Recently, Bitcoin made an attempt to surpass the $65,000 mark but has yet to succeed.

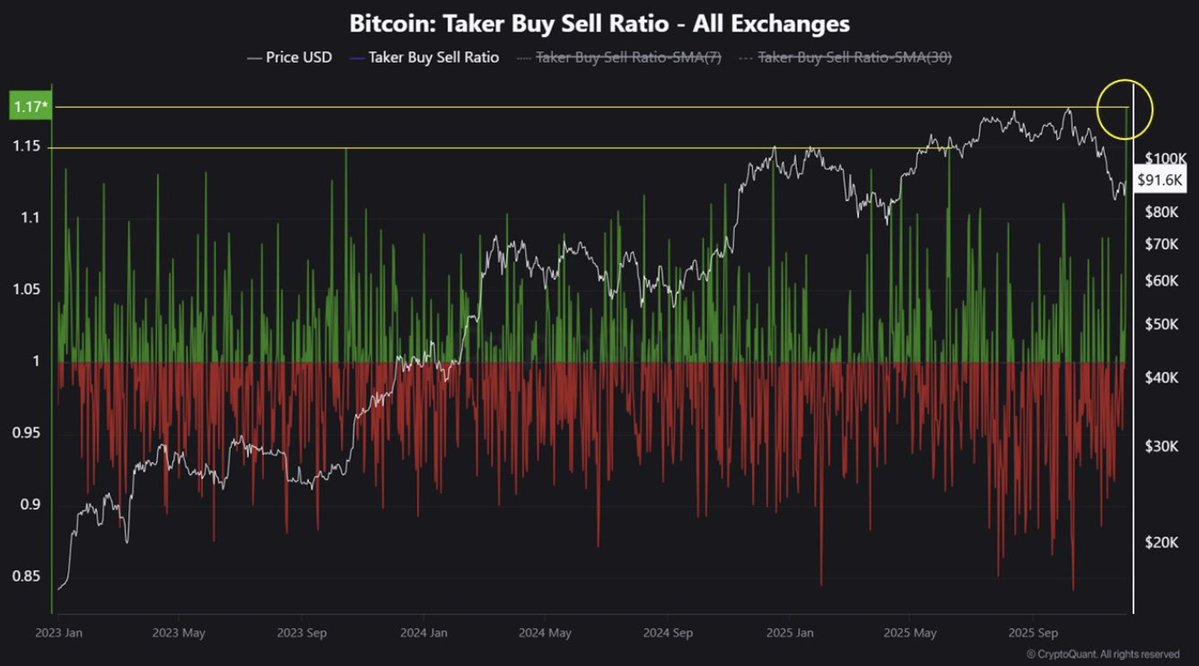

One of the reasons could be the activity of large investors, also known as “whales.” Analyst Ali Martinez reported that holders of addresses with balances of 1,000 BTC or more sold over 20,000 coins in the past 24 hours, amounting to approximately $1.28 billion, putting significant pressure on the market.

This selling pressure was so strong that BTC briefly dropped below $64,000. Additionally, the whales’ actions prompted smaller traders to start taking profits, further amplifying the downward movement.

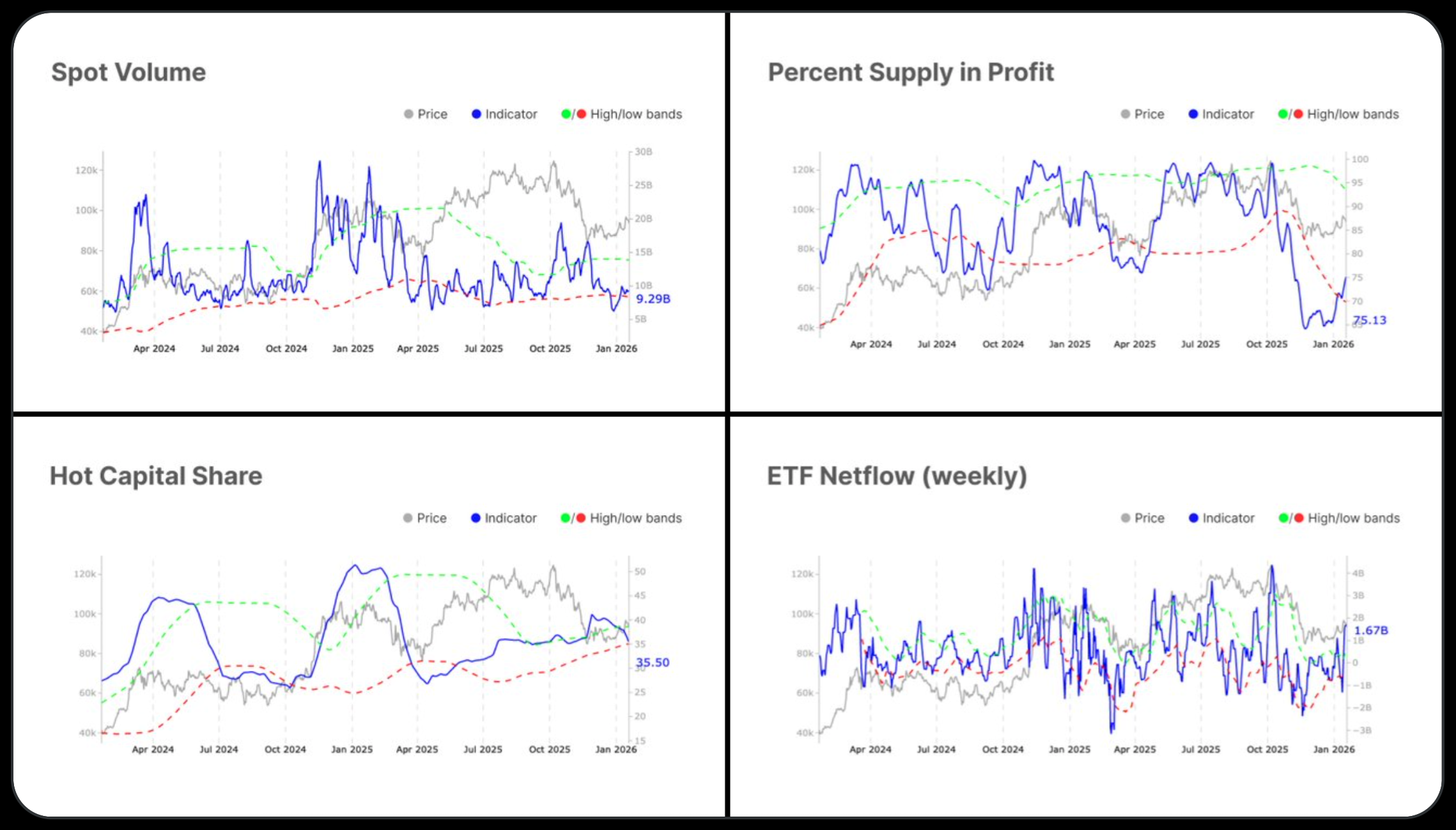

According to Martinez, the new bullish trend has not yet begun. Analyzing previous Bitcoin growth cycles shows that it typically takes about a year for Bitcoin to reach its peak from the start of a growth phase. Therefore, the current period could be seen as preparation for the next big move.

The expert suggests that if Bitcoin enters a growth phase in October, we could see new all-time highs by October of next year. However, much will depend on macroeconomic conditions, regulatory developments, and the actions of the largest market players, who continue to have a significant impact on Bitcoin’s price.

Overall, the cryptocurrency market remains highly volatile, and investors should exercise caution when making trading decisions, especially during periods of large-scale selling by whales.