Canaccord has revised its price target for MicroStrategy downward to $1,590 from $1,810, amidst new acquisitions and financial outcomes.

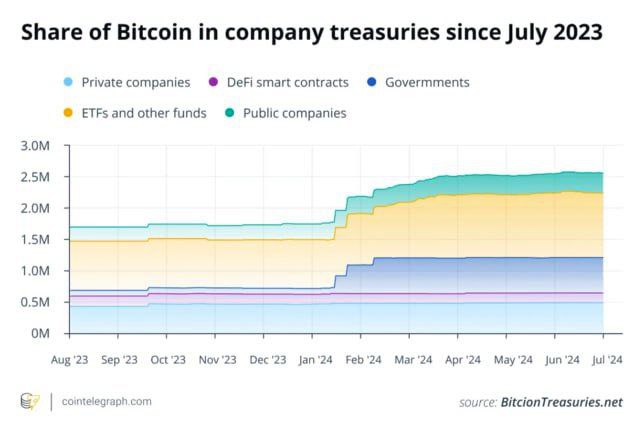

In the first quarter, MicroStrategy expanded its Bitcoin holdings, now owning 214,400 BTC valued at approximately $13.6 billion. Despite this, the company reported a net operating loss of $53.1 million due to a significant digital asset impairment charge of $191.6 million.

According to a Monday report by Canaccord Genuity, MicroStrategy raised over $1.5 billion in the quarter, investing these funds to purchase an additional 25,250 BTC. This acquisition strategy underscores its commitment to Bitcoin, which constitutes nearly 1% of the available 19.7 million Bitcoin tokens.

MicroStrategy also saw substantial growth in subscription services revenue, driven by its transition to cloud-based solutions. However, it still faced a considerable net operating loss after the impairment charge.

The company opted not to adopt new digital asset fair value accounting standards this quarter. If it had, the recent Bitcoin price rally could have allowed MicroStrategy to report significant profits.

Despite lowering the price target, Canaccord maintains a buy rating on MicroStrategy. After the adjustment, the stock price fell by 2.5% to $1,261 in after-hours trading.

Analysts, including Joseph Vafi, suggest the revised price target reflects ongoing Bitcoin appreciation and a potential revaluation of the software business. However, they do not anticipate these factors to drive significant price changes from current levels due to MicroStrategy’s existing premium over its Bitcoin holdings.

Canaccord notes the 71% equity value premium over the HODL strategy as significant, viewing any contraction as a potential risk.

MicroStrategy’s substantial Bitcoin assets are seen as having scarcity value, positioning it as a prime avenue for equity investors to access the digital asset market. This could lead to a potential premium increase in MicroStrategy’s shares.

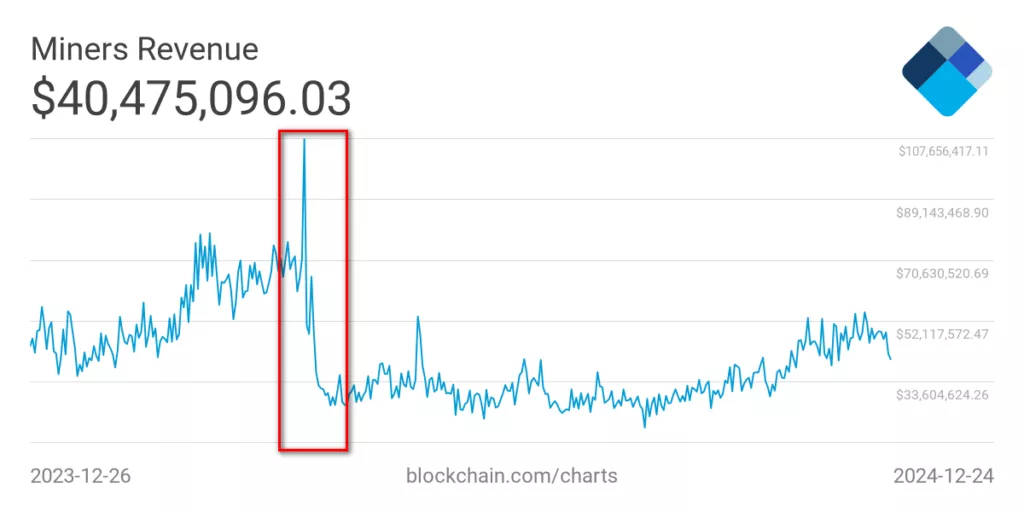

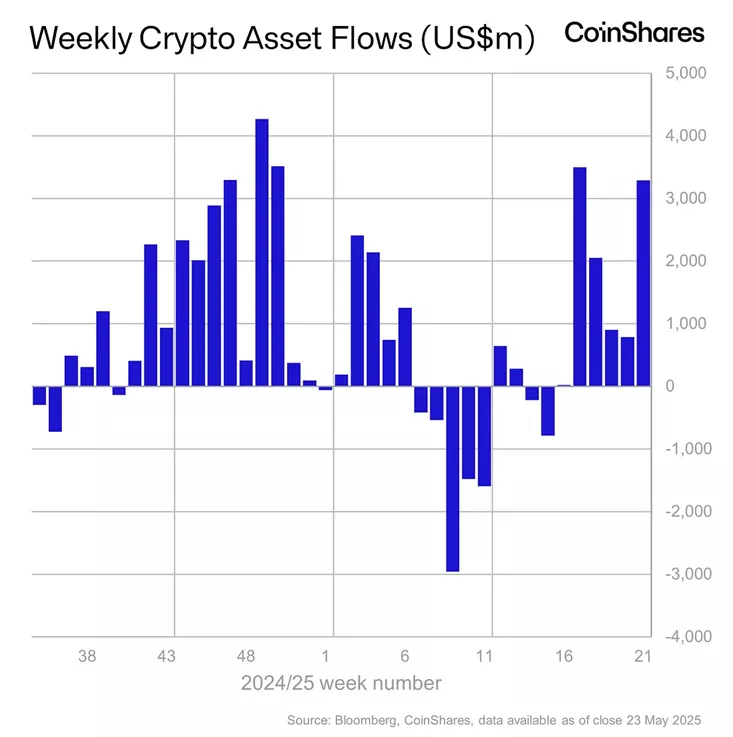

Additionally, the outlook for Bitcoin remains positive, boosted by recent U.S. approvals of Bitcoin ETFs from major asset managers and strong market adoption following the latest Bitcoin halving.