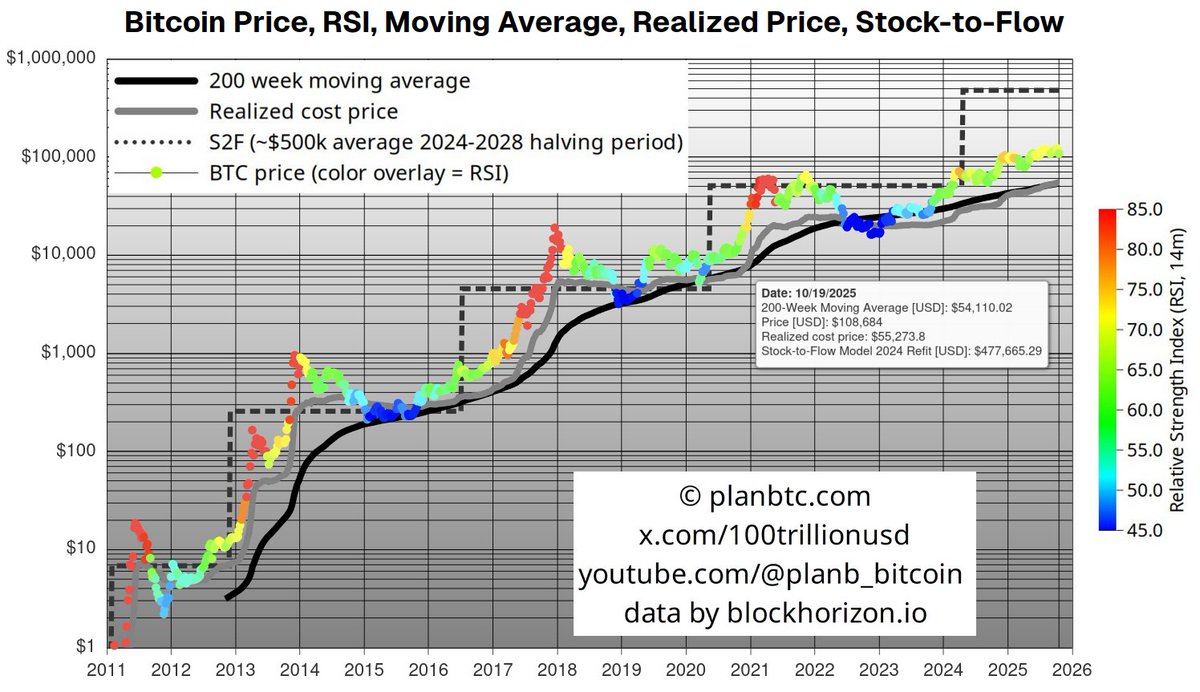

The creator of the well-known Stock-to-Flow (S2F) model and analyst PlanB believes that the recent Bitcoin correction below $108,000 does not mark the end of the bull market. According to him, the fundamental indicators continue to signal further potential for growth in the leading cryptocurrency.

“Many believe the $126,000 peak is already behind us, that Bitcoin will soon fall below $100,000, and that 2026 will be a bear market year. In my opinion, this is a serious misconception,” PlanB wrote.

📊 The End of the Four-Year Cycle?

