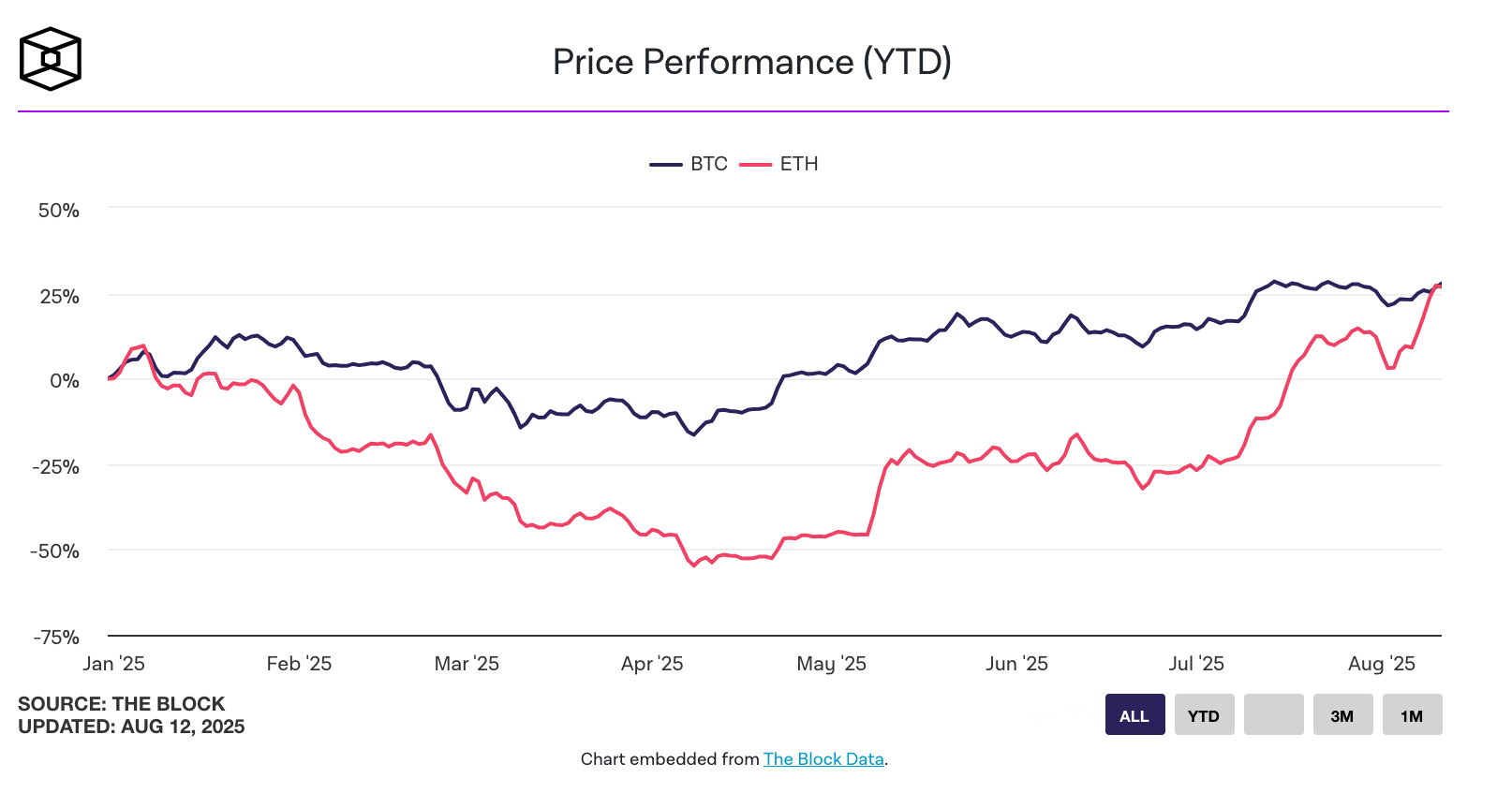

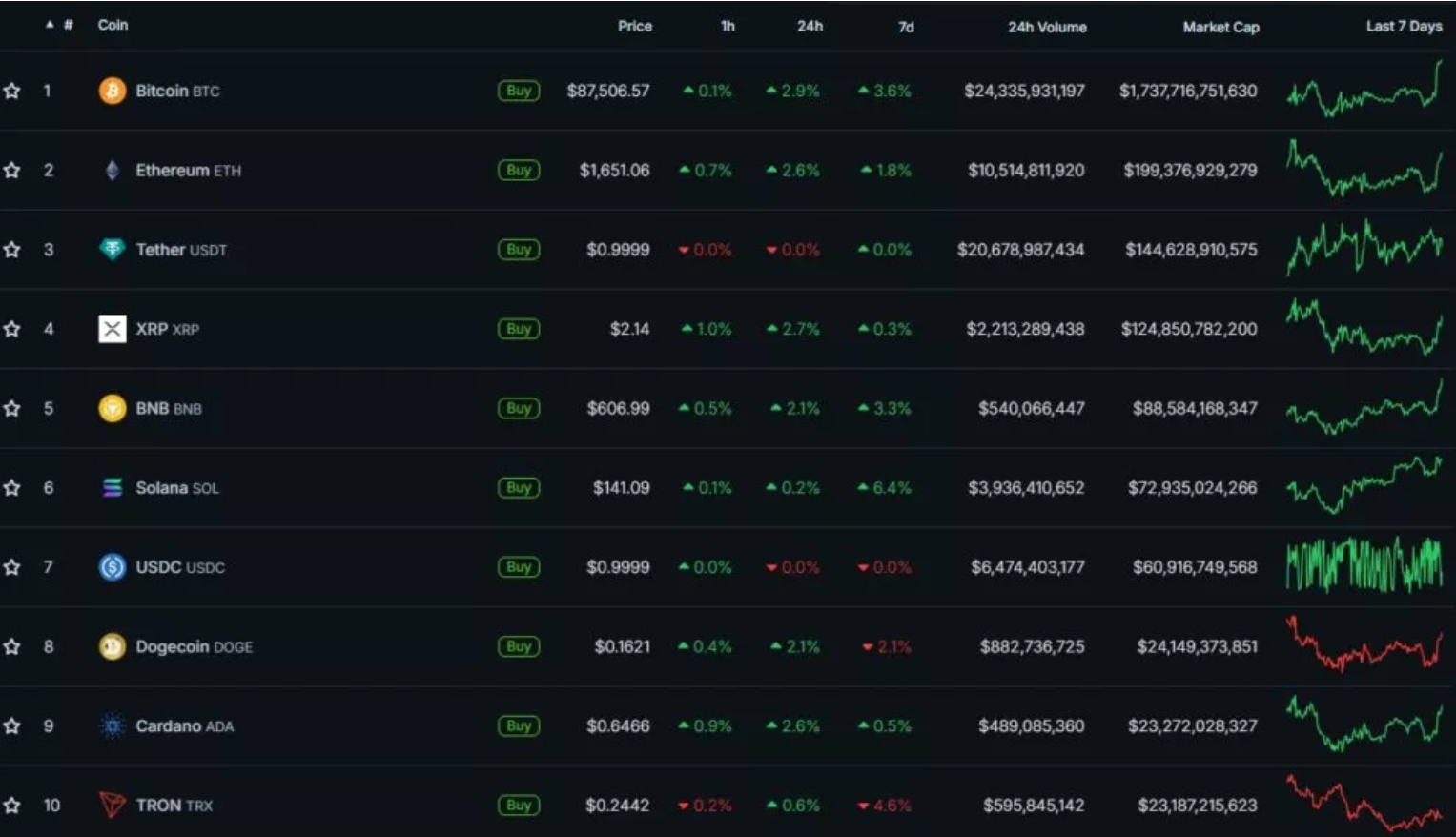

Ethereum, the second-largest cryptocurrency by market capitalization, has outpaced Bitcoin in terms of price growth for the first time in recent years. This development has caught the attention of analysts and investors, as this shift in market dynamics is rare. The information was reported by The Block, citing data from CoinGecko.

Ethereum Outpaces Bitcoin in Year-to-Date Growth

Since the beginning of the year, the price of Ethereum has risen by 29%, reaching $4,286 at the time of publication. In comparison, Bitcoin has increased by 28% over the same period, trading at $118,408.

The gap between the two seems small, but it is significant from a market psychology perspective: historically, Bitcoin has been considered the undisputed leader in growth, with Ethereum playing the role of the “follower.” However, Ethereum is now showing a steady lead.

Why is Ether Growing Faster?

1. Increased Demand from Corporate Treasuries

In recent months, a new trend has emerged: public companies have started diversifying their crypto holdings by focusing on Ethereum. While corporate treasuries have traditionally followed Michael Saylor’s strategy of buying Bitcoin as “digital gold,” a significant portion of them is now turning to Ether.

In the past week alone, corporations purchased 304,000 ETH worth approximately $1.3 billion. In total, they now control 3.4 million ETH, valued at $14.9 billion. The largest institutional holder is BitMine Immersion Technologies, known for its investments in blockchain infrastructure.

