The Chairman of the U.S. Federal Reserve, Jerome Powell, stated that the Fed has no interest in establishing a strategic bitcoin reserve. Following his remarks, the cryptocurrency’s price struggled to remain above $100,000.

On December 18, the Fed announced a reduction of the key interest rate by 25 basis points, setting it at 4.25-4.5% per year.

During the subsequent press conference, Axios journalist Neil Irwin asked Powell whether the Fed saw “any value or benefit” in the government creating a national reserve in bitcoin.

“We are not allowed to own bitcoin. The Federal Reserve Bank dictates what we can own, and we are not seeking to change that rule. This is up to Congress, but we are not interested,” Powell emphasized.

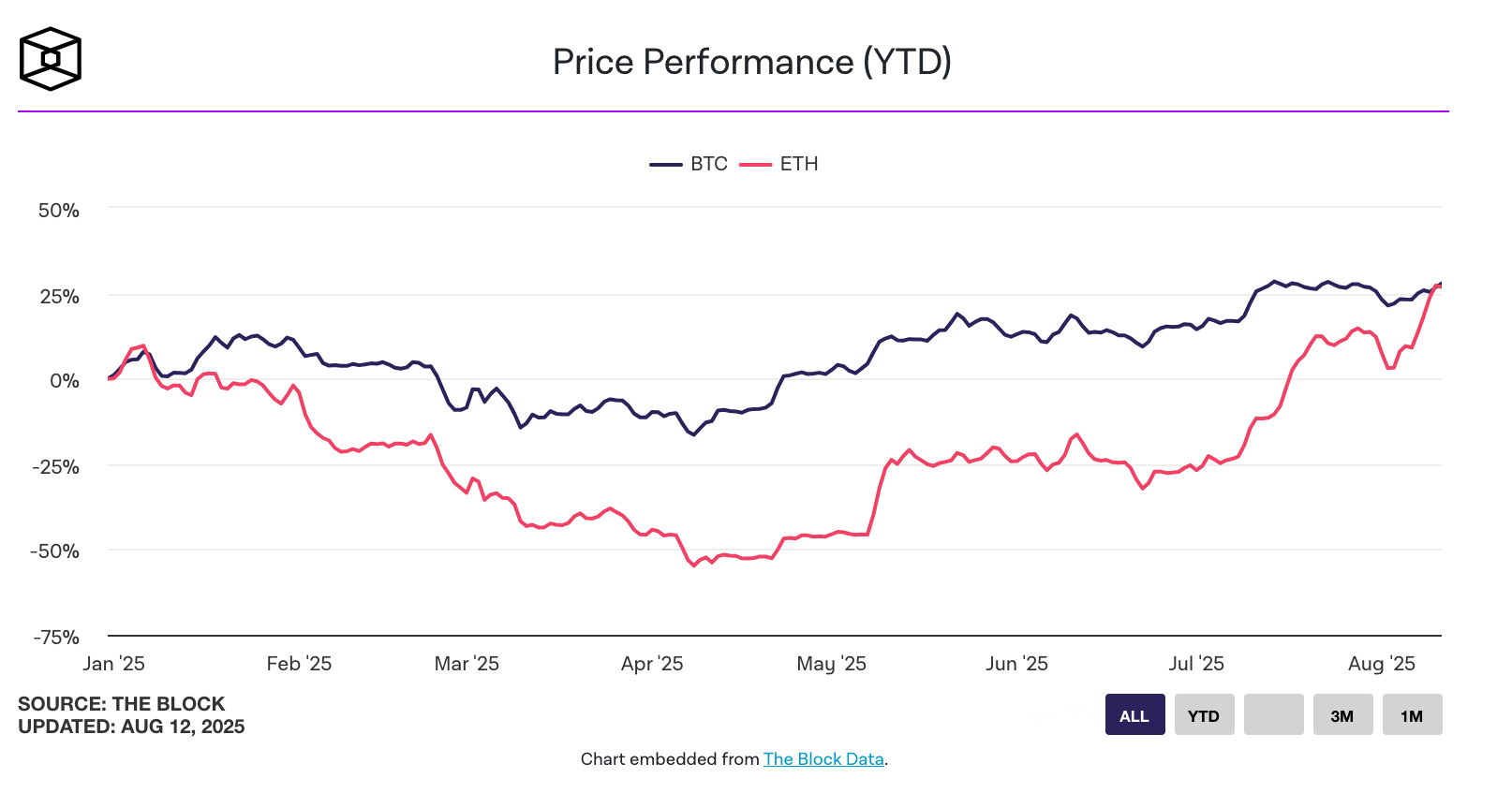

Following these comments, the price of bitcoin began to decline, dipping below the psychological level of $100,000 on the night of December 19. On Binance, the price hit a low of $98,802. However, the rate later recovered to around $101,000.

Earlier, on December 12, in an interview with CNBC, U.S. President-elect Donald Trump reaffirmed his campaign proposal to establish a national bitcoin reserve after his inauguration on January 20. Reports suggested he might sign an executive order to that effect immediately after taking office. Dennis Porter, CEO of the Satoshi Action Fund, even outlined a mechanism that would allow the government to fund this initiative without requiring Congress to change existing legislation.

Investor optimism surrounding this proposal may have driven bitcoin’s recent rally to new highs above $108,000.

Nevertheless, the idea of a bitcoin reserve has received both support, including at the state level, and criticism.

Former BitMEX CEO Arthur Hayes expressed doubt that the Trump administration would successfully implement the initiative. In his view, the actual policies of the new government will disappoint investors and lead to a “painful crash” for cryptocurrencies.

Jamie Coates, chief analyst at Real Vision, also predicted a bitcoin correction in the next two to three months.

Technical analyst Ali Martinez noted that bitcoin had broken out of a “Head and Shoulders” pattern. To invalidate the bearish outlook, the cryptocurrency would need to return above the $105,400 mark, he pointed out.