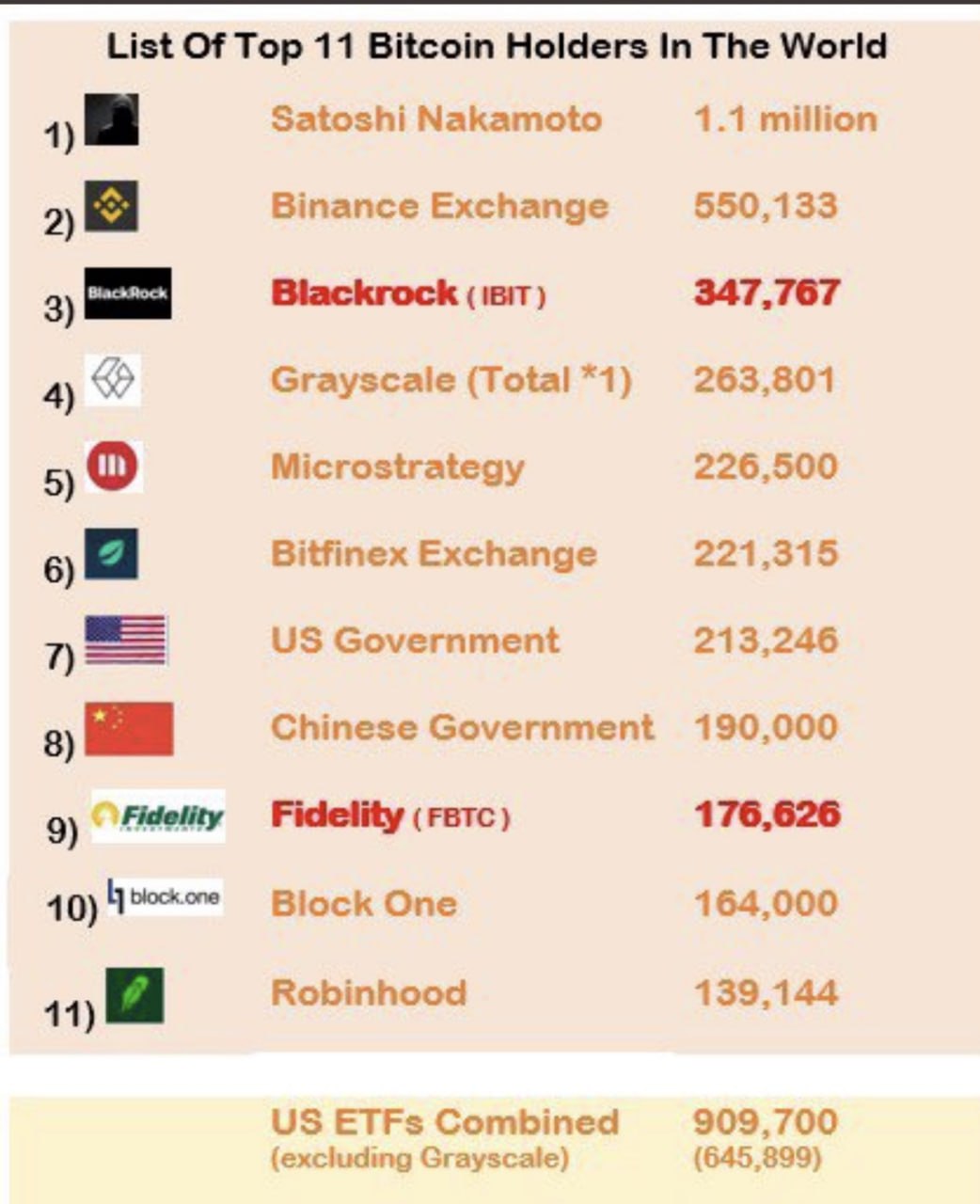

U.S. Bitcoin ETFs continue to show steady growth, increasing by 37,510 BTC (approximately $2.278 billion) per month. According to Bloomberg ETF analyst Eric Balchunas, if this pace continues, by October 2024, the amount of Bitcoin held in ETFs could surpass the estimated holdings of Satoshi Nakamoto, the creator of Bitcoin and the holder of the largest amount of this cryptocurrency.

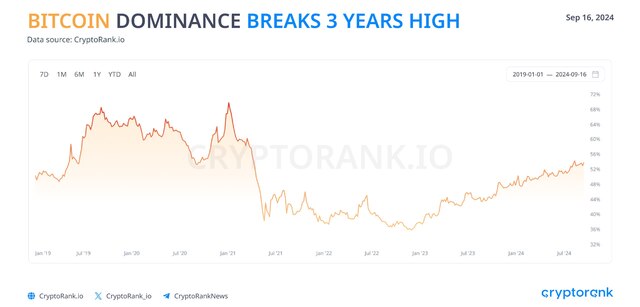

This milestone would mark an important turning point in Bitcoin’s history, reflecting not only the growing popularity and acceptance of the cryptocurrency but also the strengthening of its position in the institutional sphere. As large volumes of Bitcoin come under the management of ETFs, the market becomes more stabilized, attracting the attention of major investors, which in turn increases the overall market capitalization and boosts confidence in Bitcoin as an asset.

Balchunas also noted that without the existence of ETFs, Bitcoin’s price might have remained around $20,000, highlighting their influence on the current market. The expansion of ETFs allows a wider audience, including institutional investors, to participate in the Bitcoin market, contributing to its growth in value and popularity. The surpassing of Bitcoin volumes in ETFs over Satoshi Nakamoto’s holdings symbolizes a new direction in the history of cryptocurrencies, where traditional financial instruments begin to play a significant role in shaping the future of this technology.