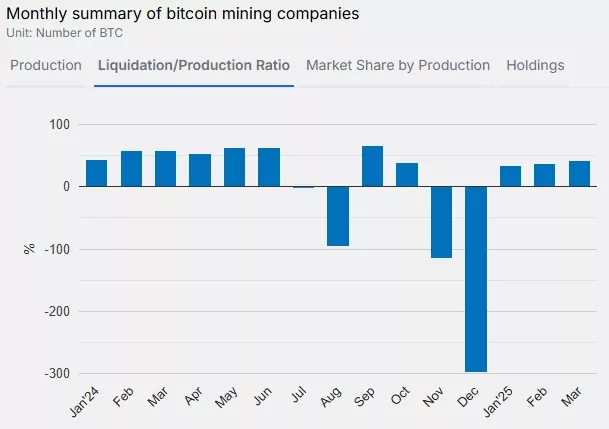

In March, public mining companies significantly increased their Bitcoin sales, reaching the highest level since October 2024, reports TheMinerMag.

15 publicly traded miners sold over 40% of their mined volume. Companies like HIVE, Bitfarms, and Ionic Digital exceeded 100%.

After the U.S. presidential elections, many industry participants shifted to a more aggressive HODL strategy. In Q4 2024, companies such as Riot, Hut 8, and MARA even started purchasing additional Bitcoins to increase their crypto reserves.

The shift toward sales in March is explained by experts as a result of declining mining profitability amid stagnant hash rates at near-minimum levels and growing uncertainty due to trade wars.

Since January 2025, companies like Bit Digital, Argo, Terawulf, and Stronghold stopped disclosing information about the sales of mined cryptocurrency.

CleanSpark confirmed it would begin selling part of its mined Bitcoins to cover operational expenses and use reserves to fund business expansion. Prior to this, the company had adhered to a policy of holding 100% of its mined Bitcoin since mid-2023.

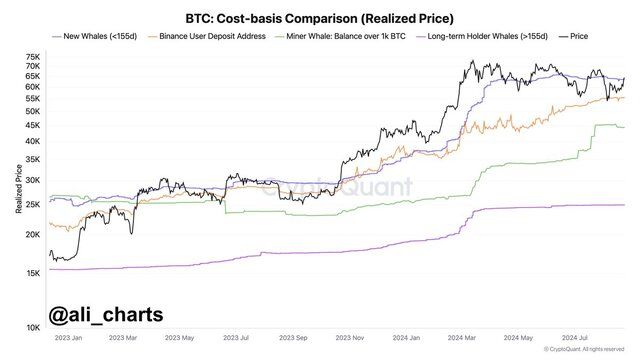

CryptoQuant analyst Axel Adler also linked the current rise in sales by miners to economic pressure from trade tariffs. However, he emphasized that this doesn’t resemble “capitulation or panic.”

“Miners are holding strong. Even with recent price drops, their sentiment is improving, which is a clear sign that they still believe in Bitcoin’s long-term potential,” noted the analyst.

According to Glassnode, on April 8, the hash rate of the first cryptocurrency (smoothed with a seven-day moving average) reached a record of 925.4 EH/s, but after a slight drop, it recovered to 905.5 EH/s.

It is forecasted that the next difficulty adjustment will increase mining difficulty by 4%, further reducing profitability.

Analysts have pointed out the concerning trend of diverging hash rate dynamics and Bitcoin price movements, but CryptoQuant sees this as a positive signal, indicating the strength of the cryptocurrency’s underlying factors.