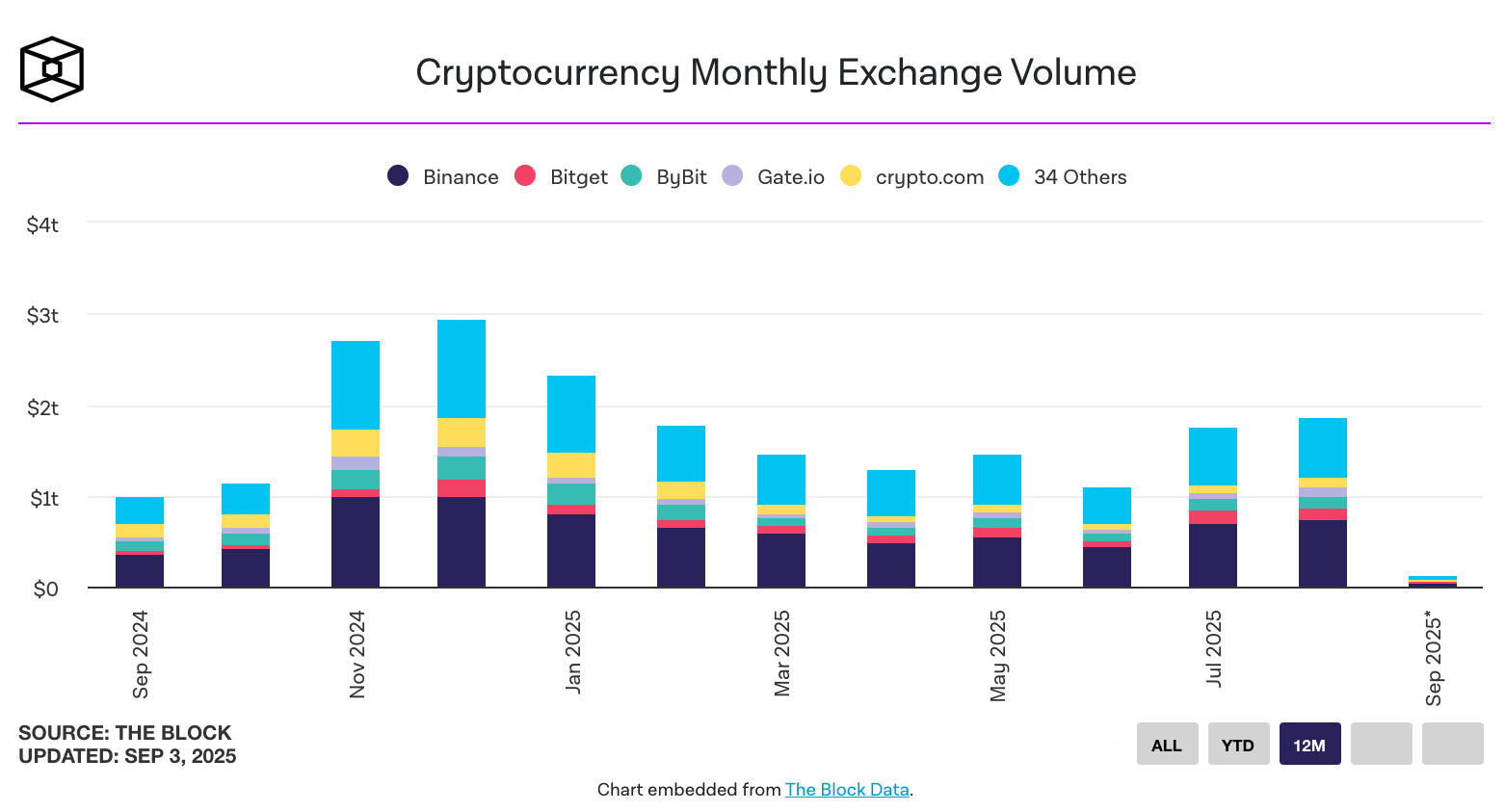

2. Record Inflows into Ethereum Spot ETFs

Another key driver of Ethereum’s growth has been the success of Ethereum-based spot exchange-traded funds (ETFs). In the latest trading session, they attracted a record $1.02 billion, surpassing Bitcoin ETFs in terms of capital inflows.

The total assets under management (AUM) for Ethereum ETFs have grown to $25.71 billion. This growth signals increasing institutional involvement: large players are increasingly using ETFs as a convenient vehicle for exposure to Ethereum without directly holding the cryptocurrency.

As a result, corporate treasuries and exchange-traded funds now control nearly 8% of the total supply of Ether — a significant share that can impact liquidity and price.

3. Technical Upgrades to the Blockchain

The latest Ethereum hard forks, Dencun and Pectra, have brought improvements that have positively impacted the network’s perception among developers and investors.

These upgrades include optimized data processing, reduced transaction costs in Layer 2 solutions, and expanded functionality for smart contracts. These changes make Ethereum more competitive and attractive for the DeFi, NFT, and enterprise blockchain ecosystems.

