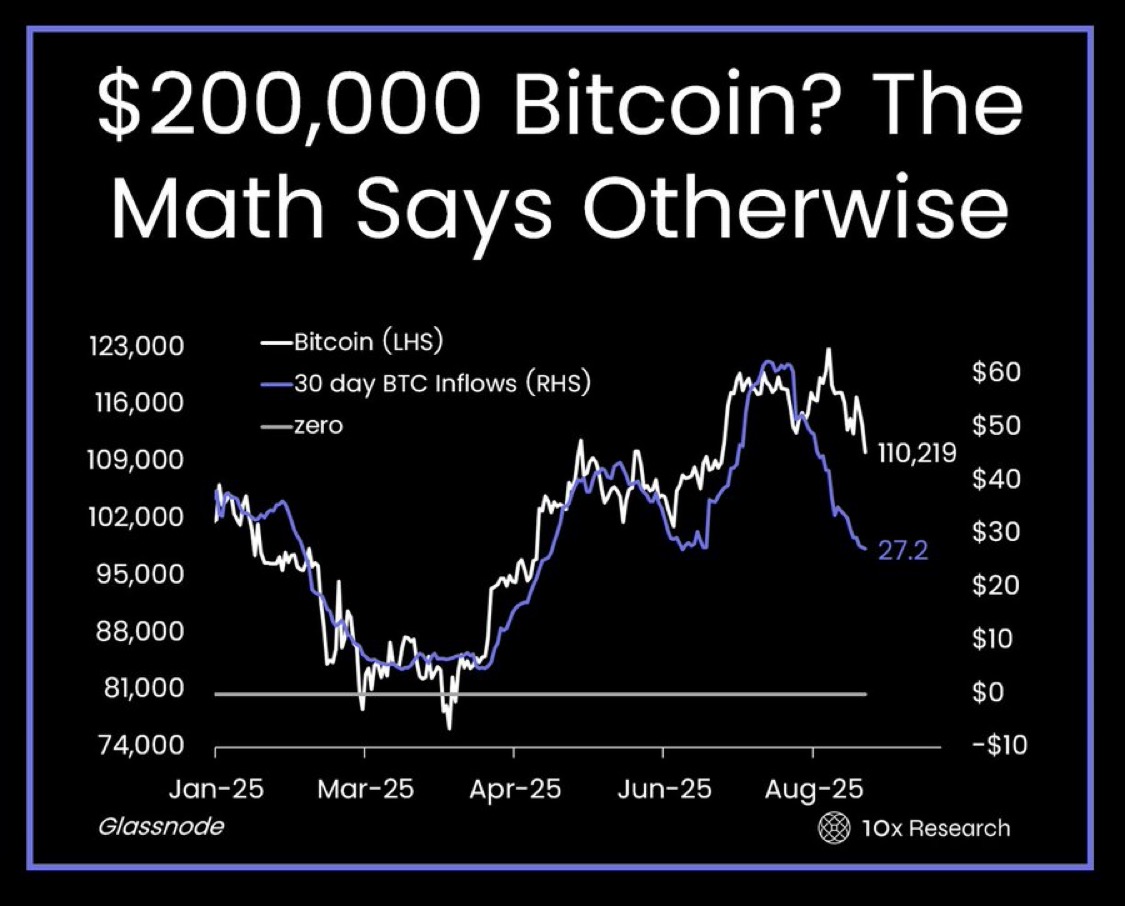

10x Research Forecast: Cautious Outlook

Research firm 10x Research argues that Bitcoin hitting $200,000 is practically unrealistic. Even a rise to $140,000 is uncertain, with only a 54% probability.

Their cautious stance is based on three key factors:

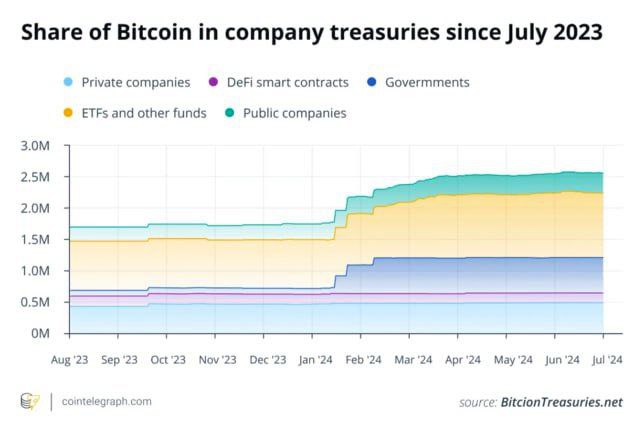

- Slowing institutional inflows. Large funds and corporations are investing less aggressively in Bitcoin, reducing fresh capital inflows.

