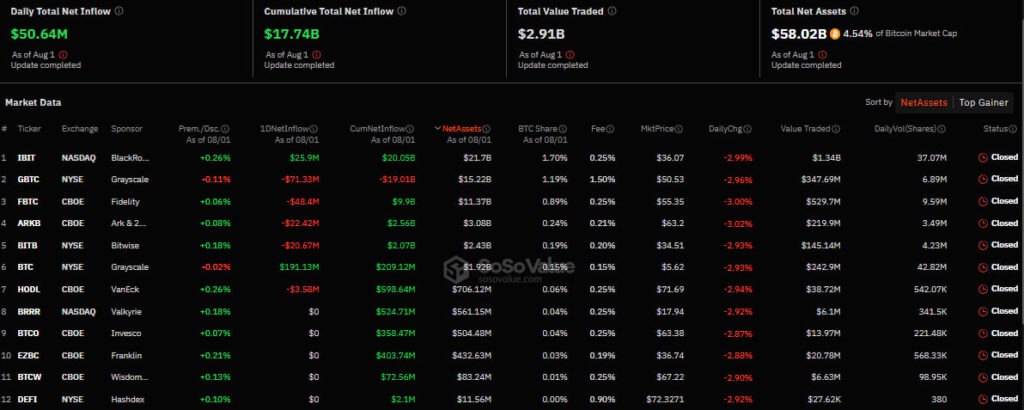

On August 1, 2024, the U.S. cryptocurrency ETF sector experienced positive dynamics. Bitcoin ETFs attracted a net daily capital inflow of $50.64 million, while Ethereum ETFs saw an inflow of $77.21 million, according to SoSo Value.

Despite five Bitcoin funds showing capital outflows, the losses were offset by inflows into Grayscale Investments’ Bitcoin Mini Trust ($191.13 million) and BlackRock’s IBIT ($25.9 million). These funds remain popular among institutional investors, contributing to the growth of their assets under management.

The Ethereum ETF sector saw a net inflow of $26.75 million, except for the Grayscale Ethereum Trust ETF (ETHE), which experienced an outflow of $77.95 million. Although this fund has shown negative dynamics since its launch, the capital outflow is gradually decreasing. Analysts suggest that the reduction in outflows may be linked to the improving overall situation in the cryptocurrency market and increasing investor interest in Ethereum as a leading altcoin.

The positive dynamics in the cryptocurrency ETF sector indicate growing investor confidence in these financial instruments. In the context of ongoing volatility in cryptocurrency markets, crypto ETFs are becoming an important element for portfolio diversification and risk reduction associated with direct ownership of digital assets.