Since the start of 2024, Bitcoin has surged by 113%, but most mining companies have shown negative stock performance. Out of 25 publicly traded mining firms, only seven ended the year with gains. The leaders in stock growth are:

- Core Scientific (CORZQ) — +327%;

- TeraWulf (WULF) — +169%;

- Bitdeer (BTDR) — +167%;

- Hut 8 (HUT) — +91%;

- Iris Energy (IREN) — +72%.

However, the largest players by market capitalization suffered significant losses. For example, Argo Blockchain (ARB) shares dropped by 84%, while Bitfarms (BITF) declined by 44%.

Key Reasons for the Decline

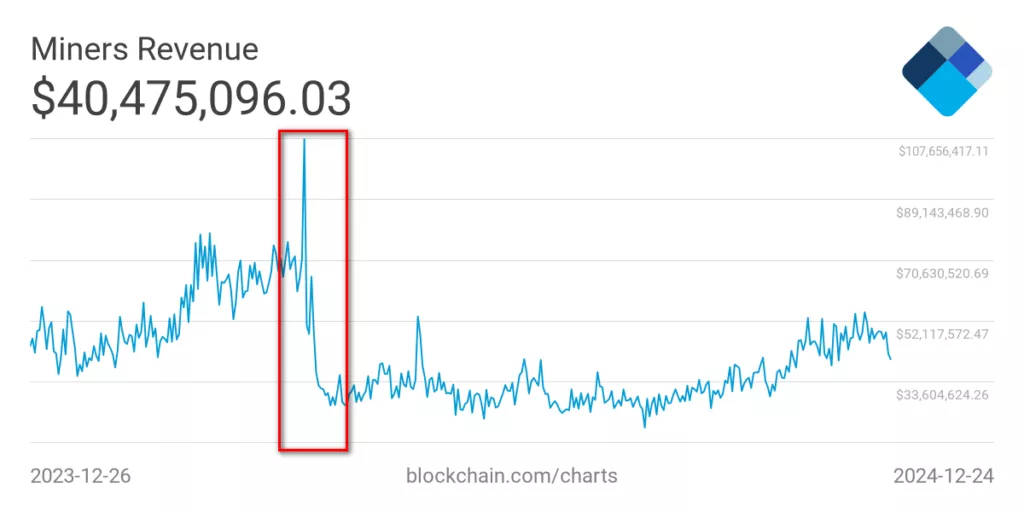

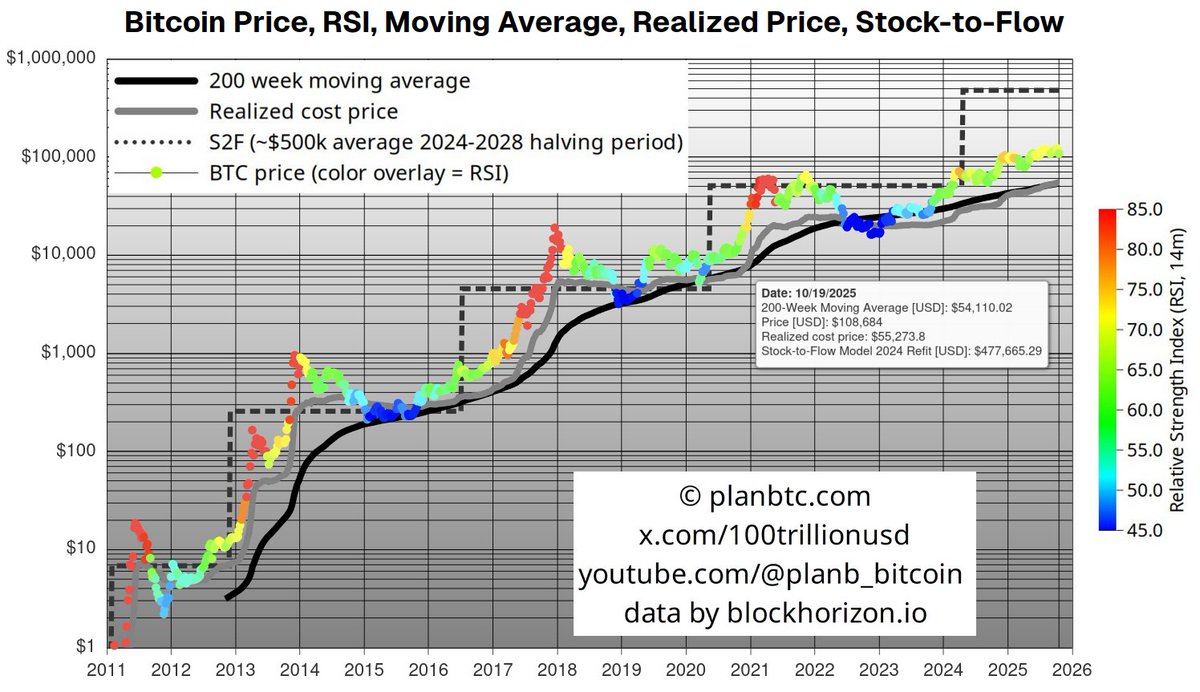

- Halving: In April, the block reward was halved from 6.25 BTC to 3.125 BTC, reducing miners’ revenues. Even with Bitcoin’s record-high price of $100,000, daily mining revenues failed to surpass $50 million.

