Recent analysis on the Derive.xyz platform has revealed an increased interest from investors in put options on Bitcoin and Ethereum, expiring on August 29. This trend signals an attempt to hedge against the risk of a price drop for these cryptocurrencies by the end of the month, pointing to a potential market correction.

What are options?

Options are financial instruments that give the right, but not the obligation, to buy or sell an asset at a predetermined price before the contract expiration date. A call option allows the purchase of an asset, while a put option allows its sale on the same terms.

When there is an increased demand for put options, it usually indicates that investors want to protect themselves against falling asset prices. This situation leads to a “bearish” asymmetry, where put options become more expensive than call options, reflecting an increase in demand for market downturn protection.

Market analysis of cryptocurrencies

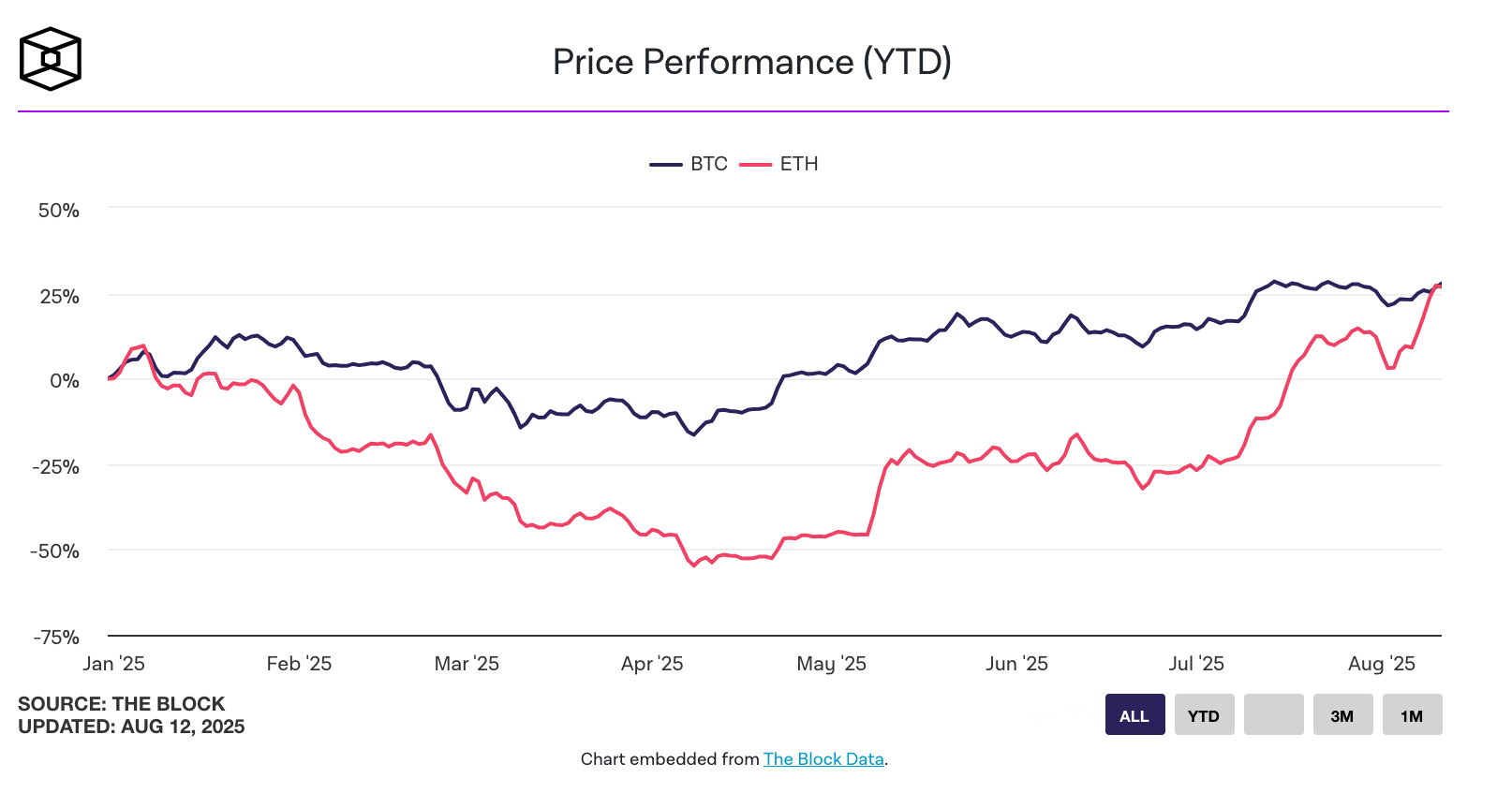

According to data from Derive.xyz, the volume of put options on Ethereum with expiration on August 29 significantly exceeds call options by more than 10%. The highest activity is observed at strike prices of $3200, $3000, and $2200. This suggests expectations of a pessimistic correction, ranging from a moderate decline to a more pronounced drop. At the time of writing, Ethereum was trading around $3600, having decreased by 2.4% over the past week.

