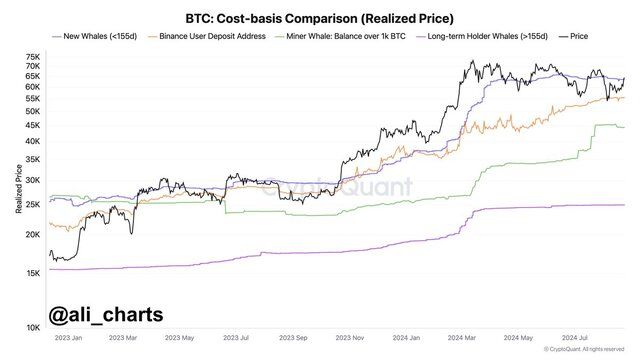

Currently, several support levels can be identified, formed by different groups of holders.

According to Ali Martinez, the upper level is at $63,450, where young whales, controlling more than 1,000 BTC, made their purchases. If Bitcoin shows an upward movement and breaks above this level, it is these young whales who will strive to prevent a decline. Their actions could play a decisive role in further price growth, as they tend to hold their positions for the long term.

The next support level is $55,540, where Binance traders made their purchases. This is a crucial zone since many of these traders might be short-term players ready to lock in profits at the first opportunity. Support at this level will be critical to maintaining a positive market sentiment.

Additionally, miners should be noted, as they are interested in keeping the price above $44,000. For them, this is a key level, as it ensures the profitability of mining cryptocurrency. If the price drops below this point, miners might start selling off their assets, putting additional pressure on the market.

The analyst also believes that the lower support level is around $25,000, where holders who have been retaining cryptocurrency for more than 12 months made their purchases. This group of holders is known for their resilience to volatility and willingness to hold assets in the long term. If the price falls to this level, they might act as the last line of defense, creating strong support for Bitcoin.

Thus, in the coming weeks and months, the market will closely watch these support levels, which could significantly influence the future movement of Bitcoin’s price.