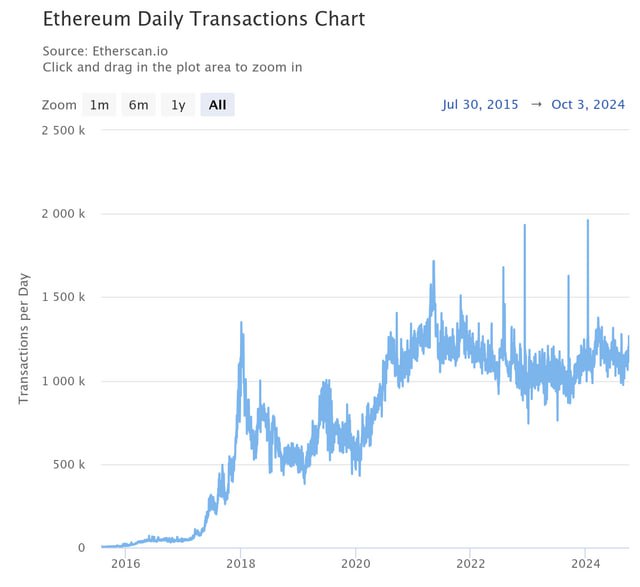

The institutionalization of the crypto market is entering a new phase: Bitwise experts believe that integrating Bitcoin into U.S. retirement programs could drive the cryptocurrency’s price to historic highs.

Retirement Savings and Bitcoin: A New Stage of Institutional Demand

On August 7, U.S. President Donald Trump signed an executive order allowing citizens to invest in cryptocurrencies through 401(k) retirement plans. Until now, such investments had remained inaccessible to most Americans, whose savings are concentrated in the largest segment of the pension market.

Andrei Dragos, Head of European Research at Bitwise Asset Management, told Cointelegraph that the impact of this step could even surpass the launch of spot Bitcoin ETFs:

“The inclusion of digital assets in retirement plans is a historic shift. We are talking about an enormous pool of capital that, for the first time, gains direct access to Bitcoin,” he emphasized.

