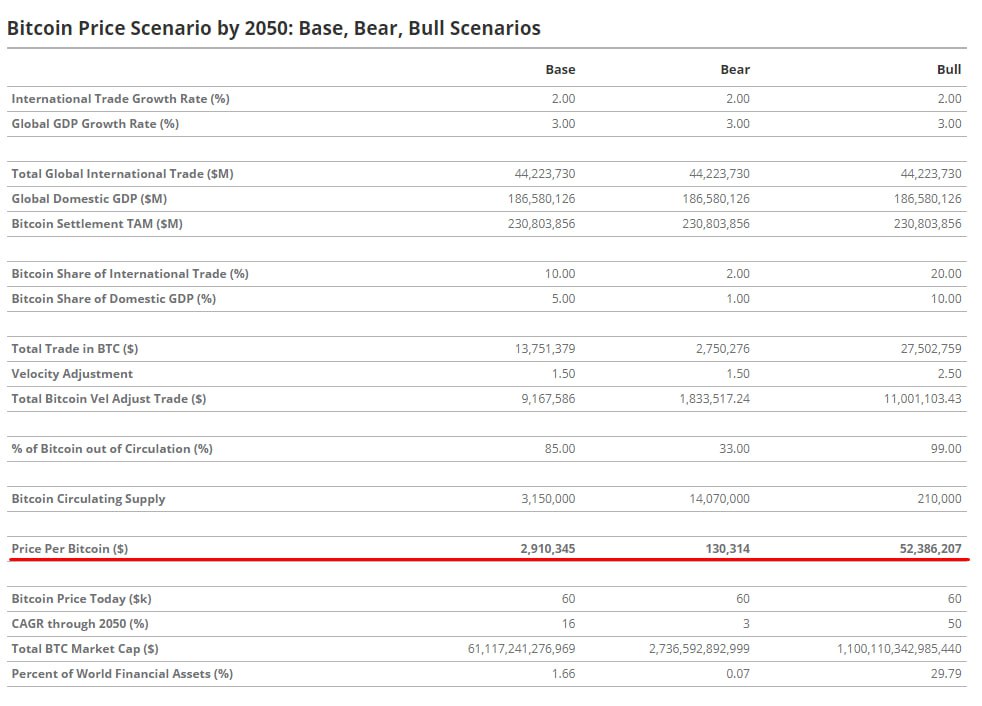

This highlights the strong interest and trust from investors in this financial instrument.

