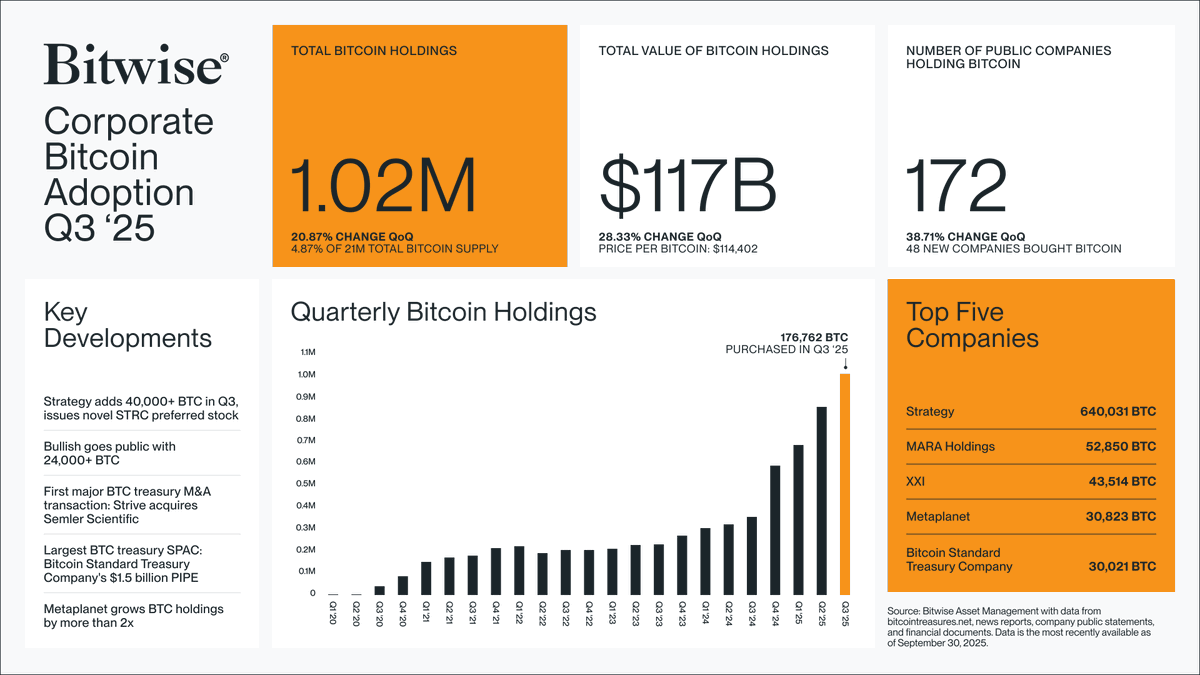

- +48 new companies started accumulating BTC from July to September.

- 172 — total corporate holders, per Bitwise.

- >1M BTC in combined company reserves (≈ $117B, 4.87% of supply).

- Top holders: MicroStrategy — 640,250 BTC (≈ $71.9B), MARA Holdings — 53,250 BTC (≈ $5.9B).

What Happened

From July to September, corporate demand for the first cryptocurrency accelerated: 48 new companies joined the ranks of “digital gold” accumulators, lifting the number of treasuries to 172. Bitwise CEO Hunter Horsley called the momentum “outstanding,” noting that it’s not just retail investors but also public companies buying Bitcoin.

Combined corporate reserves surpassed 1 million BTC — about 4.87% of total supply. The leader remains MicroStrategy (Michael Saylor) with 640,250 BTC, followed by MARA Holdings with 53,250 BTC.

Market Voices

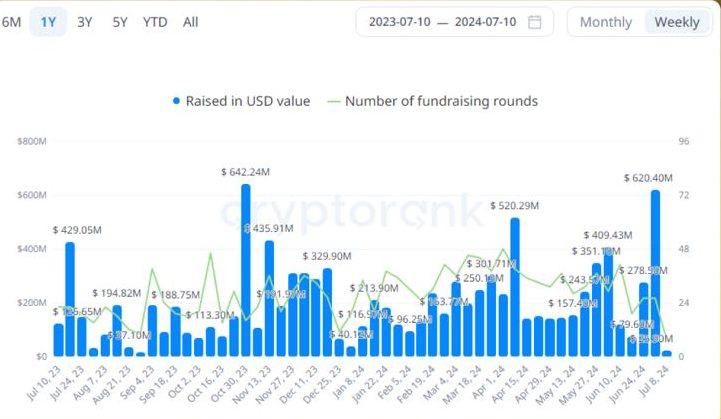

BTC Markets analyst Rachel Lucas says the growing number of crypto-oriented firms signals that big players are doubling down, not backing off. While CryptoQuant specialists pointed to a slowdown in corporate reserve growth in early September, Lucas believes the trend will persist: companies are buying BTC as a long-term strategic asset, not for short-term gains.