- Rising Mining Difficulty: As of December 16, the difficulty level hit an all-time high of 108.52 T, a 50% increase over the past year.

- Growing Costs: For example, BitFuFu’s mining expenses per Bitcoin soared by 168% in Q2, reaching $51,887.

New Strategies Among Miners

Mining companies are seeking diversification to adapt:

- AI Investments: Core Scientific signed a deal with CoreWeave, projected to generate $8.7 billion over 12 years. Companies like TeraWulf, Hut 8, and Iris Energy are also exploring AI-powered business opportunities.

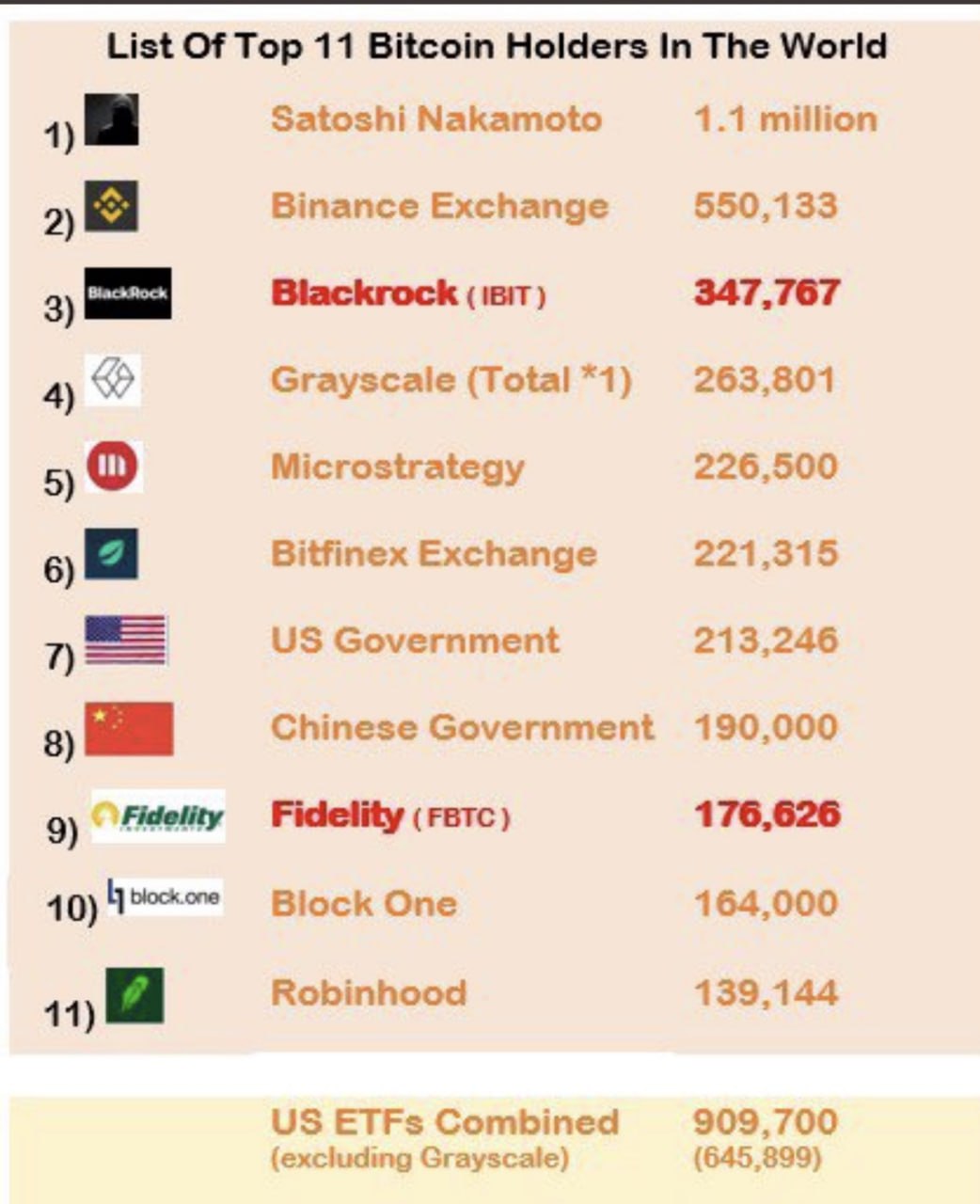

- Building BTC Reserves: Firms such as MARA and Hut 8 are actively acquiring Bitcoin to boost asset value and cover operational expenses.

The mining industry faces mounting challenges but demonstrates resilience by exploring alternative business directions and adapting to changing market conditions.