For Bitcoin, the negative asymmetry is even more pronounced. The open interest in put options for Bitcoin expiring on August 29 is nearly five times higher than the number of call options. A significant portion of contracts is concentrated at a strike price of $95,000, with another quarter near $80,000 and $100,000. This may indicate mass hedging in case of a sharp drop below $100,000. At the time of writing, Bitcoin was trading around $113,862, having fallen by 3.1% in the past week.

Options market and forecasts

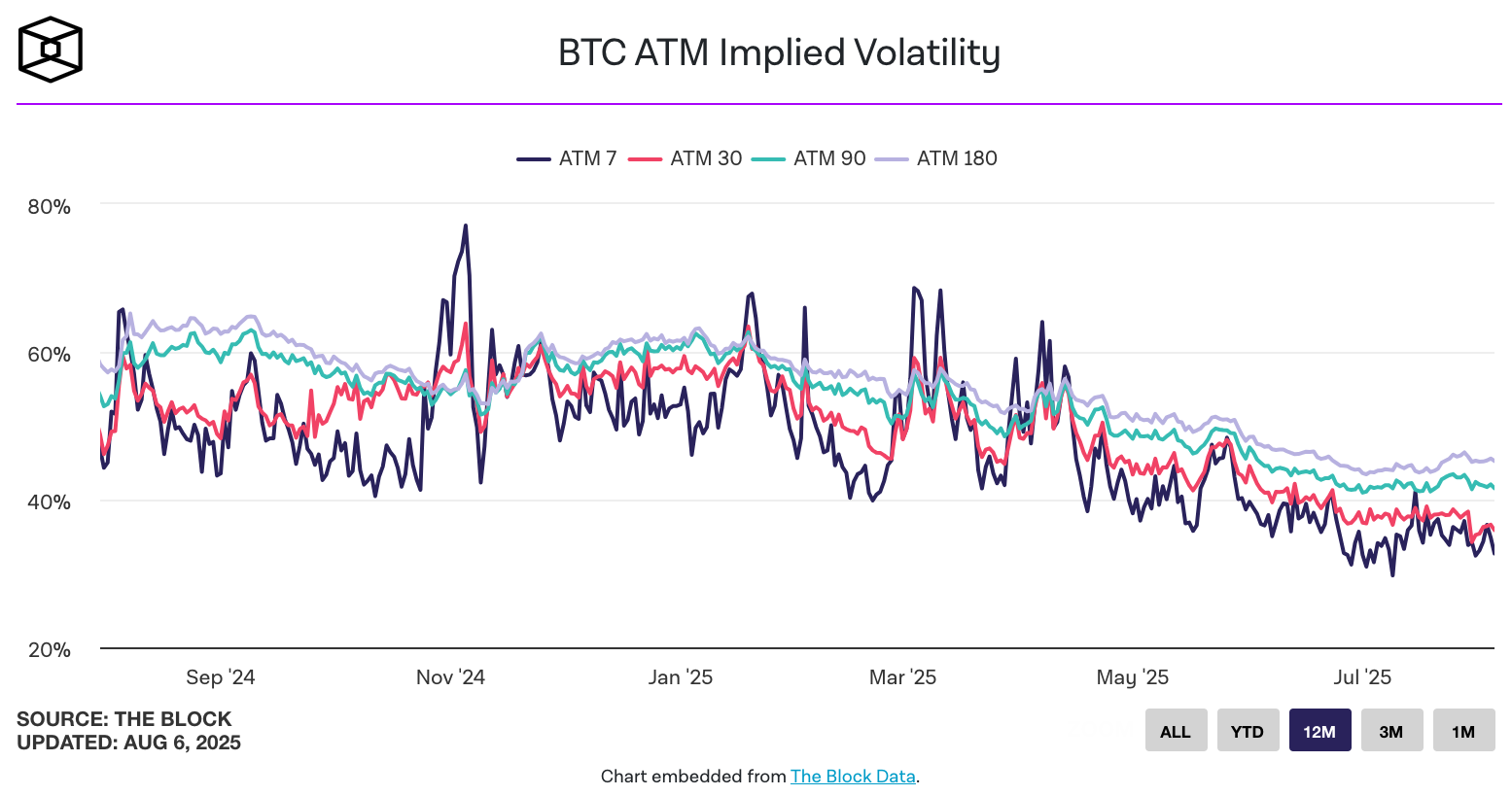

The sharp dominance of put options and their higher cost signals the popularity of hedging strategies. The indicator reflecting the difference between put and call options prices for Bitcoin has decreased from +2% to -2% over the past month, and for Ethereum, it has dropped from +6% to -2%. This suggests growing uncertainty in the market as investors seek to protect themselves from potential losses.