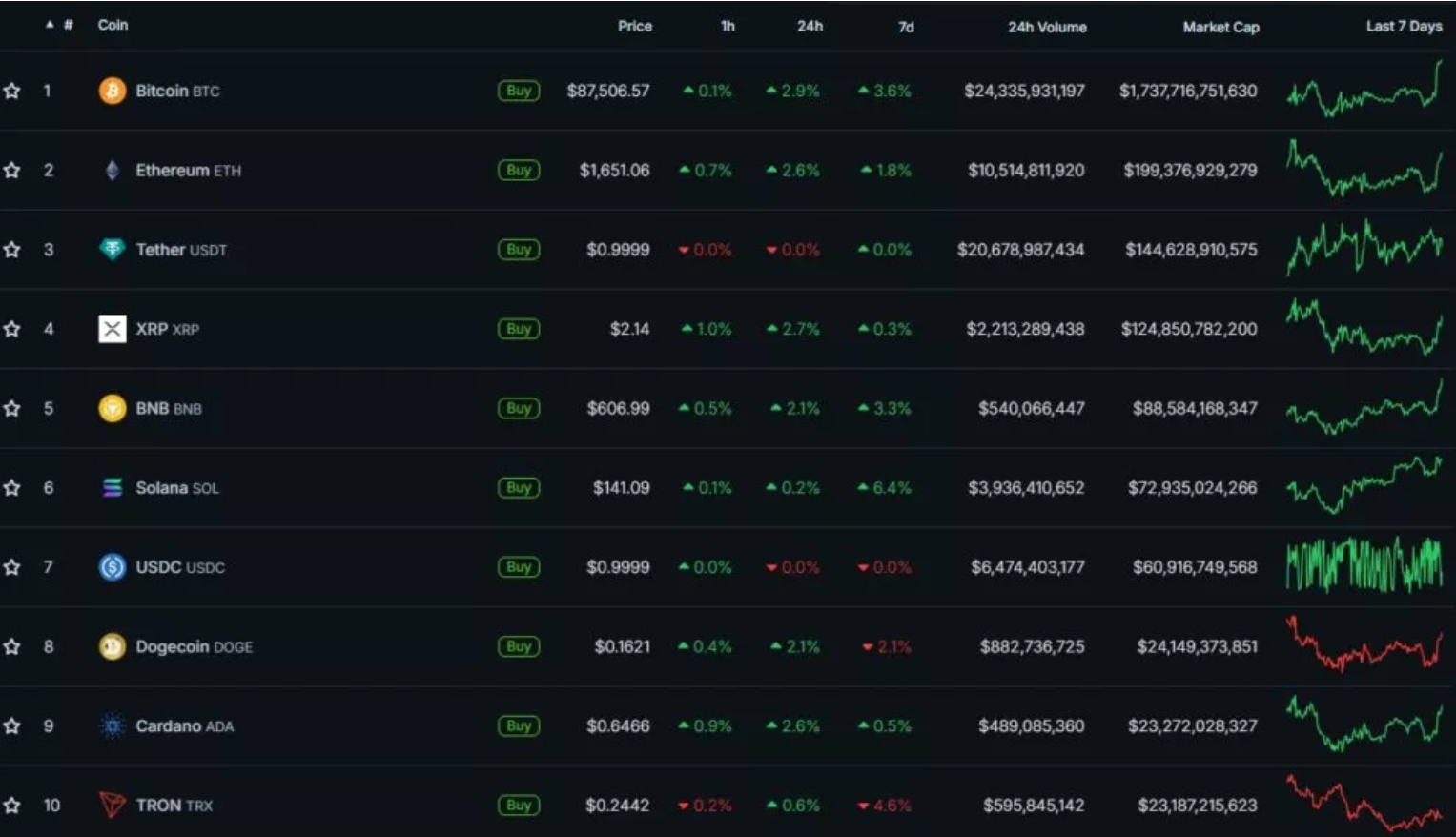

The analyst argues that the familiar four-year Bitcoin cycle no longer reflects market reality. The three previous cycles, he noted, are too small a sample to form a reliable pattern. According to the traditional model, Bitcoin’s peak should have occurred in October, roughly 18 months after the last halving.

However, PlanB pointed out that key signals typical for a market top have not yet appeared. The RSI indicator has not surpassed 80, and the realized price remains close to the 200-week moving average. This suggests two possible scenarios: either the market is preparing for a strong upward surge, or Bitcoin is entering a phase of price stability dominated by institutional investors, funds, and rebalancing mechanisms.

“Both scenarios are bullish for Bitcoin,” PlanB emphasized.

💡 Forecasts and Expert Opinions

Back in September 2024, PlanB predicted that Bitcoin could reach $1 million by 2025. Analyst Willy Woo supported the idea that the current cycle differs structurally from previous ones.

In earlier bull markets, liquidity came mainly from paper derivatives, while in the current phase, this form of liquidity is shrinking.

“Paper-based instruments are short-term — investors come and go quickly. This time, it’s different: the paper segment is contracting, while long-term spot liquidity remains stable,” Woo explained, though he warned that the situation could still change.