Forecast: $122 Billion in New Investments

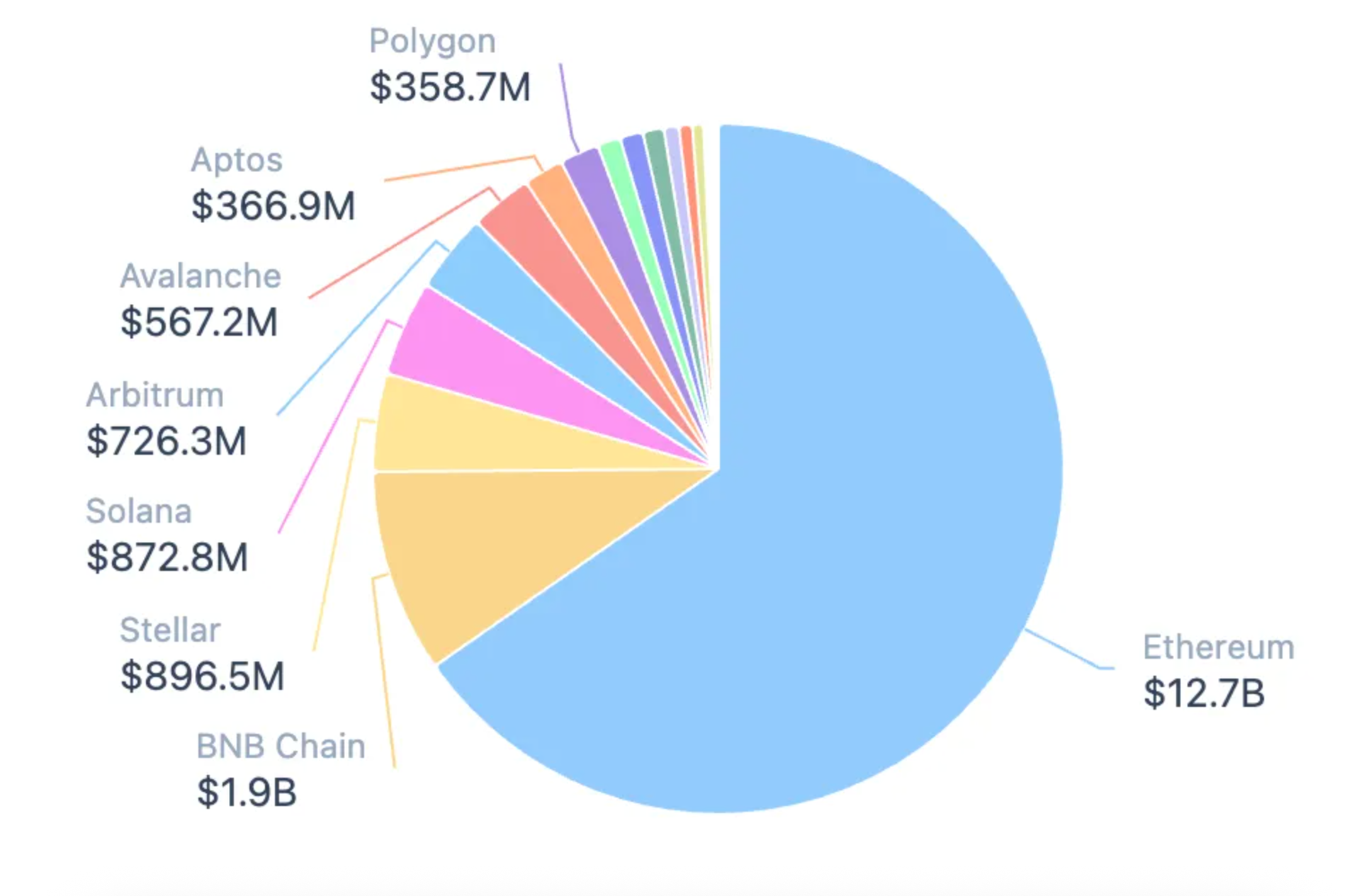

According to Bitwise’s estimates, even with a conservative allocation of 1% from the total U.S. retirement savings pool of $12.2 trillion, Bitcoin could receive around $122 billion in new inflows.

However, a company survey among financial advisors indicates that market readiness may be much higher. Most specialists recommend allocations of 2.5–3%, which could potentially multiply the inflow of funds several times over.

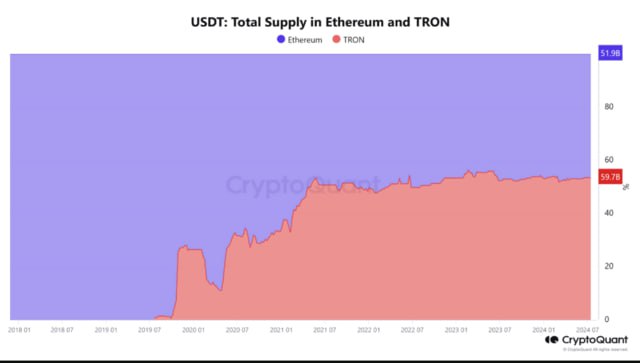

Macroeconomic Factors: The Fed’s Rate as an Additional Driver

According to Dragos, the first inflows from retirement funds may begin as early as this fall. This process is expected to coincide with changes in the Federal Reserve’s monetary policy.