Edward Carroll, Head of Markets at MHC Digital Group, adds that despite limited immediate price impact, a fundamental supply–demand imbalance is intensifying, which is constructive for prices in the medium to long term. As demand grows in a more “orderly” fashion, Bitcoin’s correlation with broad market sentiment should gradually weaken, he notes.

The Paradox: Reserves Rise, Price Stays Volatile

Why don’t corporate purchases translate directly into higher spot prices?

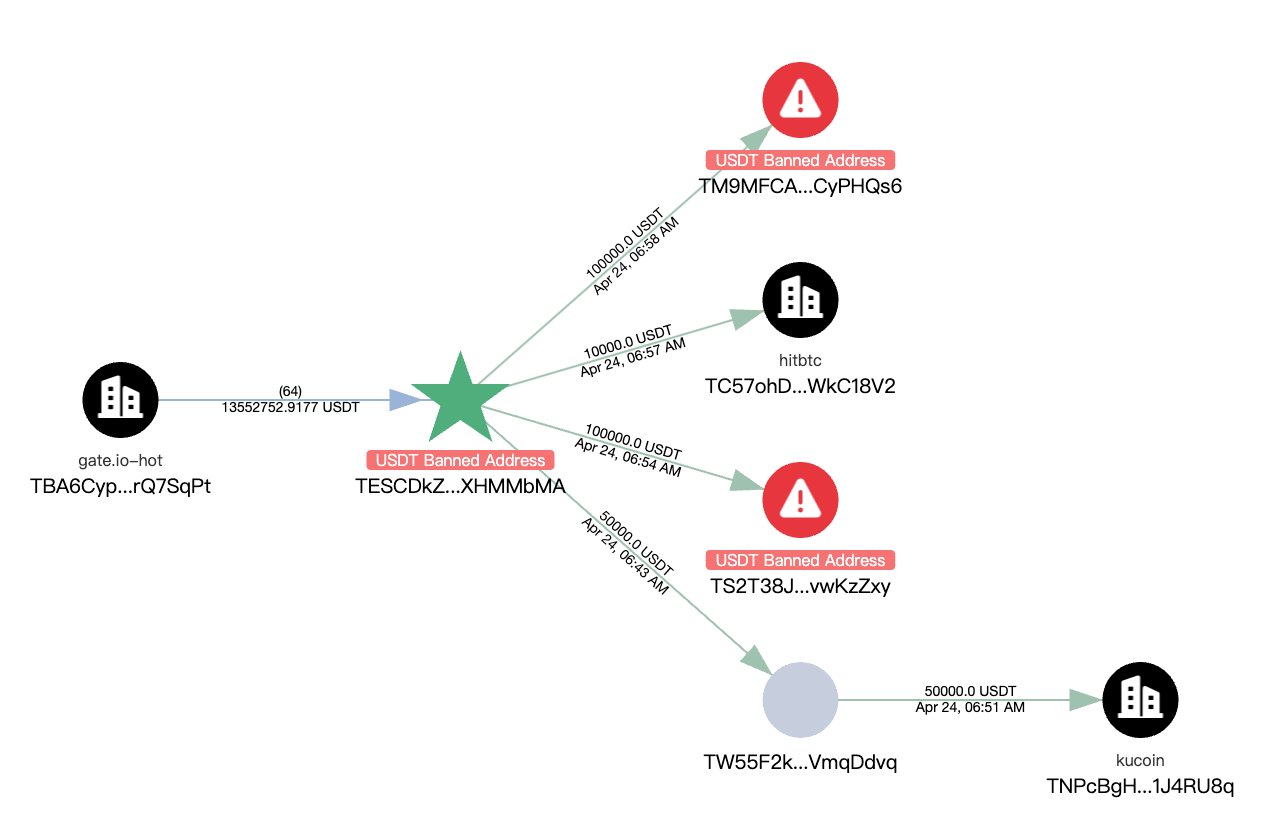

- OTC over spot. Corporations often buy via OTC desks to avoid slippage, which doesn’t move the spot price immediately.

