In the second half of 2025, Bitcoin is expected to continue its strong growth, outpacing gold in terms of performance. This forecast comes from JPMorgan analysts, who highlight the key role of institutional investors and growing support from U.S. states, reports The Block.

The “Debasement Trade” Strategy and Asset Shift

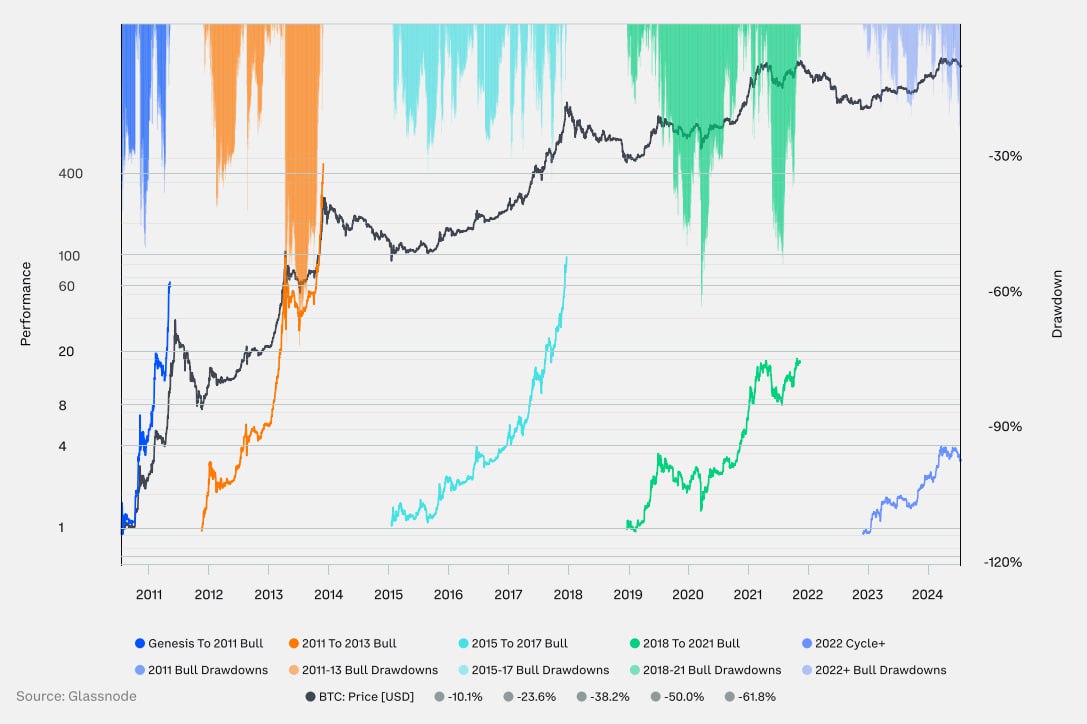

Since late 2024, the market has been influenced by the so-called “debasement trade” strategy—investing in safe-haven assets amid inflationary and macroeconomic risks. Initially, this strategy supported gold’s rise at the expense of Bitcoin. However, this model has now evolved into a zero-sum game, where the strengthening of one asset happens at the cost of the other.

“From mid-February to mid-April, gold appreciated by drawing liquidity away from Bitcoin. But over the last three weeks, the trend has reversed, with Bitcoin strengthening and gold losing ground. We expect this dynamic to continue through the end of the year. Catalysts related to digital assets are clearly creating an advantage for Bitcoin,” JPMorgan emphasized.

