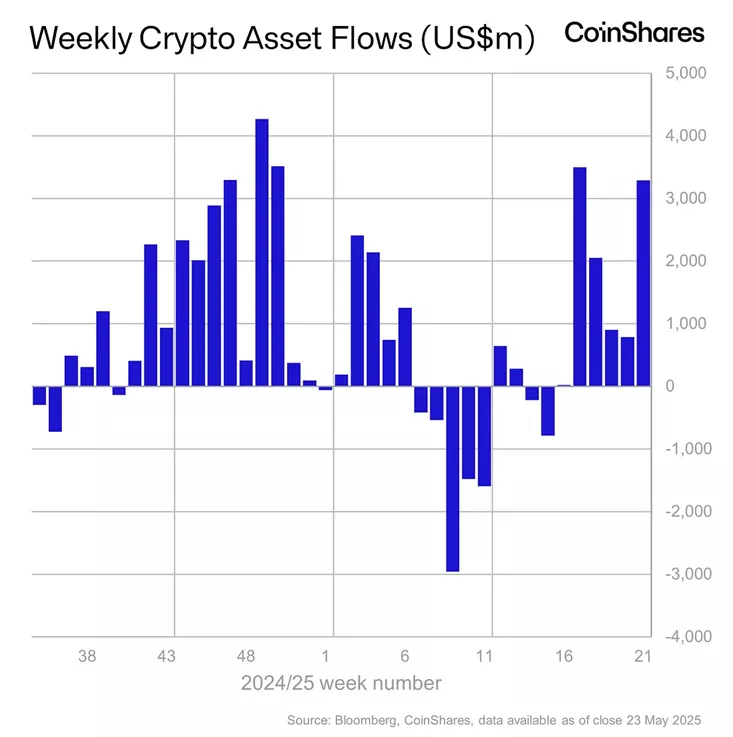

According to a recent CoinShares report, crypto investment funds saw inflows of $3.29 billion for the week of May 17–23, marking the second-largest weekly figure of the year. This represents a sharp increase compared to the previous week’s inflows of $785 million.

The positive momentum has now continued for six consecutive weeks, with cumulative year-to-date inflows reaching a record $10.82 billion.

Assets under management (AUM) in crypto funds rose to $183.7 billion, just below the all-time high of $187.5 billionrecorded earlier in May.

Analysts attribute the sustained inflows to growing market uncertainty, including the recent downgrade of the U.S. sovereign credit rating by Moody’s, which sparked a surge in U.S. Treasury yields and fueled demand for alternative investments like digital assets.

Bitcoin-based products were the primary driver of inflows:

- Inflows into Bitcoin funds surged from $557 million to $2.98 billion.

- U.S. spot Bitcoin ETFs attracted $2.75 billion, significantly higher than the $603.7 million added during the previous week.

Ethereum funds also saw strong demand, with inflows climbing from $205 million to $326 million, the highest level since February 2024. Analysts attribute the spike to the successful rollout of the Pectra upgrade.

Altcoin funds posted mixed results:

- Solana-based products attracted $4.3 million, while Sui-based funds saw $2.9 million in inflows.

- XRP-based funds, however, recorded a $37.2 million outflow, marking the end of an 80-week streak of consecutive inflows and the largest outflow on record for XRP products.

Previously, CoinDesk analysts published six key charts demonstrating the strong fundamentals supporting Bitcoin’s potential breakout above $100,000 in the medium term.