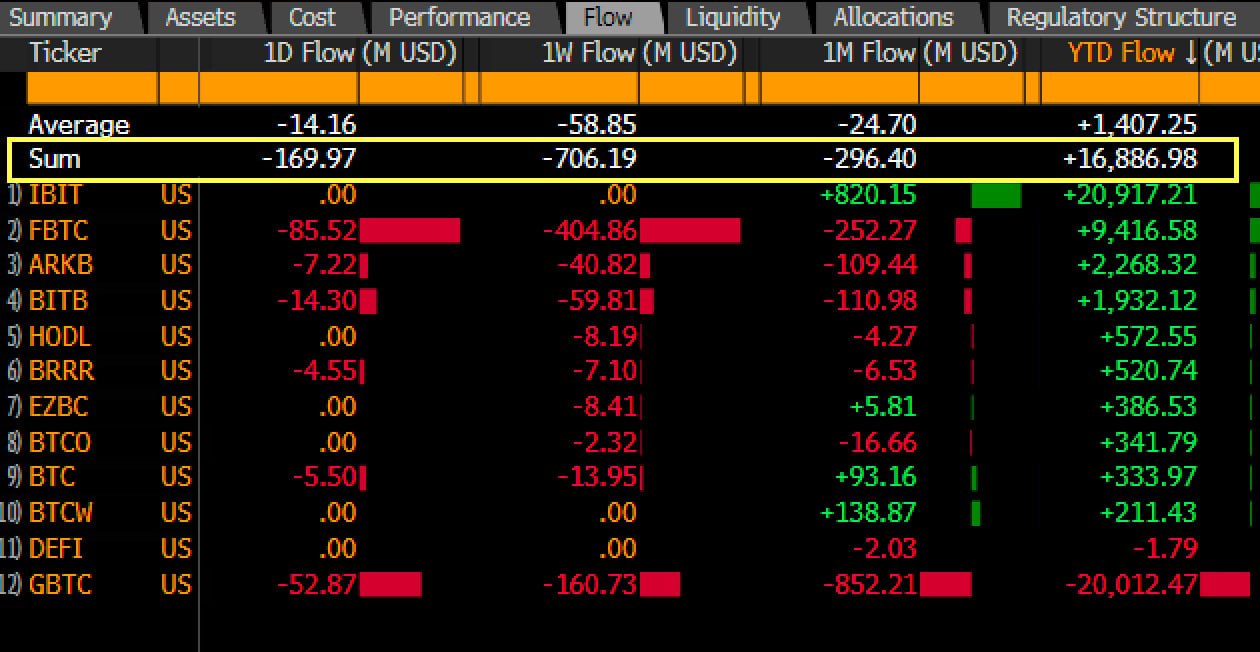

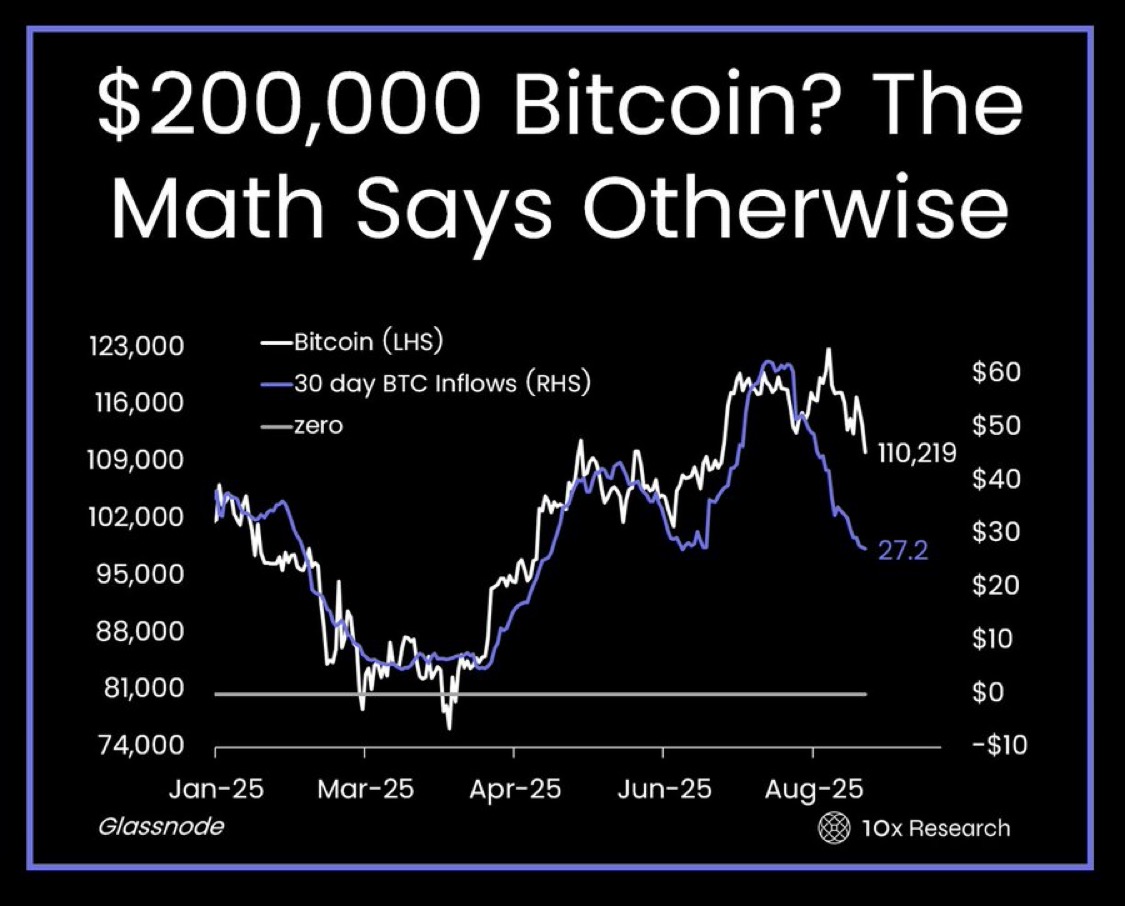

99% of investors remain in the game despite minor market corrections. I’m amazed at how the crypto community and skeptics start to panic over the slightest outflow of capital. But it’s important to remember that the cryptocurrency market moves by the principle of “two steps forward, one step back.” These fluctuations are natural, and we must accept them as part of the journey.