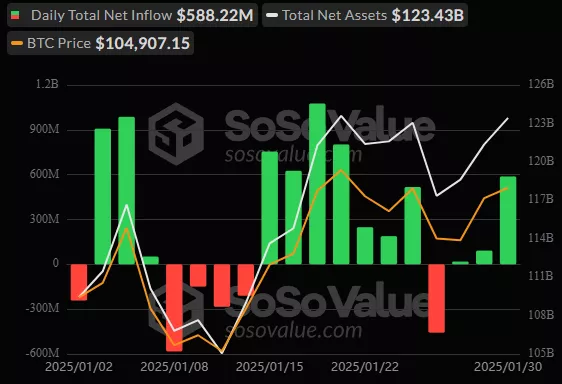

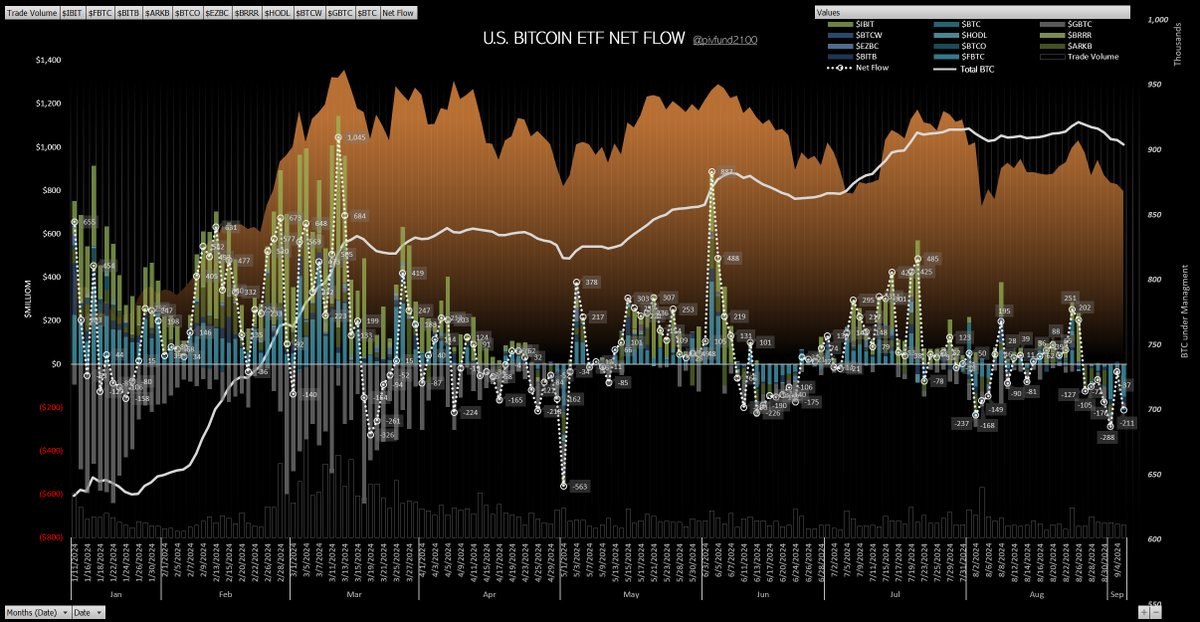

Market Data and Investor Behavior

Since April 22, gold prices have fallen nearly 8%, while Bitcoin has risen about 18%. Investment flows reflect a similar shift: funds are actively moving out of gold ETFs into spot and futures BTC ETFs, as well as crypto ETFs.

Futures market data confirms this sentiment change—open interest in gold contracts is shrinking, while Bitcoin contract positions are growing. Earlier in 2025, the opposite was true.

Impact of Institutional Investors and Corporate Strategies

Increasing interest in Bitcoin is being driven by major firms and funds. Strategy and Metaplanet are actively increasing their Bitcoin holdings. Michael Saylor’s MicroStrategy has announced plans to raise up to $42 billion in Bitcoin investments by 2027 — already reaching 60% of its target.

These moves reinforce Bitcoin’s status as “digital gold,” making it attractive for long-term investment, especially amid global financial uncertainty and rising inflation.

Role of U.S. States and Local Initiatives

JPMorgan highlights efforts by New Hampshire and Arizona to promote digital assets and “digital gold” initiatives in their local economies and legislation. These initiatives foster a favorable environment for crypto investors and create long-term growth prospects.

Analysts believe that expanding the number of states with such initiatives will be an important sustainable market driver.

Maturation of the Derivatives Market

The crypto derivatives market is showing signs of maturity and institutionalization. JPMorgan pointed to major deals such as Coinbase’s acquisition of Deribit, Ninjatrader’s deal with Kraken, and Gemini receiving licenses to offer derivatives products in Europe. This development increases liquidity and market safety, reducing volatility and making instruments more appealing to professional investors.

Asset Reallocation in Asia and Global Trends

UBS reports that wealthy investors in Asia are gradually shifting capital away from dollar-denominated assets into gold, cryptocurrencies, and Chinese markets. This is driven by changing geopolitical conditions, currency volatility, and rising interest in alternative asset classes.

Growing Institutional and Government Interest

Galaxy Digital emphasizes that Bitcoin is increasingly viewed as a digital analogue to gold—a store of value asset capable of preserving wealth long-term. Support from institutional players, ETFs, and even some governments is growing, lowering risks and facilitating mainstream adoption of cryptocurrencies.

Political Events and Strengthening Safe-Haven Status

Researchers at NYDIG link Bitcoin’s strengthening as a safe-haven asset to political events such as U.S. President Donald Trump’s “Liberation Day,” which shifted market sentiment in favor of cryptocurrencies. Similar conclusions were reached by QCP Capital—interest growth is fueled by overall global instability and a search for new ways to preserve capital.

Potential Risks and Challenges

However, analysts caution that the cryptocurrency market remains vulnerable to regulatory risks and high volatility. Increased regulation, geopolitical conflicts, and technological challenges could temporarily slow growth. Nevertheless, the combination of institutional support, expansion of the derivatives market, and governmental adoption of digital assets creates a strong foundation for Bitcoin’s continued strengthening in the long run.