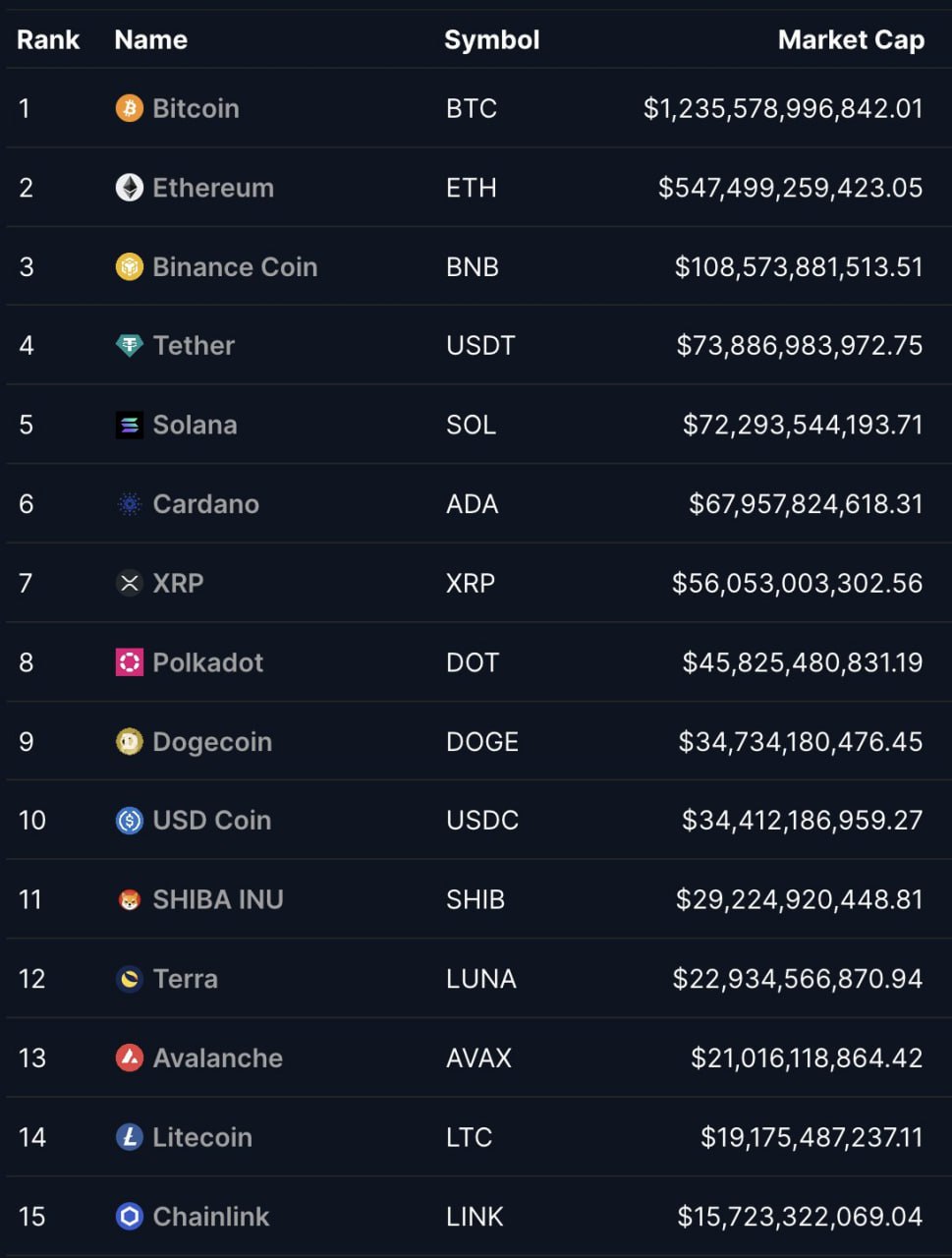

🪙 Institutional Shift

In January, PlanB revealed that he had moved part of his Bitcoin savings into spot ETFs backed by digital gold, reflecting a more mature phase of the market increasingly driven by institutional investors.

His view is echoed by other notable figures, including BitMEX founder Arthur Hayes, analysts from K33, CryptoQuant CEO Ki Young Ju, and Bitwise CIO Matt Hougan. All agree that the traditional four-year Bitcoin cycle has lost its predictive power — the crypto market is evolving into a new, more stable growth phase.