The results are unprecedented. IBIT from BlackRock alone has 661 holders, and around 20% of its shares are reportedly owned by institutional investors and major advisors. My forecast is that within the next 12 months, this figure will grow to 40%, further emphasizing the confidence of major players in this instrument’s potential.

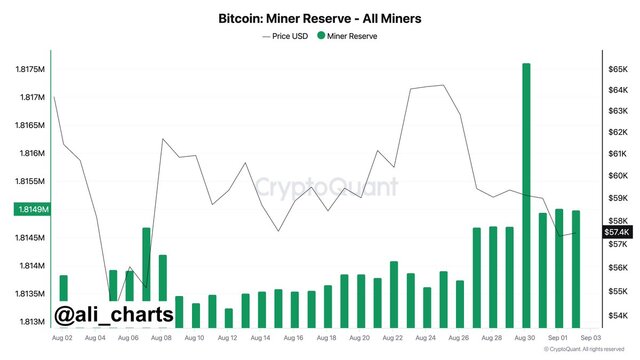

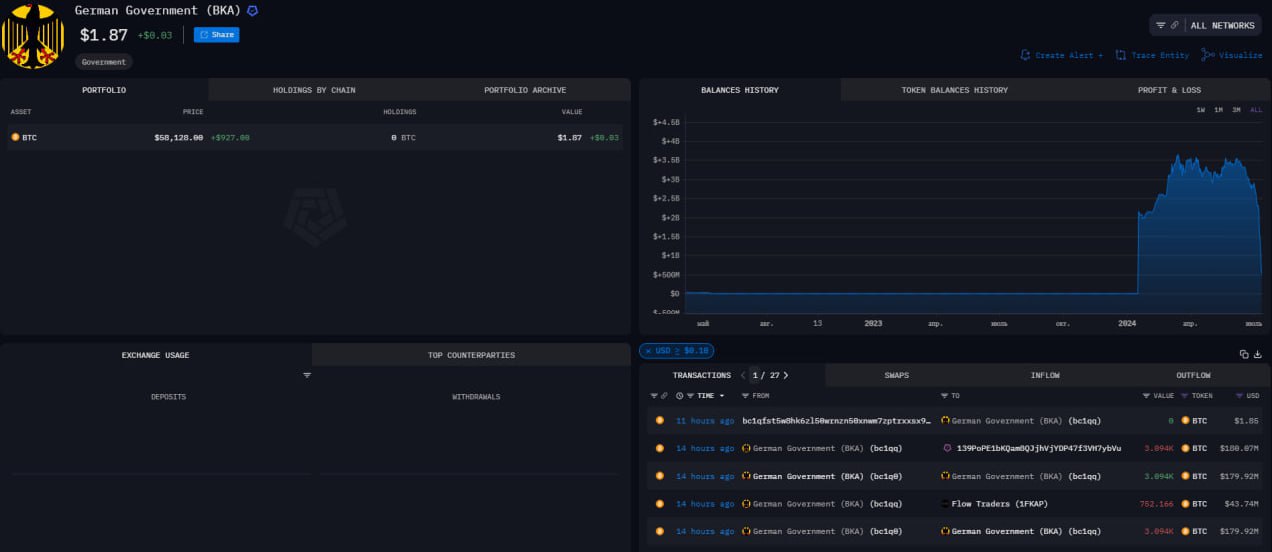

The tool has reached unprecedented heights, demonstrating incredible results. Compared to spot ETFs on gold and other assets, it shows a consistent growth trajectory. It’s important to note that we are under pressure from a bankrupt fund that is actively selling its assets and holding back overall growth. However, despite this, investments continue to flow in, which speaks to the trust in the industry and its future potential. In the near future, we could see significant position strengthening once the pressure from these sell-offs eases.