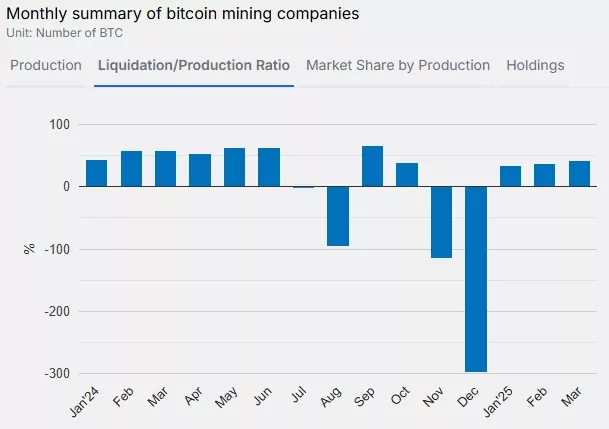

- Miner sell-offs. Bitcoin miners are cashing out profits, adding selling pressure to the market.

- Seasonal weakness in Q3. Historically, the third quarter has been one of Bitcoin’s weakest periods of the year.

Together, these factors point to a greater risk of correction rather than explosive growth.

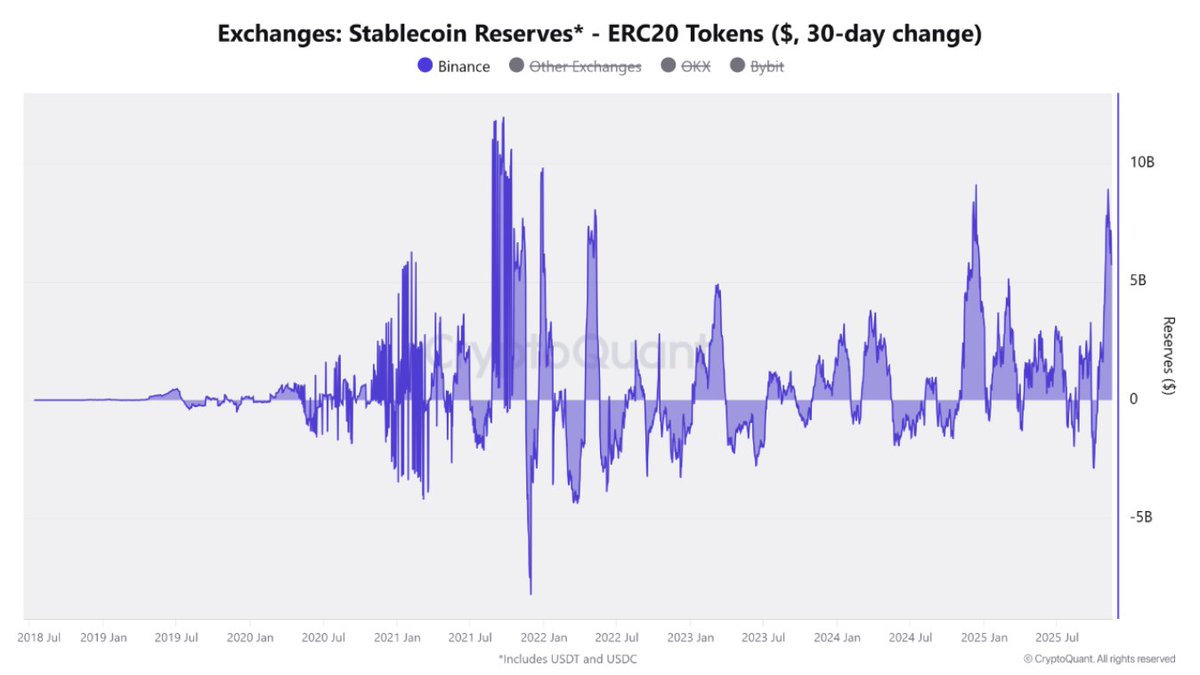

Market Signals Confirm Weakness

Data from analytics platform CryptoQuant further supports this outlook. Bitcoin’s buy-sell ratio fell to -0.945, showing sellers dominate the market. Analyst Gaah noted that similar levels were seen in November 2021 at Bitcoin’s $69,000 peak—just before the market correction began.

In other words, indicators suggest downward pressure is stronger than bullish momentum.

Traders’ Sentiment: Polymarket Forecasts

Skepticism is also reflected on Polymarket, a prediction platform where users bet on future outcomes. Only 9% of participants believe Bitcoin can hit $200,000 this year.

A far more realistic target is $125,000, with a 71% probability of being reached. This shows that most market participants expect moderate growth, not a parabolic surge.

Optimistic Scenario: $160,000 by Christmas

Despite widespread caution, some experts remain more optimistic. Economist Timothy Peterson predicts Bitcoin could rise to $160,000 by Christmas.

His forecast is based on historical data: in 70% of past years, Bitcoin gained an average of 44% between late August and late December. Under this scenario, the digital gold could indeed reach $160,000 by year-end.

Still, Peterson warns that this is more of a guide than a rule. He excluded 2017, 2018, 2020, and 2022 from his model as atypical years due to unique market and macroeconomic conditions.

Current Situation and Outlook

At the time of writing, Bitcoin is trading at $111,900. To reach even the “moderate” targets of $125,000–140,000, the cryptocurrency would need significant growth in just a few months.

Thus, the $200,000 scenario remains largely theoretical, while more realistic year-end targets lie in the $125,000–160,000 range, depending on whether seasonal patterns prevail or selling pressure intensifies.