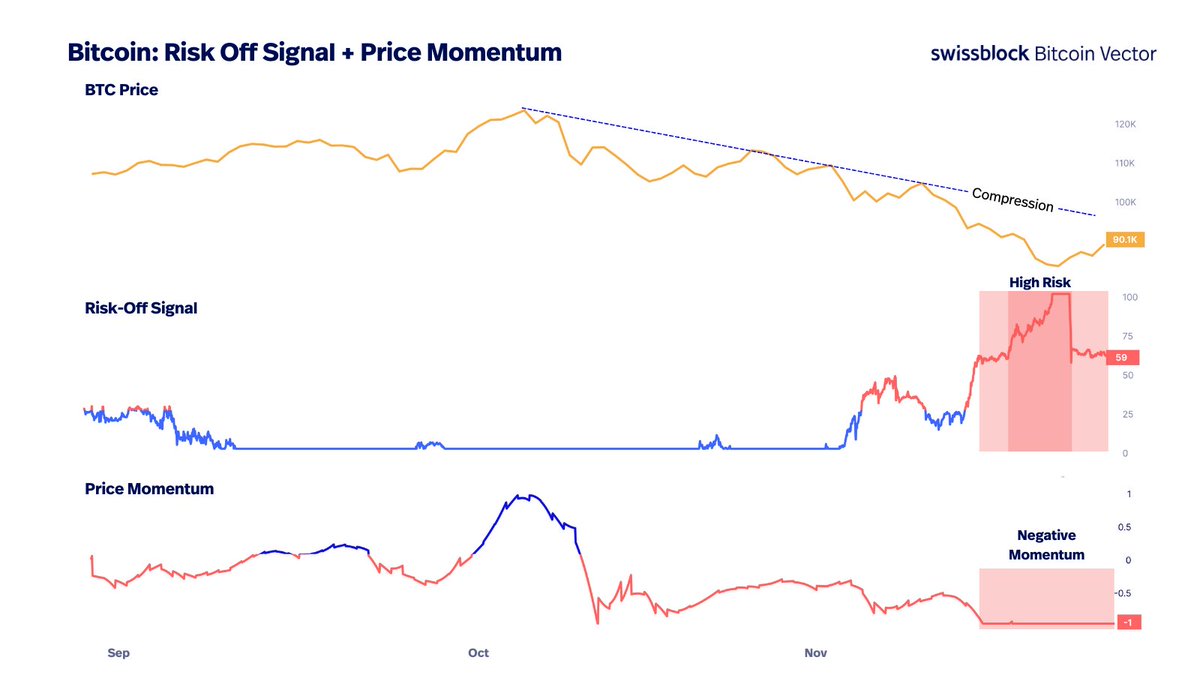

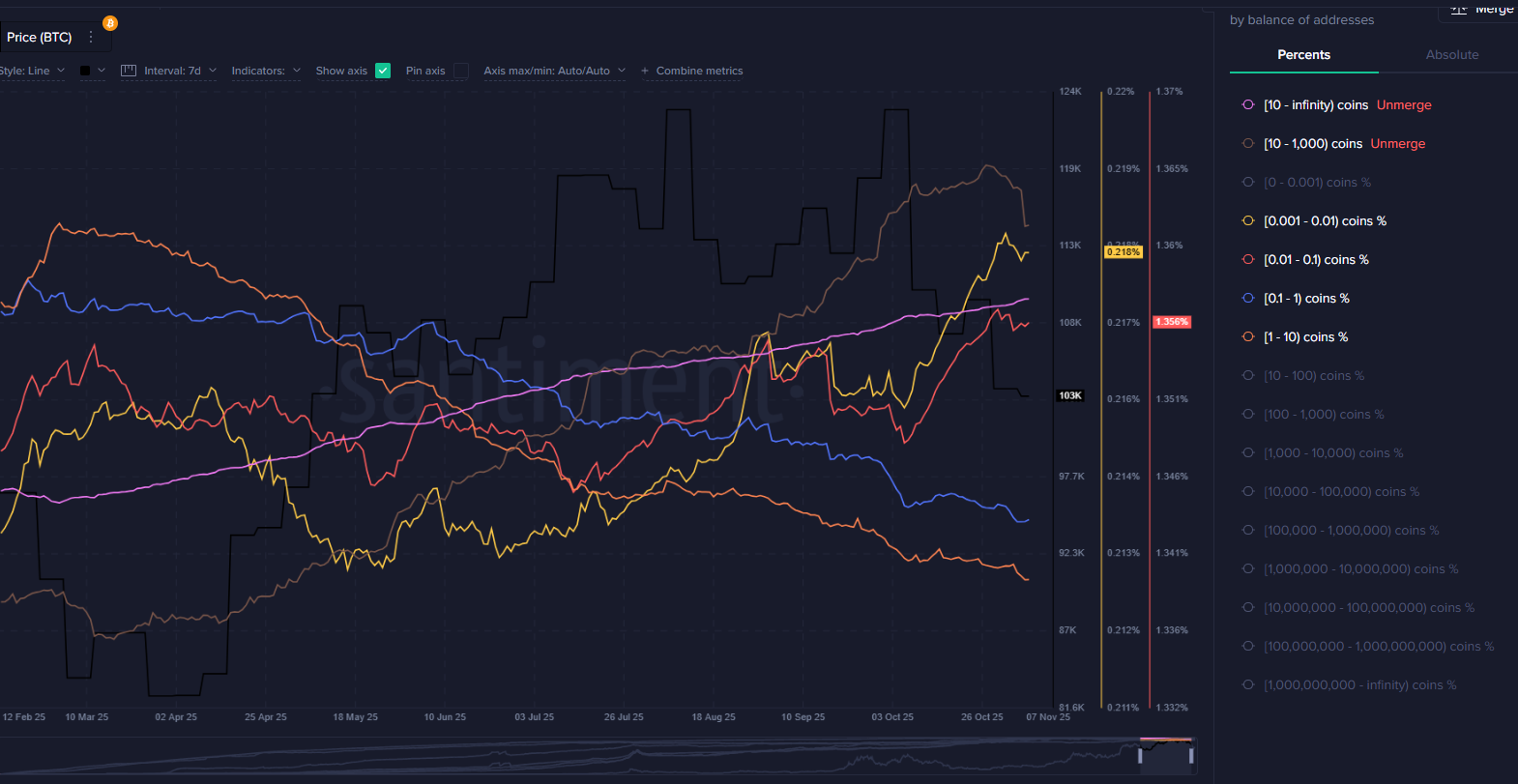

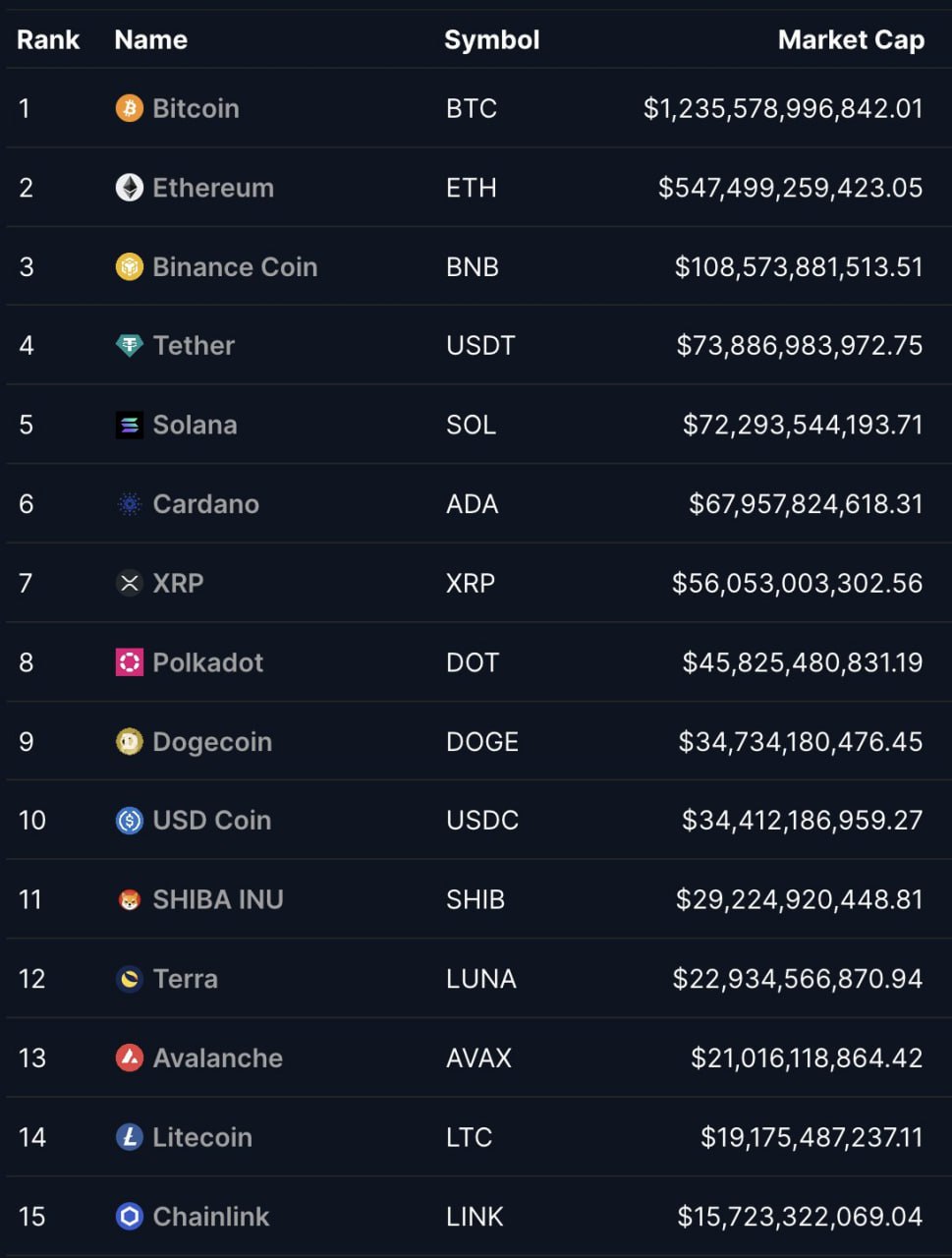

On Monday, Bitcoin (BTC) exhibited unusual volatility compared to altcoins. Its market share dropped by 1.8%, reaching 54.34% – the most significant decline in the last five months.

This is linked to plans for compensating those affected by the Mt. Gox hack in 2014. BTC’s value fell by nearly 5%, dropping below $59,000. The increased demand for put options on the Deribit exchange indicates investor concern. However, there is a possibility that the selling pressure due to the Mt. Gox payouts will be more moderate.

Decrease in Bitcoin Dominance