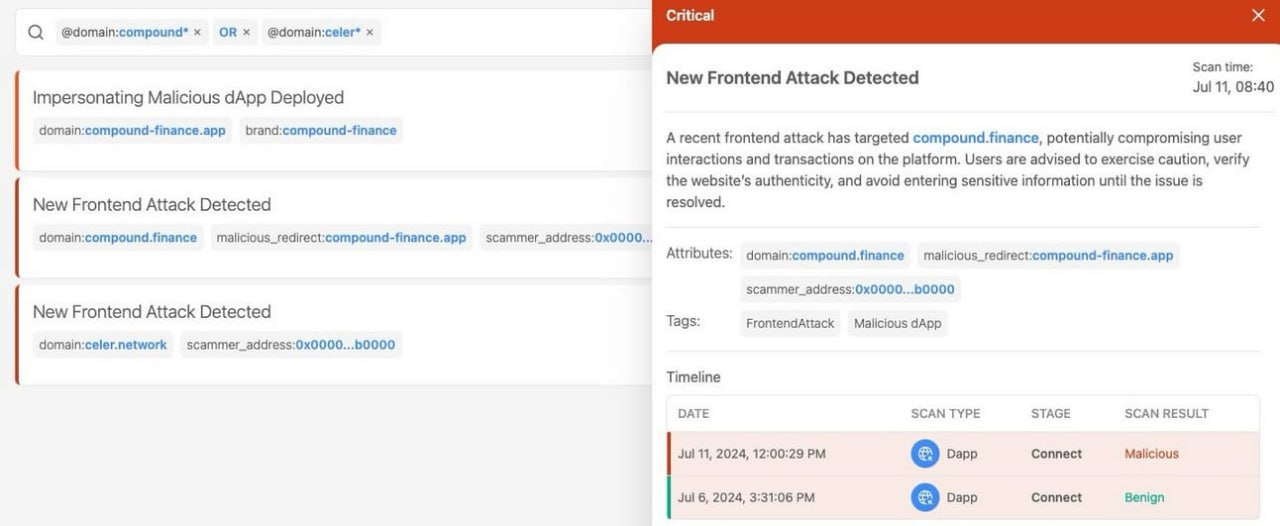

This is due to liquidation risks and an uncertain macroeconomic environment, according to analysts at Glassnode.

Following one of the largest corrections since 2022, which occurred on October 1 when Bitcoin dropped by 3.7% to $60,000, bulls managed to recover the price to $62,500. This level corresponds to the average acquisition price for short-term investors.

Experts noted that further movement from this level could put additional pressure on recent buyers, especially given the challenging macroeconomic conditions in recent months.

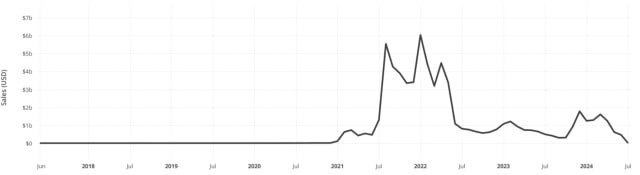

Glassnode provided medium-term benchmarks: True Market Mean ($47,000) and Active Investor Price ($52,500), which could serve as key support levels if the upward momentum weakens.

Since the beginning of the year, Bitcoin has traded above these levels, with the exception of a sharp drop on August 5, indicating a relatively stable market with demand support during downturns.

Analysts also pointed out two major supply levels at True Market Mean and Active Investor Price. Near these levels are “air gaps,” where few Bitcoin transactions have occurred, which could attract investor interest if volatility increases.

“The market is on ‘fragile ground,’ and supply will be highly sensitive to the next major price movement,” stated Glassnode.

Experts also emphasized the importance of monitoring the ratio of “profitable” and “loss-making” coins to identify key moments in price dynamics.