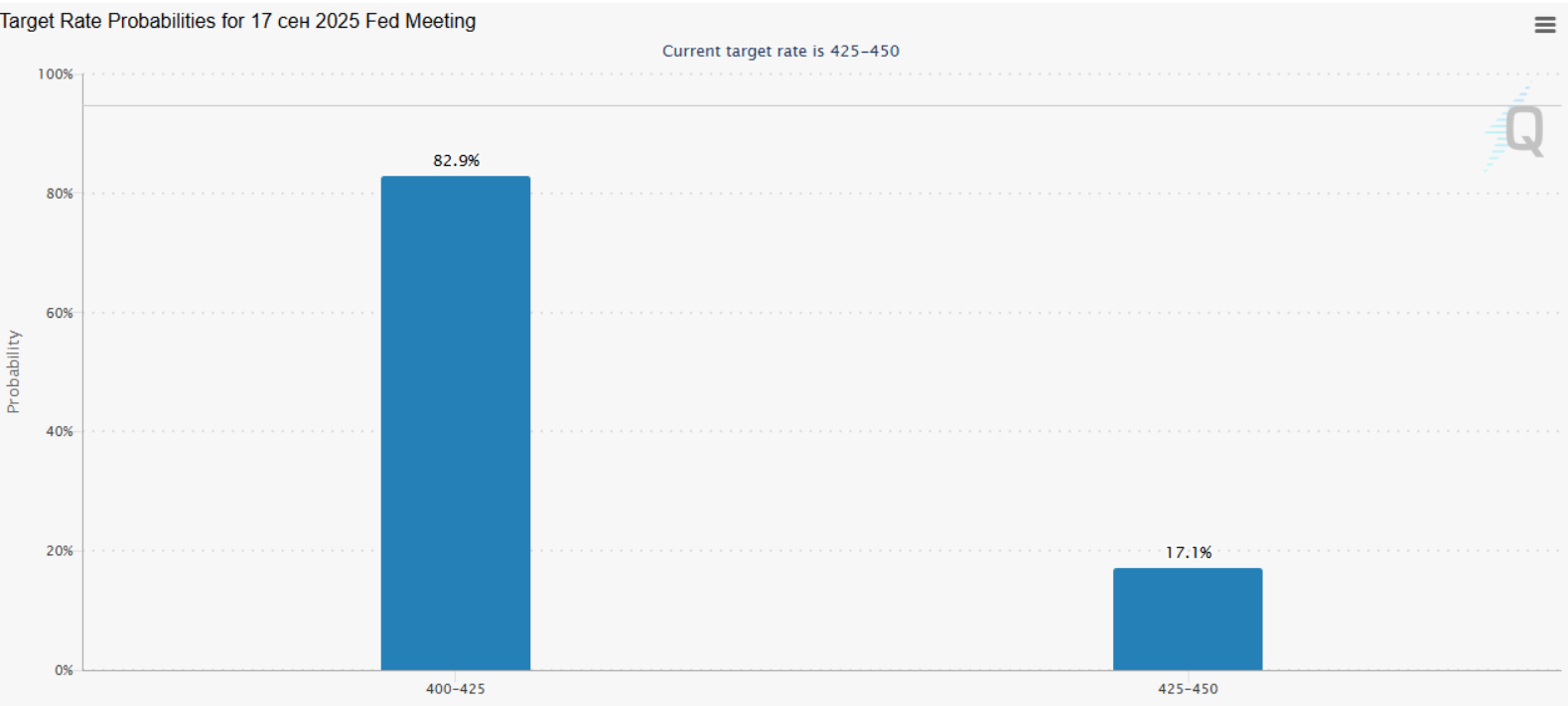

Data from CME FedWatch shows that market participants currently estimate the probability of a Fed rate cut in the coming months at 82.9%. Lower borrowing costs traditionally boost investor appetite for alternative assets, including gold and Bitcoin.

“If U.S. monetary policy does indeed ease, it will align with institutional capital flowing into cryptocurrencies. Under these conditions, Bitcoin could reach $200,000 by the end of the year,” Dragos said.

