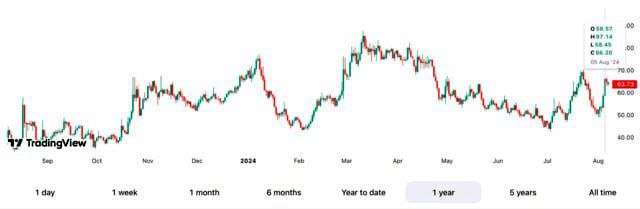

According to TradingView data, on August 5, the BTC Volatility Index peaked since November 2022. The indicator rose to 97.14 during a brief drop in Bitcoin below $50,000.

After a short-term consolidation, the market began to grow again. However, experts warn that before a full-fledged bullish trend, there may be another period of sideways movement, so it is recommended to hedge risks in the crypto derivatives market.

In the options market, there is a preference for Put contracts, which are oriented towards a bearish scenario. The trading volume of options has decreased as hedge funds are currently reluctant to take on increased risk.

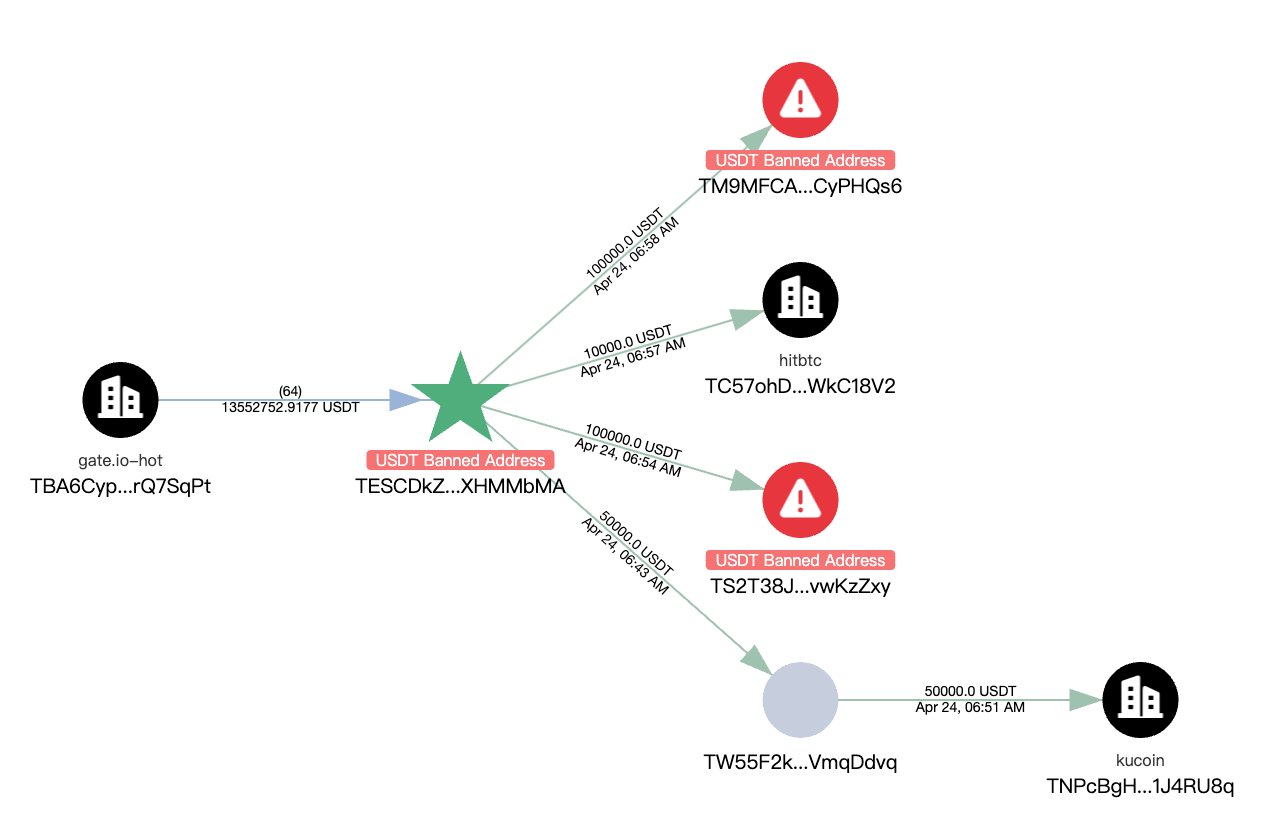

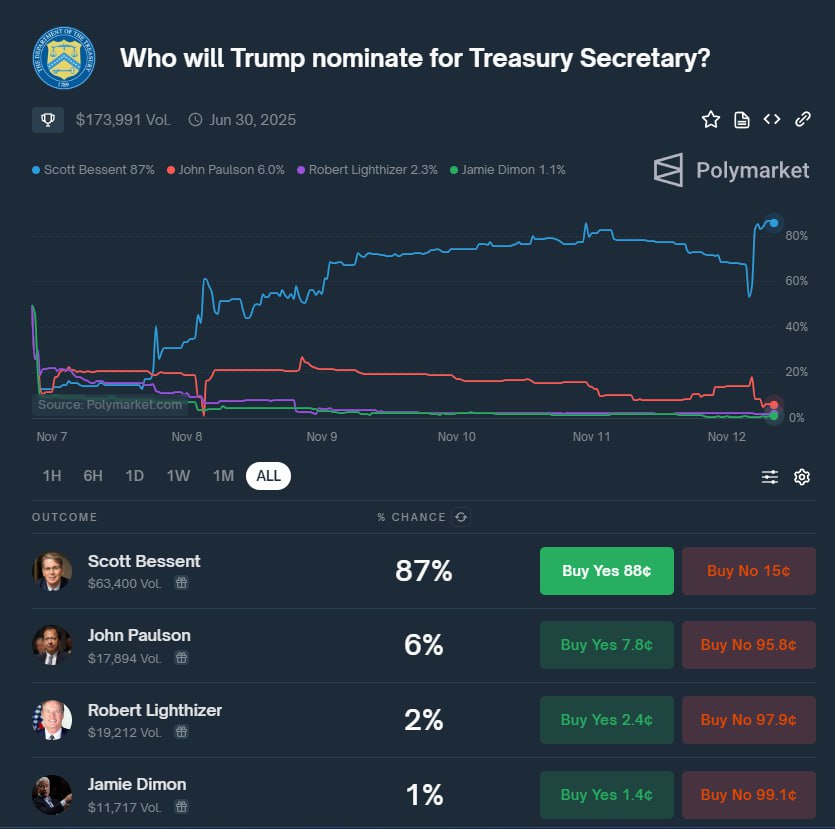

Investors are exercising caution due to recent market fluctuations and uncertainty regarding the future regulation of cryptocurrencies. In conditions of high volatility, traders are looking for ways to minimize potential losses, focusing on protective strategies.

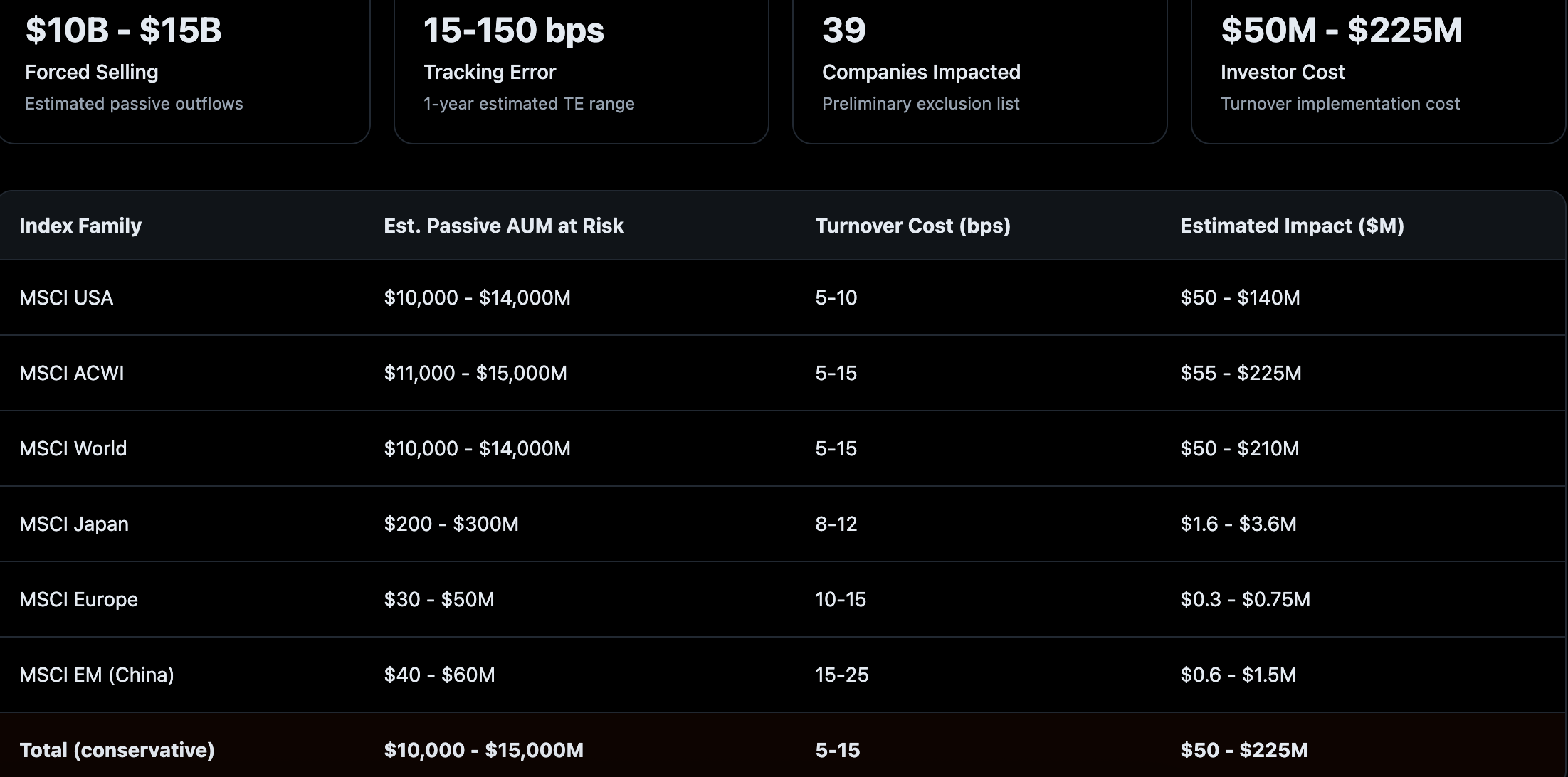

Analysts also note that macroeconomic factors such as inflation and changes in interest rates continue to influence the cryptocurrency market. Many market participants expect that in the coming months, Bitcoin and other digital assets will continue to experience significant fluctuations.