Moreover, the expected monthly volatility is about 35% for Bitcoin and 65% for Ethereum. The gap between these indicators has increased from 24% in early June to the current ~30%, pointing to a higher likelihood of significant price fluctuations for Ethereum in August, despite less pronounced bearish sentiment in the options structure.

Investor expectations

Derive’s data also shows that investors’ forecasts for cryptocurrencies remain mixed. The probability of Ethereum’s price dropping below $3,000 by the end of August is 25%, while the probability of it rising above $4,000 has increased from 15% to 30%. For Bitcoin, analysts estimate the likelihood of a retest of the $100,000 level by the end of the month at 18%.

Impact on investor behavior

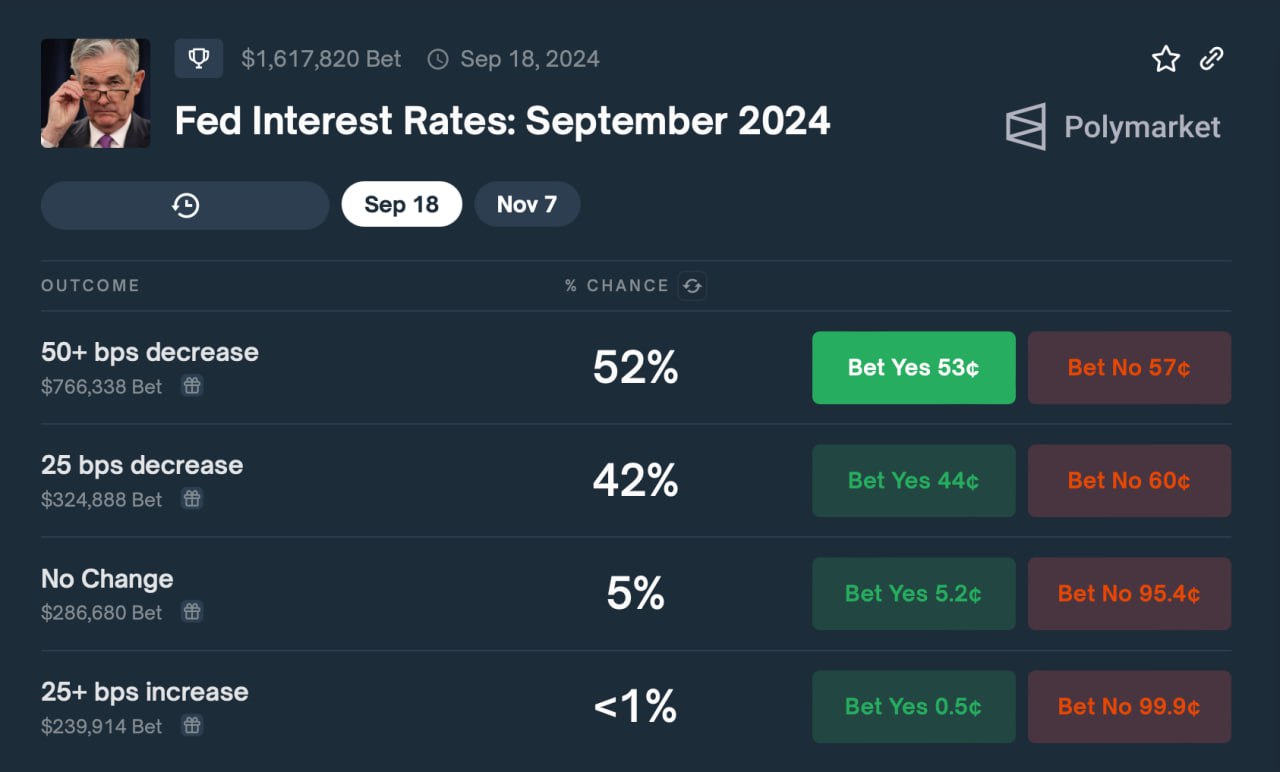

Following the Federal Reserve’s meeting in July, where the interest rate was expectedly kept unchanged, investors have become more cautious. The regulator highlighted ongoing inflation risks and economic uncertainty, which has affected the cryptocurrency market and investors’ hedging strategies.

Thus, the current data on options indicate growing expectations of a potential correction in the cryptocurrency market in August, while investors actively employ defensive strategies in case of a price drop.