Analyst CryptoQuant under the nickname oininen_t reported that open interest in Ethereum derivatives on Binance has reached $10 billion, and the volume of short positions has grown by 500% since November 2024. In his view, if this trend continues, a sharp upward price movement could occur due to a “short squeeze.”

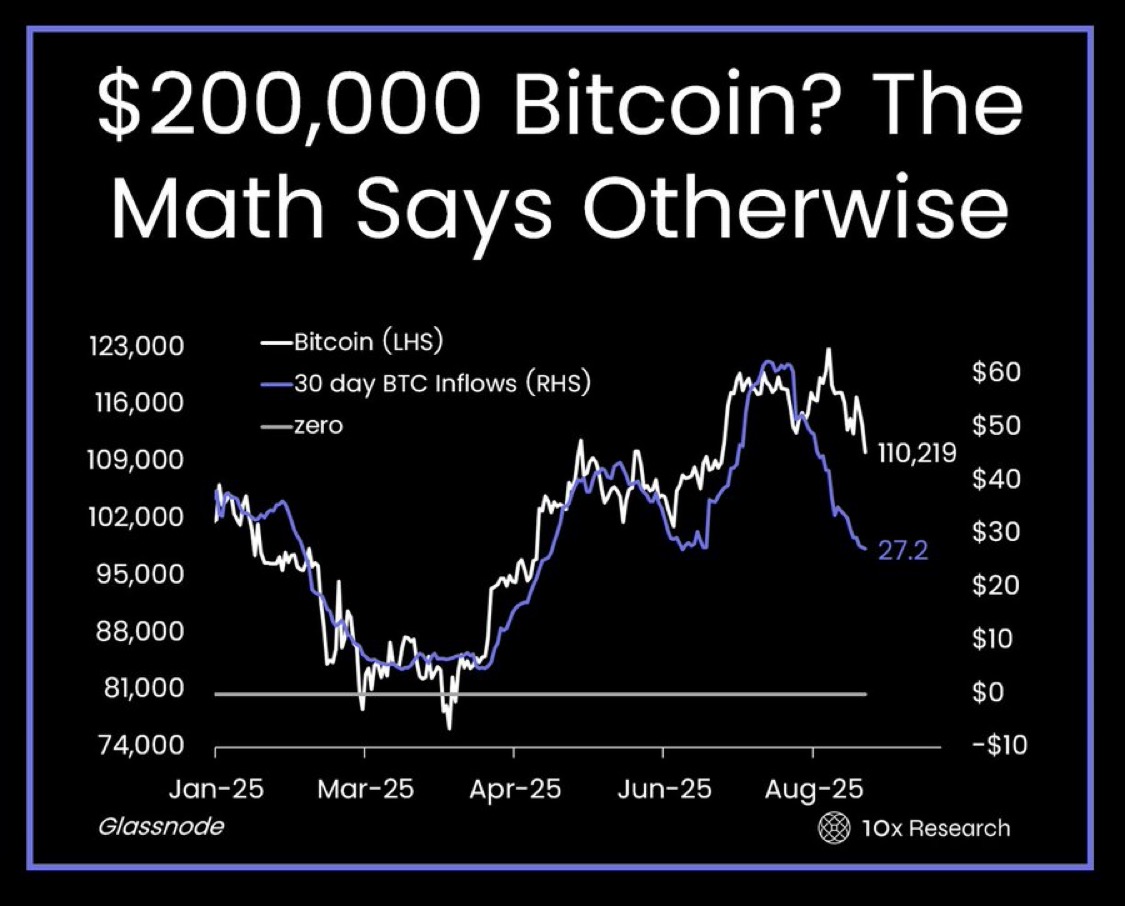

Signals of Potential Correction

Despite the optimism, Glassnode analysts warn of the risk of a pullback. Short-term holders of Ethereum have been locking in profits more actively than long-term investors.

The 7-day Simple Moving Average (SMA) for realized daily profits has reached $533 million, with the bulk of it coming from speculative traders. Long-term holders who have not moved their Ether in over 155 days are realizing profits at levels seen in late 2024.

It’s important to note that the current metrics are still 39% below the peak of July last year, when the price of Ether was around $3,500. This suggests that there is still room for growth, but there are forces in the market ready to lock in profits at the first signs of overheating.

The Role of FOMO and Market Psychology

According to Santiment, news of large institutional purchases could trigger FOMO (fear of missing out) among retail investors. In the short term, this could boost demand but may lead to overheating and a subsequent price correction in the long run.

Conclusion

Ethereum in 2025 has not only caught up to but has also outpaced Bitcoin in terms of price growth — a development that may have significant implications for the entire crypto industry. Demand from institutions, the success of ETFs, and technological upgrades create a strong foundation for continued upward momentum. However, the high activity of speculators and psychological factors in the market suggest caution when entering the asset.