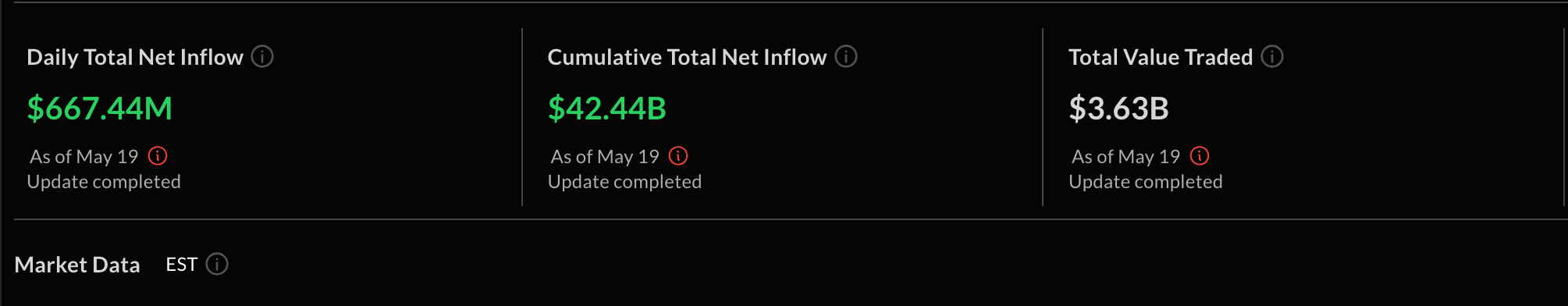

On May 19, amid increased activity in the cryptocurrency market, significant net inflows were observed into spot exchange-traded funds (ETFs) based on Bitcoin. According to the analytics platform SoSoValue, net inflows for the day reached $667.44 million, marking the fourth consecutive day of steady growth.

Since the start of the tracking period, the cumulative amount of investments attracted to these products has exceeded $42 billion, reflecting growing institutional interest in digital gold. The total assets under management (AUM) for spot Bitcoin ETFs currently stand at approximately $125 billion, representing about 5.96% of Bitcoin’s total market capitalization, demonstrating that ETFs remain a key investment vehicle for cryptocurrency exposure.

Top Performers by Inflows

The largest daily inflows were recorded by the following products:

- IBIT by BlackRock — $305.9 million, confirming the leading position of the world’s largest asset manager in crypto investments;

- FBTC by Fidelity — $188 million, further strengthening one of the most respected financial institutions on the market;

- ARKB (ARK 21Shares Bitcoin ETF) — $155 million, indicating growing interest from both retail and institutional investors toward innovative funds.

Together, these three products accounted for more than 90% of the total daily inflows. Meanwhile, the only product to see outflows was BTCO by Invesco, which experienced withdrawals of $5.27 million, possibly due to short-term shifts in demand for this particular ETF.

Ethereum ETFs: Moderate but Stable Growth

Net inflows into spot Ethereum ETFs amounted to $13.66 million during the same period, with the entire amount attributed to the ETHA by BlackRock fund, which is strengthening its market position. No outflows were recorded in the Ethereum ETF segment.

Total assets under management by spot Ethereum ETF providers amount to $8.72 billion, approximately 2.86% of Ethereum’s market capitalization. This share is significantly lower than Bitcoin’s, reflecting a more conservative institutional approach to Ether and a less developed ETF infrastructure for this asset.

Market Performance and Current Trends

Over the last 24 hours, Bitcoin’s price increased by 2.9%, reaching around $106,000, while Ethereum rose by 6.8%, according to CoinGecko data. The cryptocurrency rally is supported by overall market recovery, growing institutional interest, and positive sentiment around upcoming technological upgrades.

Bitwise Investment Director Matt Hougan expressed confidence in continued growth of inflows into crypto ETFs, especially funds focused on “digital gold.” He noted that institutional investors are increasingly diversifying their portfolios by using ETFs as a convenient and regulated way to gain exposure to cryptocurrencies.