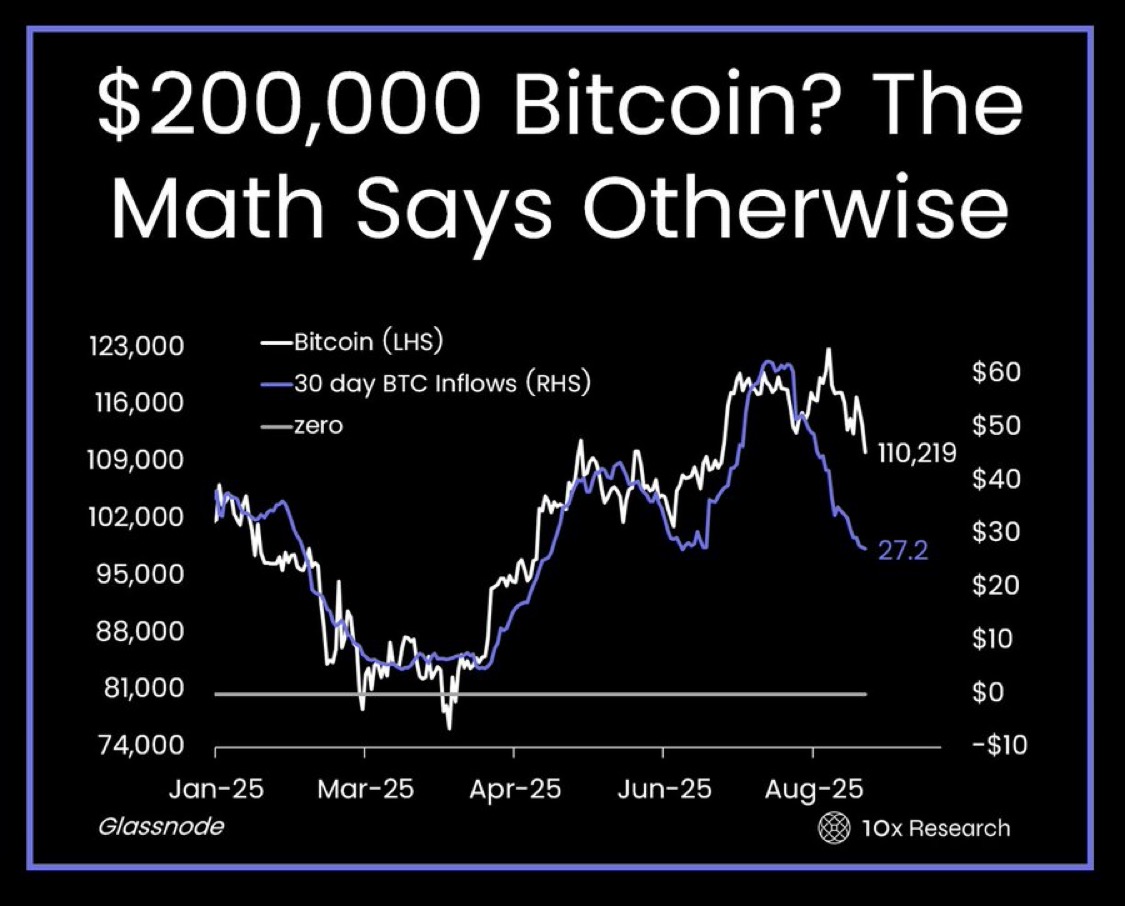

According to Kaiko, on August 5th, the Bitcoin-to-gold return ratio reached its lowest level since February, indicating a decline in the cryptocurrency’s attractiveness compared to traditional assets during market turbulence.

Gold demonstrated greater resilience, continuing to hold its position as a safe haven for investors. Meanwhile, Bitcoin experienced a drop, falling to just below $50,000. However, thanks to support from traders who prevented further declines, the price quickly recovered.

Analyst Ali Martinez notes that the $60,000 level remains a key target for investors. If the bulls manage to push the price up to $59,700 in the coming days, there is a chance for further growth to $62,200 and even $64,000. Martinez views these levels as potential local peaks in Bitcoin’s current cycle.

Despite recent fluctuations, many analysts continue to see significant growth potential in Bitcoin, especially in the long term. Investors are closely watching developments, anticipating that the cryptocurrency could regain lost ground and once again outperform traditional assets in terms of returns.