Forecast from Brian Armstrong

Coinbase CEO Brian Armstrong has stated that Bitcoin could reach $1 million by 2030. According to him, the main drivers of this growth will be regulatory clarity and global adoption of cryptocurrencies.

He shared his opinion during Stripe’s Cheeky Pint podcast.

Armstrong emphasized that the industry is at a stage where digital assets are no longer a marginal idea but are becoming part of the financial infrastructure of governments and corporations.

GENIUS Act and CLARITY Act: A New Regulatory Era

Armstrong highlighted two new U.S. legislative initiatives as crucial factors for Bitcoin’s growth:

- GENIUS Act — regulates the issuance and circulation of stablecoins, giving them a legal framework. This creates the foundation for their integration into the banking system and makes the market more transparent.

- CLARITY Act — establishes a common regulatory framework for the crypto industry, reducing risks for companies and investors by eliminating legal uncertainty.

According to the Coinbase CEO, passing these laws by the end of the year will be a “historic milestone” that could boost investor confidence in digital assets.

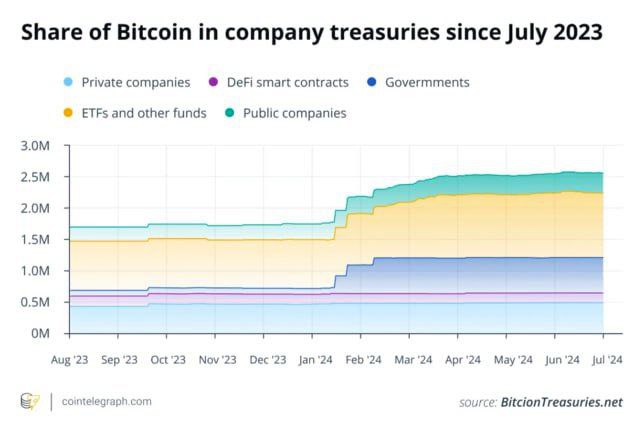

U.S. Strategic Bitcoin Reserve

Another significant step Armstrong mentioned is the creation of a strategic Bitcoin reserve at the government level.

“Five years ago, people would have called you crazy if you had said the U.S. government would officially hold Bitcoin,” Armstrong remarked.

This move can be seen as an analogue to a gold reserve, strengthening Bitcoin’s position as digital gold in the long run.

Eric Trump: “I’m a Bitcoin Maximalist”

Armstrong’s forecast was supported by Eric Trump, the son of the U.S. president. Speaking at a blockchain conference in Wyoming on August 19, he declared:

“I’m a Bitcoin maximalist and believe the price will reach $1 million.”

Eric Trump revealed that he now spends half of his time on crypto projects. He is the co-founder of:

- World Liberty Financial — a fintech company with a focus on decentralized finance.

- American Bitcoin — a U.S.-based mining company.

Previously, he actively encouraged investors to buy Bitcoin during market dips and also recommended Ethereum as an investment.

Who Else Believes in $1 Million Bitcoin?

Armstrong and Trump are not alone in their optimism. Several industry leaders have made similar predictions:

- Cathie Wood (Ark Invest CEO): forecasted Bitcoin at $1.5 million by 2030 under a bullish scenario and recently reaffirmed this outlook.

- Arthur Hayes (former BitMEX CEO): believes Trump’s policies could push Bitcoin to six-figure levels.

- Adam Back (Blockstream co-founder): described the current price as “unreasonably low” and predicted Bitcoin could reach $500,000–$1 million within this cycle.

A More Cautious Outlook

Not everyone is as optimistic.

James McKay, founder of McKay Research, urged Bitcoin supporters not to rush ahead:

“Let’s first try to hold $124,000, folks.”

Nevertheless, he admitted Armstrong’s forecast is not unrealistic, especially given that Standard Chartered already projects Bitcoin at $500,000 by 2028.

Current Market Situation

At the time of writing, Bitcoin is trading at around $113,108, down 0.4% over the past 24 hours, according to CoinGecko.

Earlier, Andre Dragos (Bitwise) suggested that including crypto assets in U.S. retirement plans could push Bitcoin to $200,000 by the end of 2025.

Meanwhile, Bernstein analysts expect this milestone will only be reached by 2027.

Conclusion

Bitcoin continues to attract attention not only from investors but also from politicians.

The combination of clear regulations, institutional interest, and global recognition could indeed push the first cryptocurrency to unprecedented heights.

Still, even crypto enthusiasts warn that the road to $1 million will likely be volatile, with the market remaining highly sensitive to macroeconomic and political factors.