A noticeable shift is underway among Bitcoin miners: many, including so-called Satoshi-era miners — early participants who began mining during Bitcoin’s formative years — are pausing large-scale sales and instead building up their reserves.

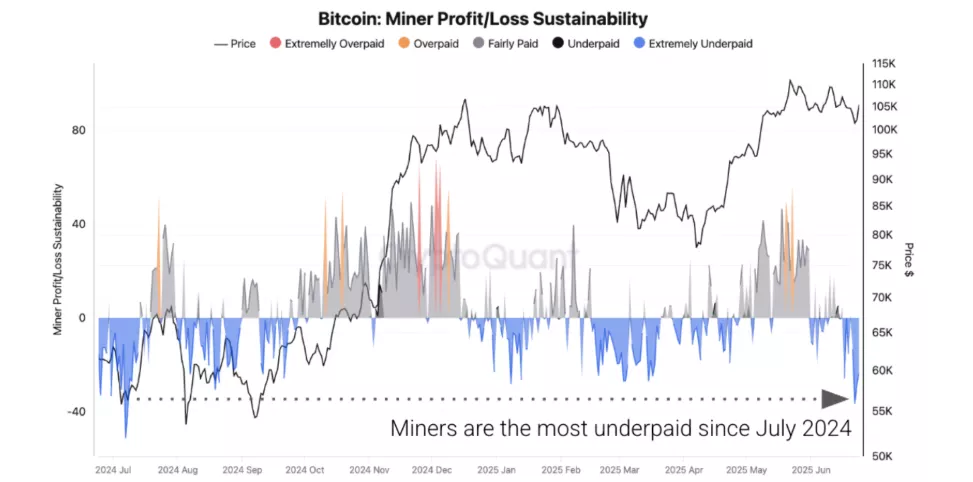

According to a recent report by analytics firm CryptoQuant, miners have increased their BTC holdings by 4,000 BTC since April, despite a significant drop in revenue. Daily mining income has fallen to $34 million, the lowest level since April 20, 2025. This decline is attributed to lower transaction fees and a recent dip in Bitcoin’s market price.

Accumulation Over Liquidation

The report highlights a sharp decrease in BTC outflows from miner wallets. In February 2025, daily outflows peaked at 23,000 BTC. Today, that number has dropped to just 6,000 BTC. Moreover, direct transfers from miners to exchanges remain at historically low levels, indicating a shift toward long-term holding.

CryptoQuant analysts suggest this trend is supported by relatively high operating margins, which currently average around 48%, allowing miners to maintain reserves rather than sell at lower prices.

Whale Wallets Return to Accumulation

Wallets holding between 100 and 1,000 BTC have also increased their holdings by 4,000 BTC since April, bringing their total balance to 65,000 BTC — the highest level since November 2024. This marks a resurgence of accumulation among mid-tier holders, sometimes referred to as “crypto whales.”

Satoshi-Era Miners Sell Almost Nothing

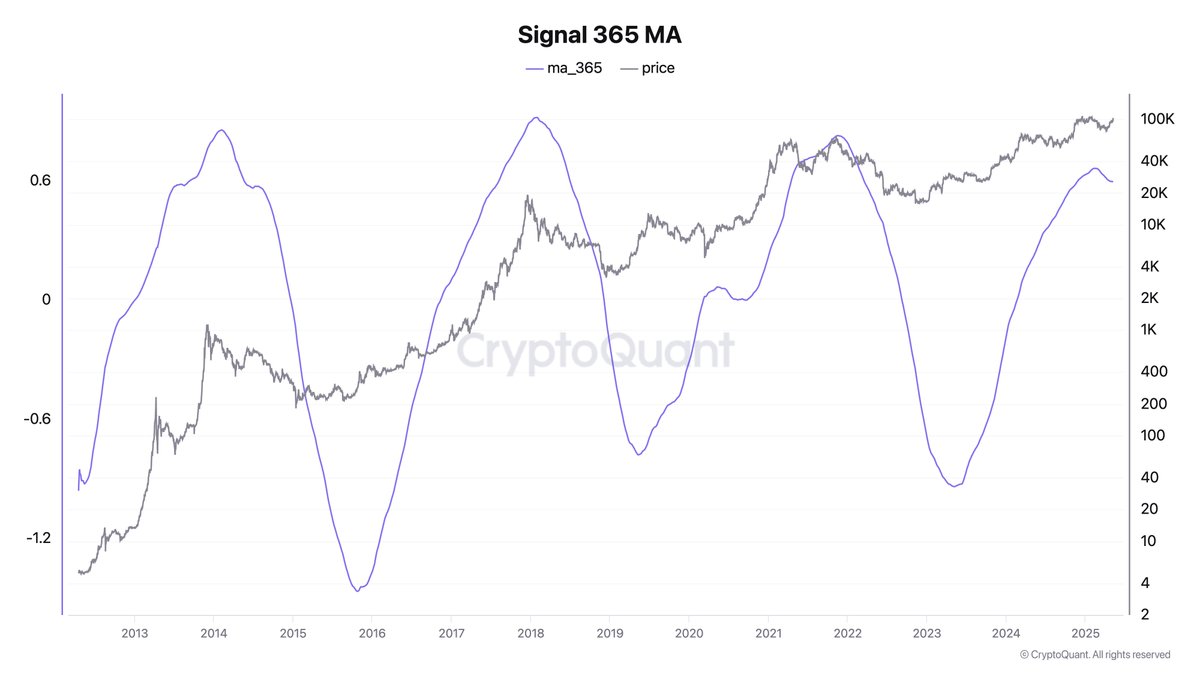

The behavior of Satoshi-era miners is particularly noteworthy. These long-time holders — who possess significant amounts of BTC mined in Bitcoin’s earliest days — have sold only 150 BTC in 2025. In comparison, they sold nearly 10,000 BTC in 2024. Historically, such sell-offs were seen as indicators of local market tops.

Transaction Fees Continue to Decline

Since the beginning of June, total transaction fees earned by miners have amounted to only $7 million, representing just 0.97% of the total mining revenue of $722.8 million. This signals a continued decline in fee-related income and adds pressure to mining profitability.

Conclusion

Despite current market volatility, miners appear confident in Bitcoin’s long-term value. The decline in sell-offs, increase in reserves, and growing activity among larger holders suggest a market shift from short-term profit-taking to strategic accumulation. This could become a key factor supporting Bitcoin’s price stability in the months ahead.