- Opposing market forces. While public companies accumulate, other participants take profits at local highs or amplify swings via derivatives.

- Macro shocks. Broad sell-offs triggered by macro events — including recent U.S.–China trade tensions — spark liquidation waves (recently >$19B) and sharp drawdowns, with BTC briefly dipping below $110,000.

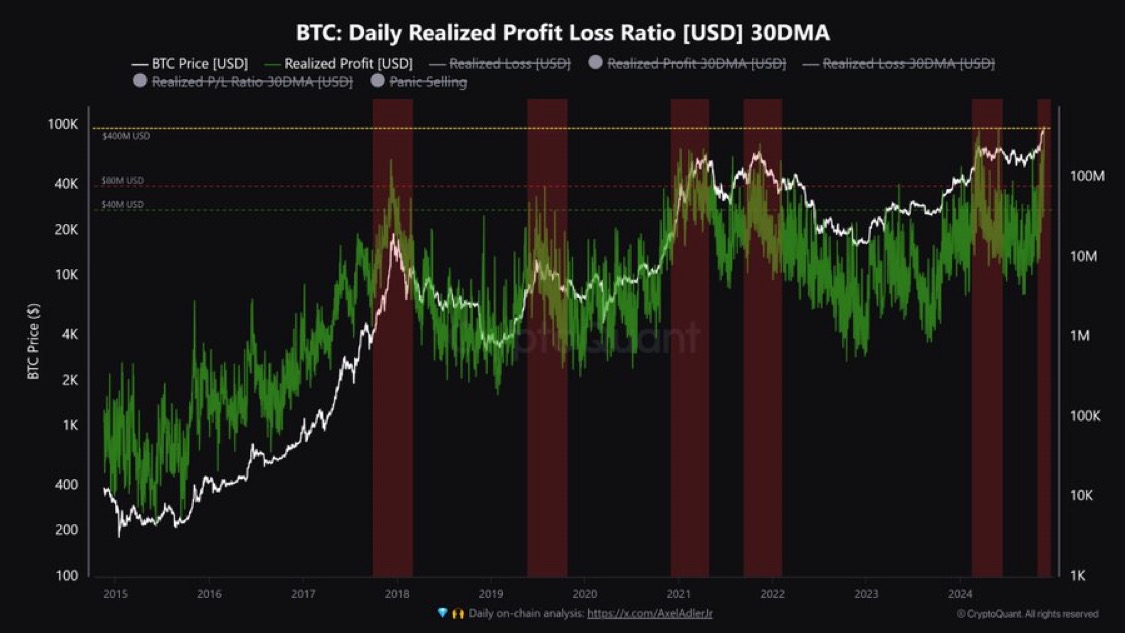

Flow Balance: The Deficit Deepens

According to Bitbo, miners produce ~900 BTC/day, while corporations buy ~1,755 BTC/day on average. This demand–supply skew creates a persistent deficit that tends to push prices higher over time, even if the market looks choppy in the short run. CryptoQuant analyst Axel Adler Jr. sums it up: Bitcoin has passed a maturity test.

By the Numbers

- New corporate treasuries in 3 months: +40% (to 172).

- Combined corporate reserves: >1,000,000 BTC (≈ $117B).

- Share of BTC supply: 4.87%.

- Top holders: MicroStrategy — 640,250 BTC, MARA Holdings — 53,250 BTC.

- Daily issuance vs. corporate buying: 900 BTC vs. ~1,755 BTC.

- Macro shocks: liquidations >$19B, BTC drop < $110,000.

What It Means for Investors and Companies

- The scarcity thesis is intact: corporate buying consistently outpaces new issuance.

- Spot prices may lag due to OTC flows and derivatives, but the underlying trend remains constructive.

- Treasury diversification into BTC is becoming a mainstream strategy for some public firms.

- Key risk — macro volatility: short-term sell-offs remain possible even as reserves grow.