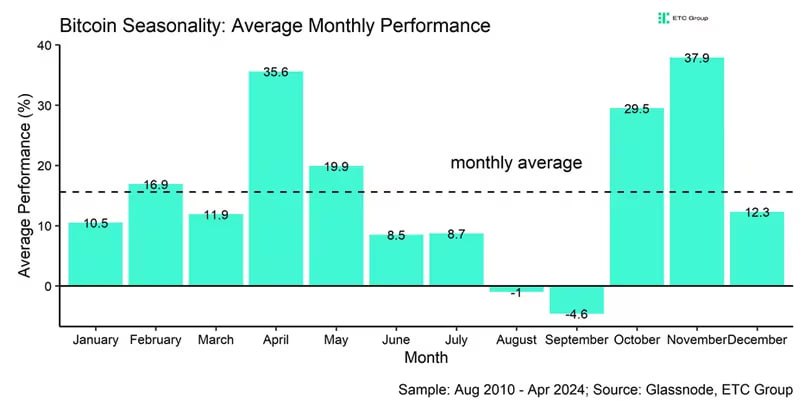

The summer period in financial markets will only conclude in October, as September is traditionally considered a weak month. For example, between 2017 and 2022, September was a losing month for Bitcoin.

For this reason, many market participants expect a recovery only in October when investors return from vacation, and companies start reporting their third-quarter earnings. This typically leads to increased activity and better performance in October, November, and December, which are also seen as more favorable months for investments.

Additionally, the end of the year often brings a reassessment of macroeconomic policies by central banks. Expectations regarding changes in interest rates, inflation, and other key economic indicators can lead to stronger bullish sentiment in the markets, especially in sectors reliant on access to cheap money and credit.

Moreover, potential growth drivers in the cryptocurrency industry shouldn’t be overlooked. Anticipation of the launch of Bitcoin spot ETFs, which could be approved by regulators by year-end, may fuel demand for crypto assets and lead to a new phase of the bull market. This would boost institutional investor interest, significantly increasing liquidity and price support.

However, for long-term investors, such fluctuations hold little importance. For most BTC holders, the best strategy remains “Buy and Hold,” disregarding short-term swings and news. Patience and confidence in the long-term potential of the asset may prove to be a more productive approach amid market uncertainty.

As a result, the end of the year could be a pivotal moment for many markets, both traditional and crypto, but for those focused on long-term prospects, it is just another phase of the market cycle.