Despite growing interest from institutional investors and consistent purchases by major corporations, Bitcoin continues to hover just below the $100,000 mark. What’s behind this prolonged consolidation—and when could the next breakout occur? Experts offer their insights.

Long-Term Holders Are Applying Selling Pressure

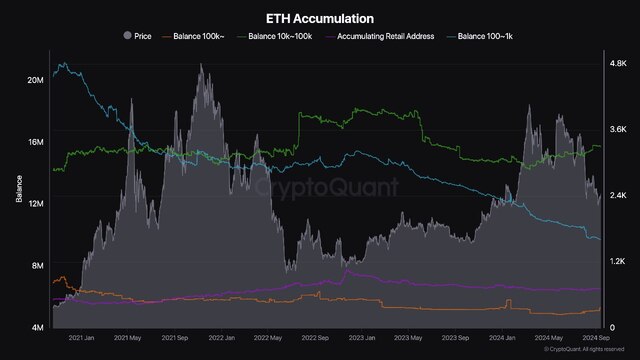

Charles Edwards, founder of investment firm Capriole Investments, believes the current stagnation is largely due to selling pressure from long-term holders (LTH)—those who’ve held Bitcoin for over two years. Since the launch of spot Bitcoin ETFs in January 2024, these holders have been “offloading coins to Wall Street” and unwinding long-standing positions.

Still, demand remains strong. Edwards notes that large corporations building digital treasuries have been absorbing the supply. He expects this trend to intensify as more companies adopt the “Strategy-style” treasury approach pioneered by firms like MicroStrategy.

“The real question is whether these firms can maintain the current pace of accumulation,” Edwards said. “On-chain metrics are still showing weakness, but if corporate buyers remain relentless, a breakout is within reach.”

Metaplanet Joins the Accumulation Race

One of the newest power players in corporate Bitcoin accumulation is Japanese firm Metaplanet, often dubbed the “Asian MicroStrategy.” The company recently purchased an additional 1,005 BTC for approximately $108.1 million, at an average price of around $107,600 per coin. With a total of 13,350 BTC, Metaplanet now ranks fifth among public companies in terms of Bitcoin holdings.

To fund further purchases, Metaplanet issued zero-coupon bonds worth $208 million. Meanwhile, MicroStrategy’s co-founder hinted at an upcoming acquisition by sharing an updated corporate BTC portfolio chart—a move that traditionally precedes the company’s official announcements.

Since August 2020, MicroStrategy has accumulated 592,345 BTC, securing its position as the undisputed leader in corporate Bitcoin treasuries.

An Alternative Take: “A Controlled Ignition”

Meanwhile, some voices in the crypto community are offering a more radical interpretation. The X account SightBringer argues that the lack of a major price response to billions in corporate Bitcoin buys may be intentional.

“They’re buying billions worth of BTC, yet the price barely moves. This isn’t a market anymore—it’s a controlled ignition chamber,” the account posted.

According to their theory:

- ETF inflows are real. Sovereign and institutional players are quietly stacking BTC.

- Exchange liquidity is misleading. Most trades happen on paper without real asset movement.

- Whales are liquidating old holdings discreetly. Early miners and OTC wallets feed demand without triggering price spikes.

- Macro funds like BlackRock and Fidelity are suppressing volatility to maintain price stability.

SightBringer concludes that what we’re seeing is not a market reaction, but a setup phase:

“This isn’t about price action. It’s about positioning before the ignition. The real question isn’t ‘Why isn’t the price moving?’—it’s ‘Who’s making sure it doesn’t… and why?’”

Conclusion: Bitcoin’s sluggish movement doesn’t signal waning interest. Behind the scenes, accumulation continues at full force. All signs point to a market quietly building toward its next explosive phase.