The surge of interest in corporate Bitcoin reserves—sparked by the success of Strategy—may soon face a harsh reality. Analysts warn that not all companies rushing to accumulate digital gold will survive the competition or retain investor trust.

The Illusion of a Simple Strategy

On-chain analyst James Check believes the current euphoria around BTC treasuries is nearing its peak. In his view, many companies are attempting to replicate Strategy’s approach—building Bitcoin reserves through debt and equity capital—without fully grasping the risks.

“Nobody needs the 50th company with a BTC treasury. We’re entering the ‘prove it to me’ phase, where companies without a solid strategy or product won’t be able to stay afloat,” Check said.

Unlike early adopters, newcomers will struggle to attract capital. Investors are more likely to trust firms that have already proven themselves in the market.

Kings and Bystanders

According to BitcoinTreasuries, 255 companies currently hold Bitcoin on their balance sheets, with 21 joining in the past month alone. However, Strategy remains the undisputed leader with 597,325 BTC, while runner-up MARA Holdings holds just 50,000 BTC.

Many players treat Bitcoin treasury strategies as a shortcut to fast growth, without understanding the fundamentals. Entrepreneur Udi Wertheimer shares this view, and Check adds that weaker players will likely be absorbed by stronger ones—or vanish entirely.

Trapped by MNAV

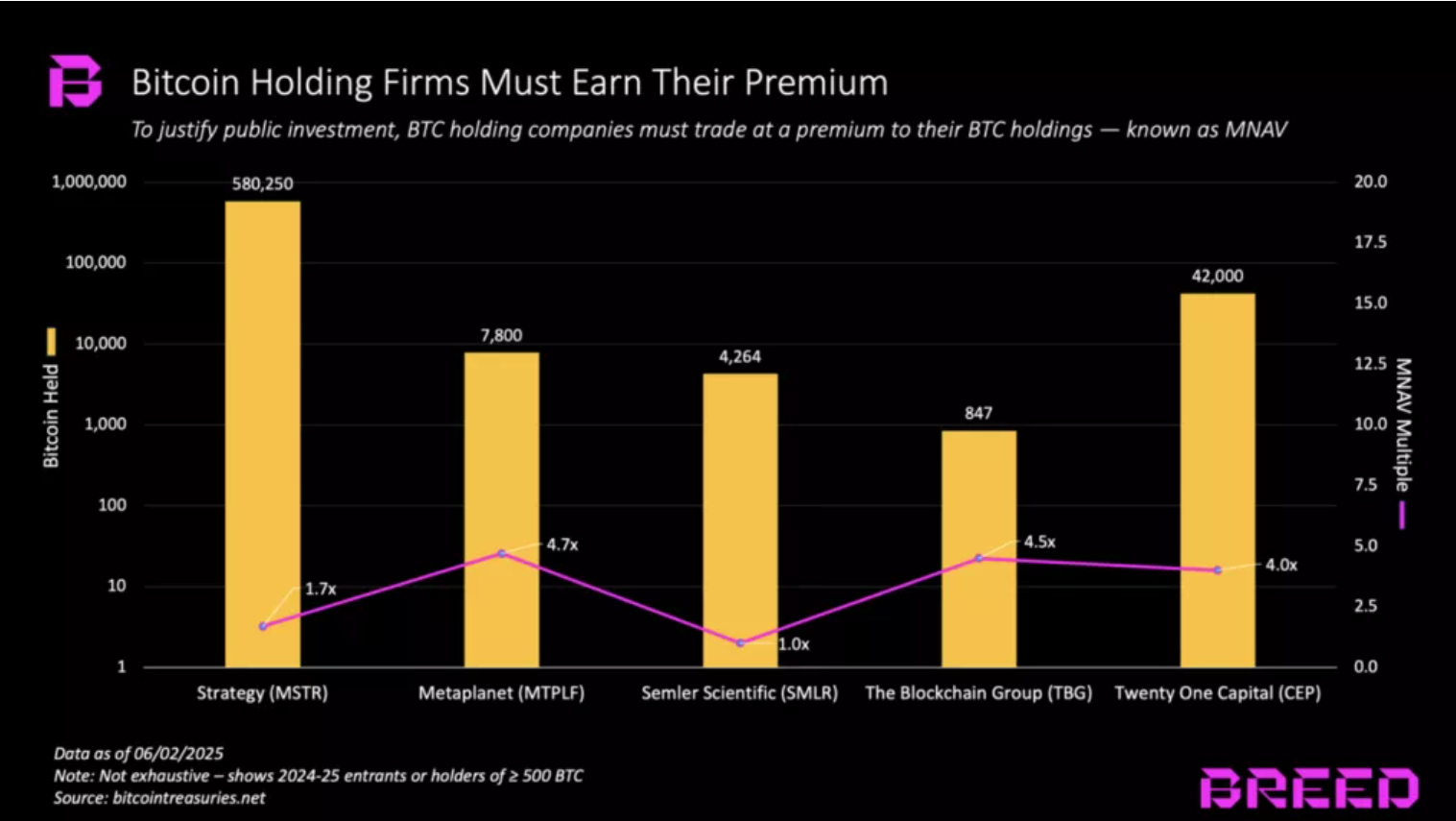

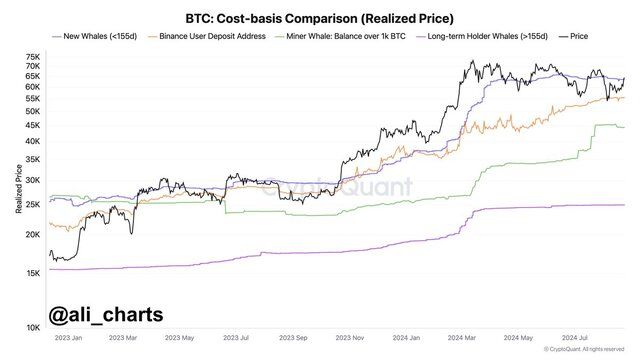

Venture firm Breed echoes these concerns. Companies that purchase Bitcoin using borrowed capital—and rely solely on BTC appreciation—are especially vulnerable.

Investor interest is often tied to the MNAV (Multiple on Net Asset Value) metric, which compares a firm’s market cap to the USD value of its BTC holdings. But this only holds up as long as market optimism persists.

“The market doesn’t reward a company with high MNAV just for owning Bitcoin. It rewards those whose leadership can grow ‘BTC-per-share’ faster than investors could on their own,” Breed analysts explain.

A prolonged bear market could sink MNAV, driving company valuations down to their net asset values. As debt refinancing becomes harder, firms may be forced to liquidate reserves—putting additional pressure on BTC prices and triggering a cascading effect.

Not All Will Survive

According to GoMining Institutional managing director Fakhul Miah, blindly copying Strategy’s model could backfire:

“There are now companies trying to become Bitcoin banks without proper security or risk management. If these smaller firms fail, we may see a ripple effect damaging crypto’s reputation.”

Still, Breed analysts believe a widespread meltdown is unlikely for now—most BTC purchases are funded through equity rather than debt. However, latecomers without scale, brand recognition, or passive inflows (like those enjoyed by Strategy) will find it increasingly difficult to compete.

Conclusion: Imitating the leader might seem like an easy path to success. But in crypto, without a strong product, investor trust, and a clear financial strategy, the journey from “Bitcoin treasury” to bankruptcy can be alarmingly short.