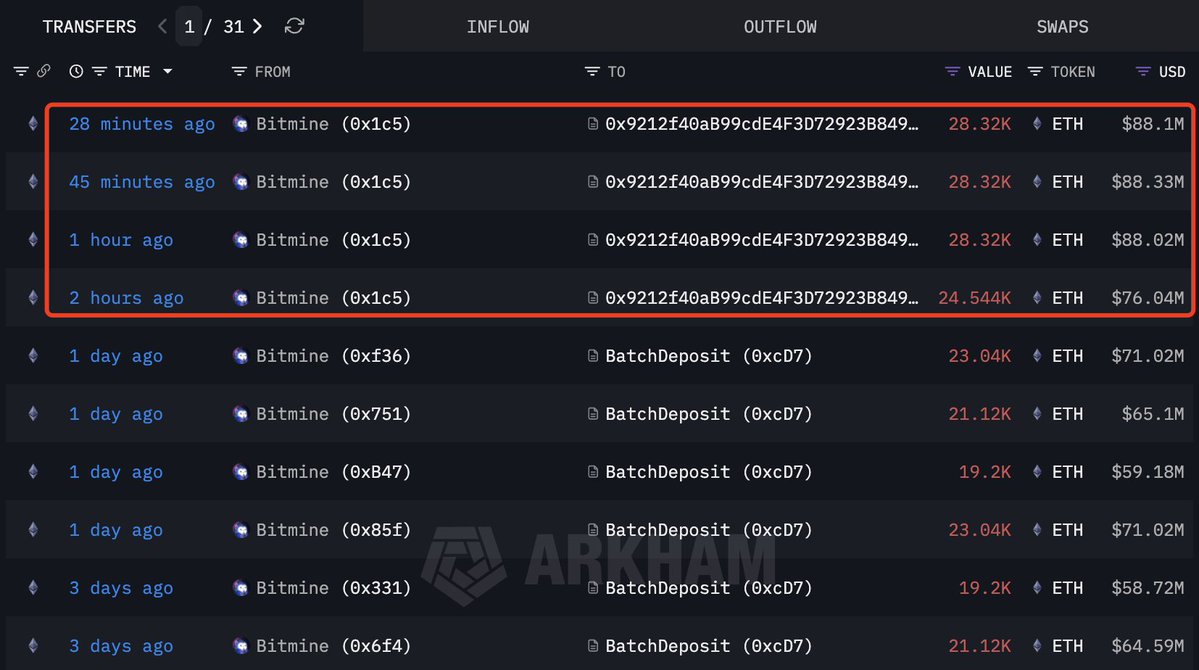

Interest from Major Players

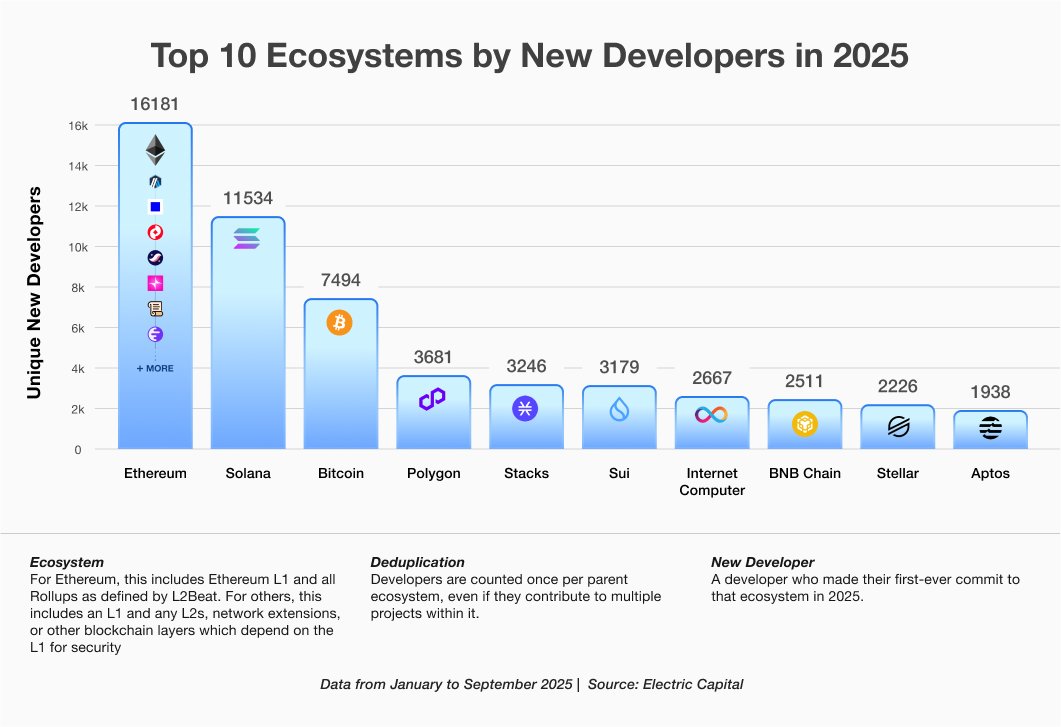

The situation is further reinforced by the fact that the largest retirement plan providers — BlackRock and Fidelity — are already issuers of spot Bitcoin ETFs. This gives them a direct economic incentive to include such products in standard client offerings, accelerating the institutionalization of the crypto market.

Risks and Context

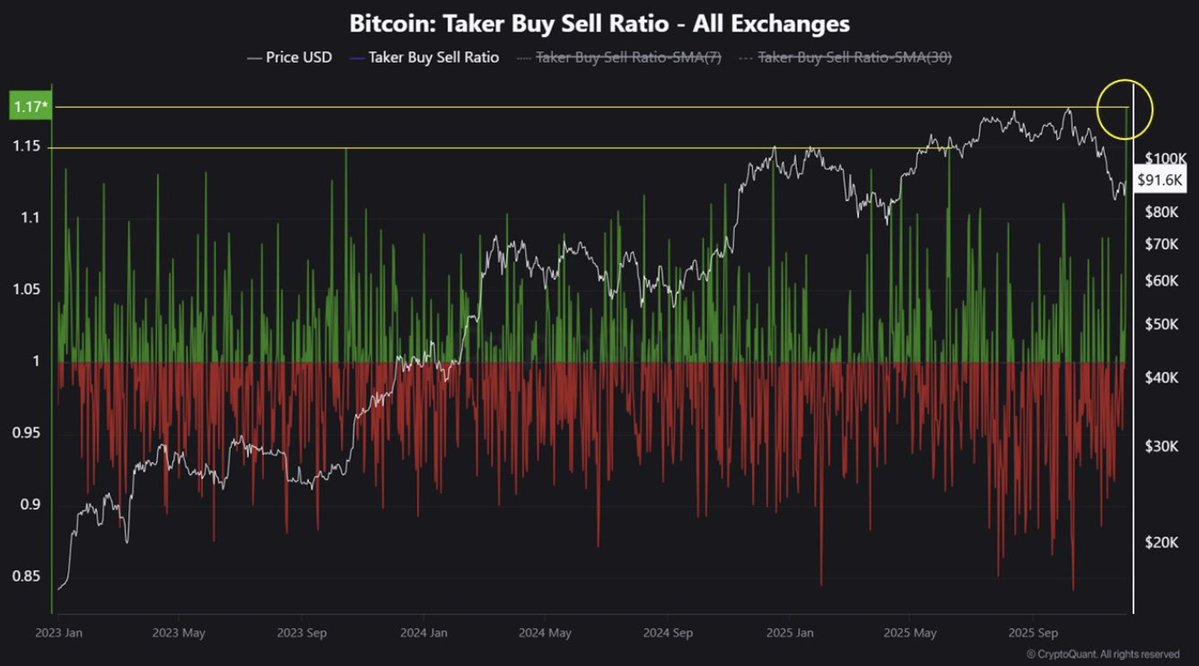

Despite the optimism, experts warn about potential risks. Vincent Liu, Chief Investment Officer at Kronos Research, previously noted that uncertainty regarding the Fed’s future policy was a key factor behind the latest market correction.

Moreover, the integration of cryptocurrencies into retirement plans raises questions about regulation and investor protection. Market volatility could become more pronounced given the sheer scale of capital involved.

Conclusion

Bitwise’s forecast highlights the growing role of institutional investment in shaping Bitcoin’s trajectory. If U.S. pension funds indeed begin to incorporate cryptocurrencies into their portfolios on a large scale, the scenario of Bitcoin rising to $200,000 no longer seems unrealistic.

However, future dynamics will depend not only on the readiness of financial advisors and funds but also on the Federal Reserve’s decisions and the broader global regulatory environment.