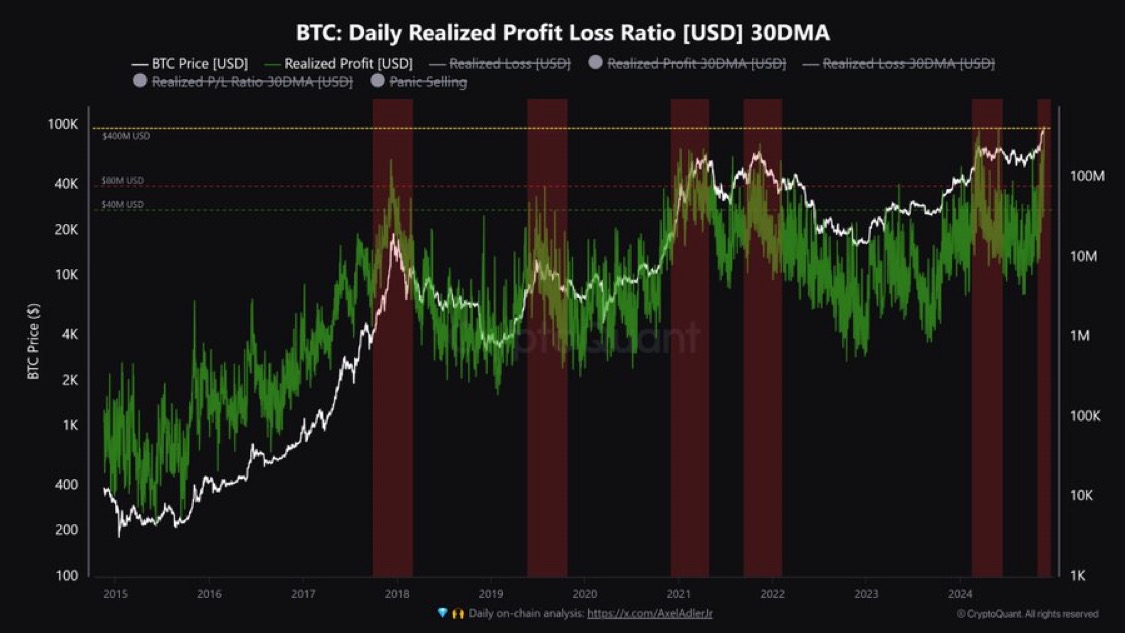

The cryptocurrency market is experiencing a new wave of growth, and this time, it’s not retail investors leading the charge — institutional players are taking the spotlight. According to CryptoQuant analyst Burak Kesmeci, on-chain data and market dynamics point to a shift in momentum.

A Changing Landscape: Institutions Accumulate While Retail Exits

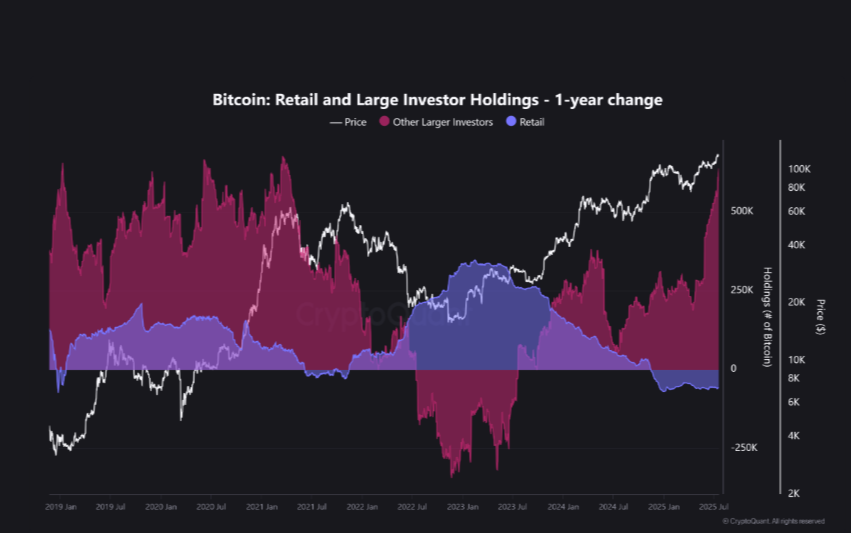

Kesmeci notes that since 2023, there’s been a consistent decline in Bitcoin balances held by small, retail investors. Meanwhile, starting in 2024, large holders — commonly referred to as “whales” — have significantly increased their accumulation.

The analyst believes these entities are likely institutional investors, funds, or wallets associated with spot Bitcoin ETFs. Despite a lack of retail enthusiasm, these large players have quietly but steadily grown their positions.

Smart Money at Work

Google Trends data supports this narrative: searches for the term “Bitcoin” remain relatively low, far below the euphoric levels seen during the 2021 bull run.

“We’re seeing quiet, smart money stepping in while the majority are still watching from the sidelines,” Kesmeci explains.

He also believes that the rally still has room to run — but the eventual return of retail investors could serve as a warning sign that the market is nearing a cycle top.

Whale Inflows Surge 60% in One Week

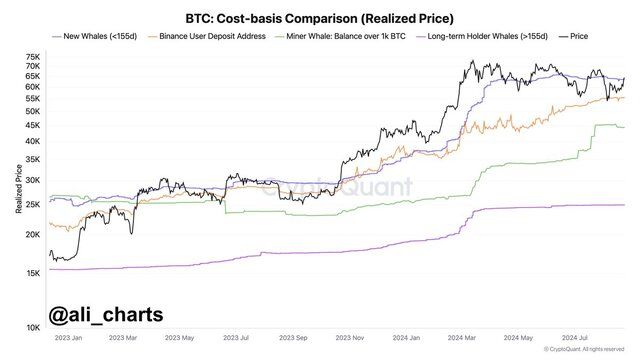

Further evidence of growing institutional interest comes from whale inflow data. According to CryptoQuant contributor Darkfost, inflows from Bitcoin whales surged by 60% in just one week.

In short, Bitcoin’s current rally is being powered by institutional accumulation — while retail investors have yet to fully reenter the market.