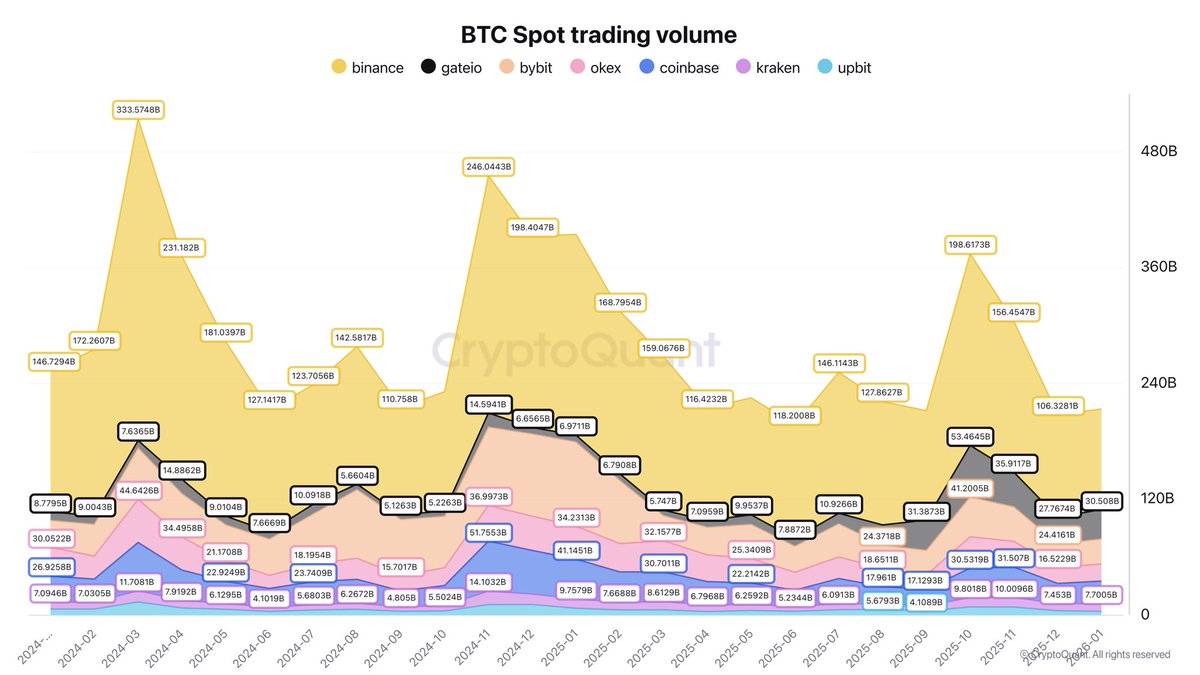

According to CoinGlass, June ended with BTC down by 6.96%.

In the first quarter, Bitcoin showed confident growth, closing each month in the positive. However, the situation changed in the second quarter, and Bitcoin’s price dropped by 15%.

At the beginning of the quarter, Bitcoin was priced around $70,000 – $71,000, but by the end, it had fallen to $60,800.

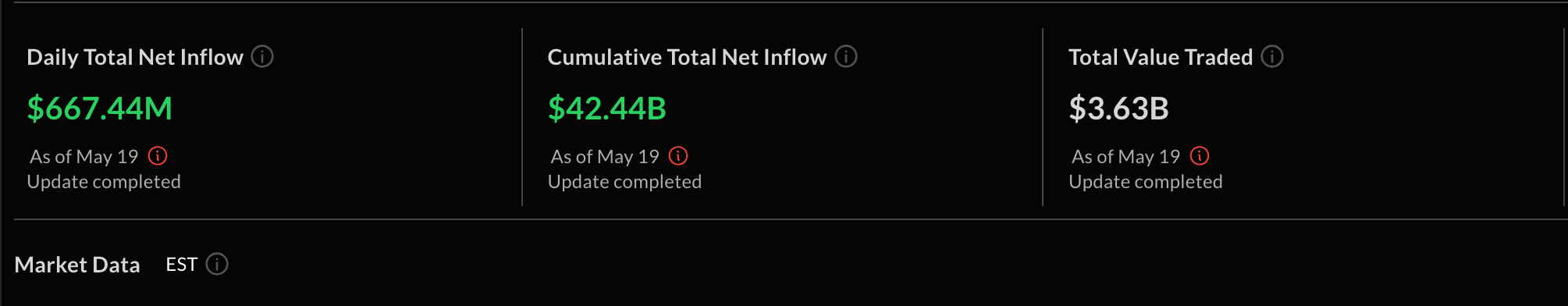

Positive news in May about the launch of spot ETFs for ETH had a temporary positive impact on BTC. However, the subsequent postponement by the SEC negatively affected the market.

Along with BTC, altcoins, including ETH, also suffered. The CoinDesk Composite Index, reflecting the overall performance of cryptocurrencies, fell by more than 21% over three months.

Nevertheless, many analysts expect a bullish scenario by the end of the year, predicting a price rise to $100,000.

At the end of June, bears became active and tried to push the price down to $55,000, but the bulls managed to hold the level and bounced back from $60,000.