BTC is trading at $54,300 and the crypto market capitalisation has once again fallen below $2 trillion. The main reason is believed to be Mt Gox, which has officially announced the start of compensation payments and has already sent 47,229 BTC ($2.7 billion).

Practically, Mt Gox is bringing down the crypto market once again. If the payouts had been made during a period of growth, compensation recipients would probably prefer to wait for $100,000 per BTC. But now they are choosing to sell so that they can buy again if the market reverses.

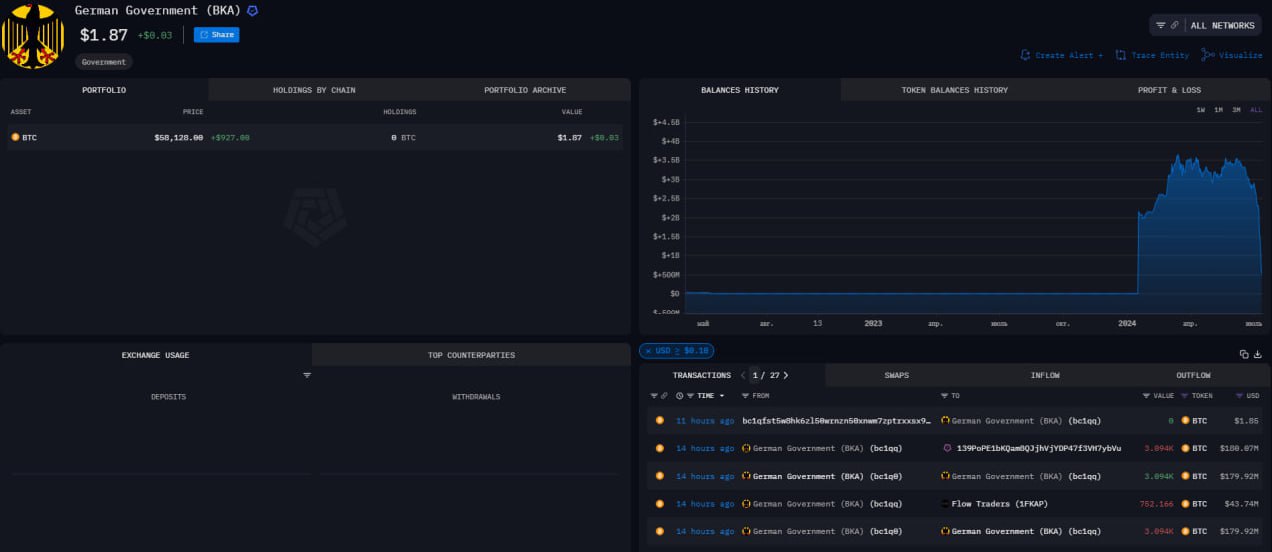

Whales have sold 30,000 BTC in the last month. Perhaps the big players have insider information or are planning to return to the market after a correction. However, such sales do not yet indicate the end of the bullish trend.

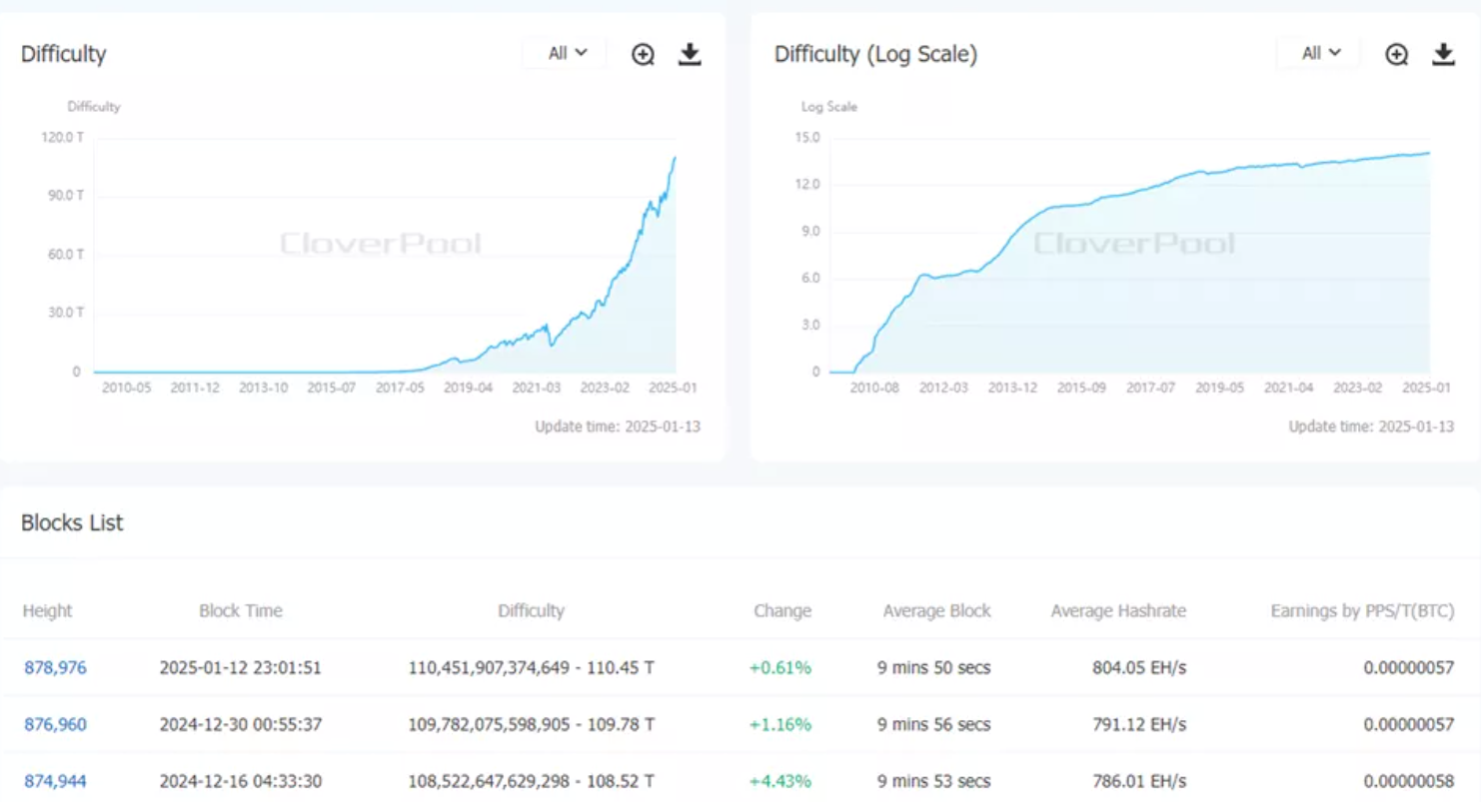

At the moment, only six models of ASIC miners are profitable, the rest of the BTC mining equipment is operating at a loss at the current price. Miners are in a state of capitulation, and this situation may get much worse.