According to a study by Psalion, global adoption of digital assets is projected to rise from 7.41% to 11.02% by the end of 2025 — surpassing the critical 10% threshold. Analyst Alec Beckman notes this milestone could mark a pivotal turning point in the history of crypto.

From Experiment to Infrastructure

The current growth trajectory of the crypto industry mirrors that of early internet and smartphone adoption. Historically, hitting the 10% adoption rate signals the transition from “early adopters” to the “early majority” — a moment that typically triggers exponential growth due to network effects, technological maturity, and rising public trust.

This tipping point is well described in Everett Rogers’ Diffusion of Innovations Theory, where the shift from niche to mainstream occurs around 10–15% adoption.

Network Effects and a New Financial Reality

For cryptocurrencies, crossing the 10% mark means more than just growing user numbers. It unlocks greater liquidity, wider merchant acceptance, and an explosion in developer activity — ultimately making digital assets more practical for everyday use like payments and remittances.

In the U.S., for instance, crypto ownership among adults is expected to rise to 28% (approx. 65 million people), compared to 15% in 2021. Two-thirds of these users plan to increase their holdings, and two out of three Americans are already familiar with cryptocurrencies.

Key Drivers of Growth

📡 Technology and Infrastructure:

- Blockchain: With transparency and security, blockchain enhances money transfers, supply chain tracking, and fraud prevention.

- AI Integration: Over 90 tokens leverage artificial intelligence to improve governance, predictions, and DeFi automation.

- Financial Inclusion: Cryptocurrencies provide access to financial tools for unbanked populations, especially across Asia and Africa.

- Regulatory Clarity: Countries like the UAE, Germany, and El Salvador are promoting adoption through supportive policies, while uncertainty in India and China poses barriers.

🌍 Economic Catalysts:

- Inflation & Instability: Crypto’s role as a hedge against inflation fuels adoption in markets like Brazil ($90.3B in stablecoin transactions) and Argentina ($91.1B).

Institutions and Businesses Accelerate Adoption

Major financial institutions are helping bring crypto into the mainstream. BlackRock and Fidelity have already launched crypto ETFs, while the SEC is reviewing over 70 more product applications.

Meanwhile, businesses are embracing crypto payments to cut fees and expand globally. Merchant platforms now offer tools to accept crypto and settle in local currencies, mitigating volatility risks.

DeFi activity has surged in regions such as sub-Saharan Africa, Latin America, and Eastern Europe. The latter accounted for more than 33% of crypto value received, making it the third fastest-growing DeFi region worldwide.

Challenges and Breakthroughs

Despite rapid progress, crypto adoption still faces hurdles:

- High volatility;

- Cybersecurity risks;

- Regulatory pressure in certain jurisdictions.

Even so, analysts remain confident in the current growth trajectory. Market optimism, regulatory openness, the ETF momentum, and real-world utility of payments all point toward continued expansion.

“Crypto is following the path of the internet and smartphones. If innovation continues to align with trust, digital assets will grow even faster in the years to come,” the Psalion report concludes.

Conclusion

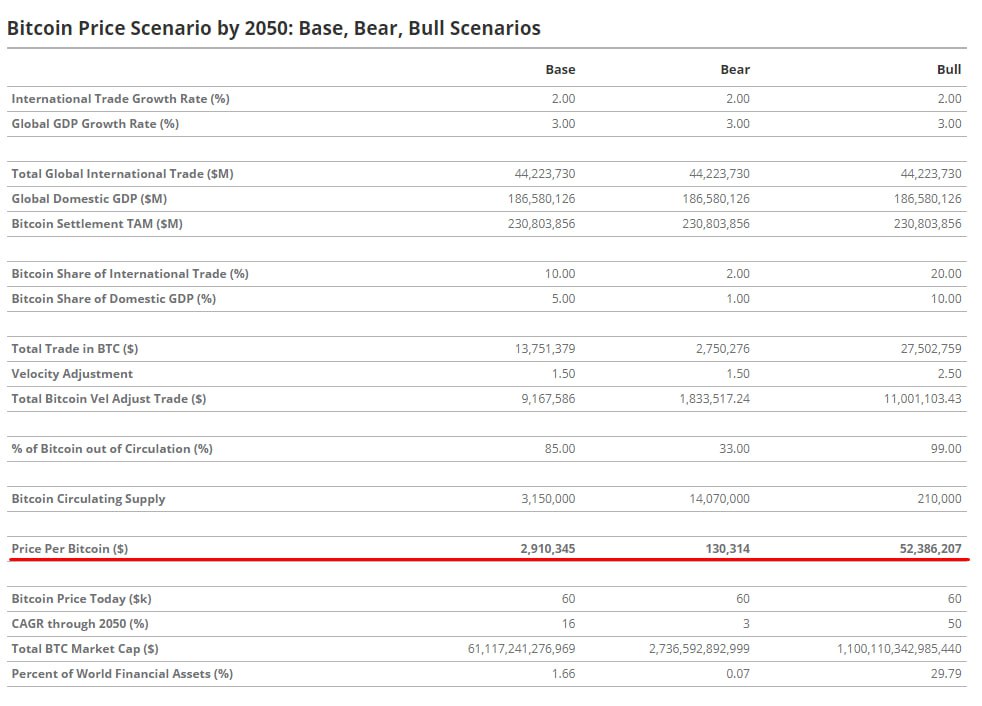

The crypto industry is entering a new era. What was once a speculative experiment is fast becoming a core part of the global financial ecosystem. According to River, around 4% of the global population already holds Bitcoin. And as BlackRock CEO Larry Fink recently stated, Bitcoin is increasingly seen as a digital alternative to gold — and its adoption is set to keep rising.