Bitcoin offers unique opportunities for a new generation, while the administration of Donald Trump threatens major shifts in global trade and central banks continue to flood markets with fiat liquidity. This was stated by Jeff Park, Head of Alpha Strategies at Bitwise Asset Management.

“The world is teetering on the edge of maximum chaos—tariff wars, rising national debt, deglobalization—as well as signs of economic degradation, such as unprecedented tax cuts, inevitable YCC, and the weakening position of gold,” he emphasized.

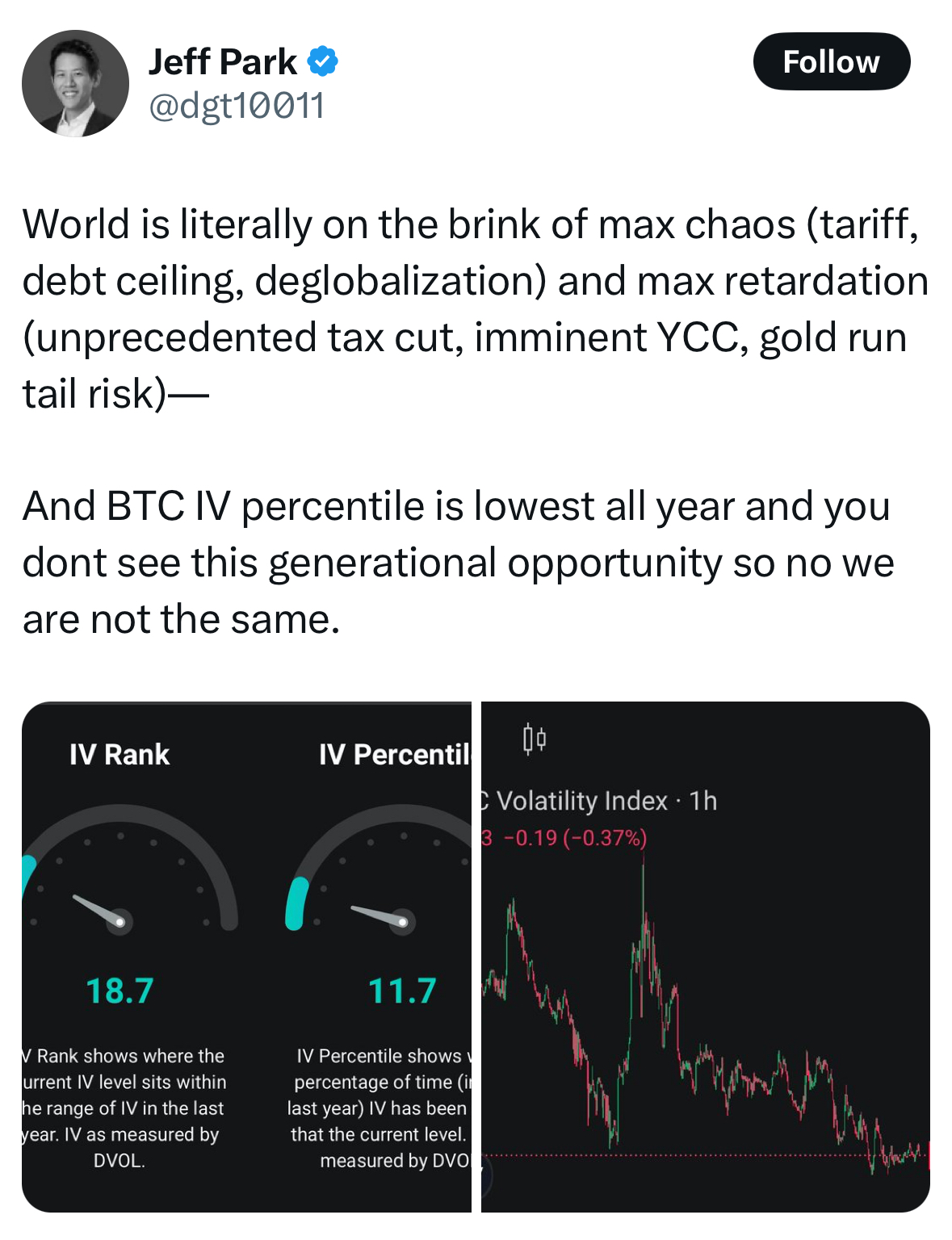

At the same time, Bitcoin’s implied volatility (IV) remains at its lowest levels in a year. This indicator reflects the percentage of days over the past 12 months when the asset’s volatility was lower than its current level.

According to Deribit data, the IV index is currently at 51.22, whereas at the end of January, it peaked at 71.28. Bitcoin’s volatility percentile stands at 12.3.

Bitwise Invest CEO Hunter Horsley stated that his optimism about Bitcoin is at an all-time high:

“People underestimate the massive leap Bitcoin is going to make into the mainstream this year,” he noted.

At the moment, the leading cryptocurrency is trading at $95,960, down 1.4% over the past 24 hours. Its weekly decline stands at 1.2%.